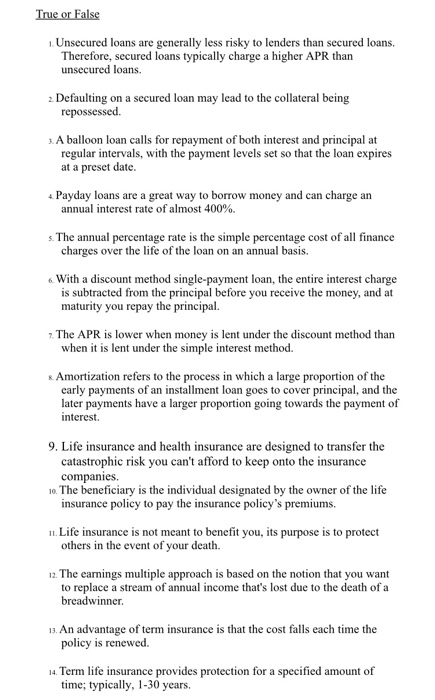

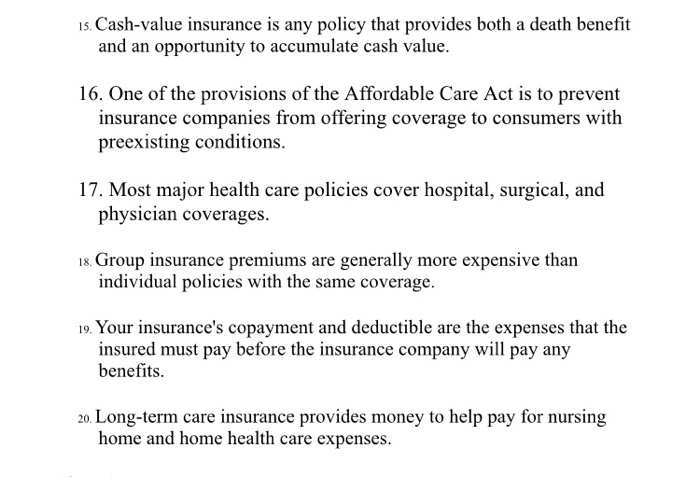

True or False Unsecured loans are generally less risky to lenders than secured loans. Therefore, secured loans typically charge a higher APR than unsecured loans. 2. Defaulting on a secured loan may lead to the collateral being repossessed. A balloon loan calls for repayment of both interest and principal at regular intervals, with the payment levels set so that the loan expires at a preset date. 4. Payday loans are a great way to borrow money and can charge an annual interest rate of almost 400%. s. The annual percentage rate is the simple percentage cost of all finance charges over the life of the loan on an annual basis. 6 With a discount method single-payment loan, the entire interest charge is subtracted from the principal before you receive the money, and at maturity you repay the principal. 7. The APR is lower when money is lent under the discount method than when it is lent under the simple interest method. * Amortization refers to the process in which a large proportion of the carly payments of an installment loan goes to cover principal, and the later payments have a larger proportion going towards the payment of interest. 9. Life insurance and health insurance are designed to transfer the catastrophic risk you can't afford to keep onto the insurance companies. 10. The beneficiary is the individual designated by the owner of the life insurance policy to pay the insurance policy's premiums. 11. Life insurance is not meant to benefit you, its purpose is to protect others in the event of your death. 12. The earnings multiple approach is based on the notion that you want to replace a stream of annual income that's lost due to the death of a breadwinner. 13An advantage of term insurance is that the cost falls each time the policy is renewed. 14. Term life insurance provides protection for a specified amount of time; typically, 1-30 years. 15. Cash-value insurance is any policy that provides both a death benefit and an opportunity to accumulate cash value. 16. One of the provisions of the Affordable Care Act is to prevent insurance companies from offering coverage to consumers with preexisting conditions. 17. Most major health care policies cover hospital, surgical, and physician coverages. 18. Group insurance premiums are generally more expensive than individual policies with the same coverage. 19. Your insurance's copayment and deductible are the expenses that the insured must pay before the insurance company will pay any benefits. 20. Long-term care insurance provides money to help pay for nursing home and home health care expenses