Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. An effective system of internal control will segregate functions between individuals to reduce the potential for errors and fraud. True False 2. When

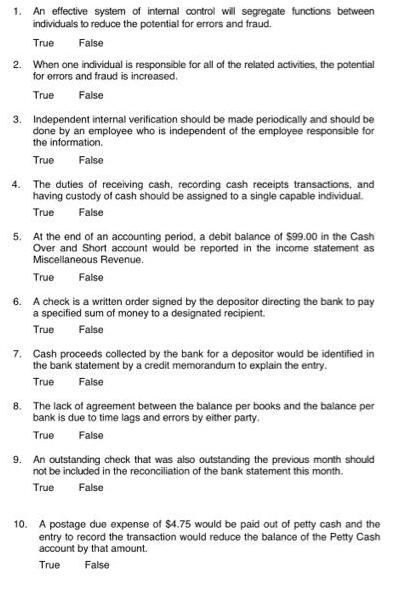

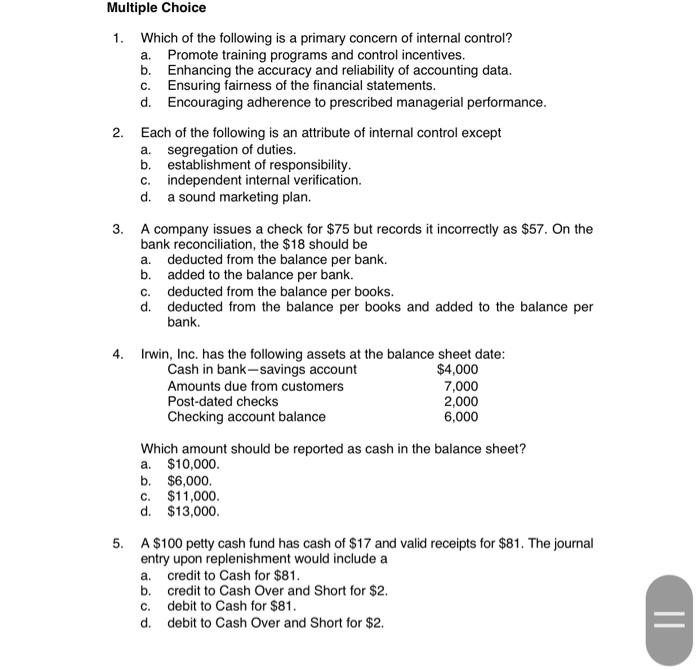

1. An effective system of internal control will segregate functions between individuals to reduce the potential for errors and fraud. True False 2. When one individual is responsible for all of the related activities, the potential for errors and fraud is increased. True False 3. Independent internal verification should be made periodically and should be done by an employee who is independent of the employee responsible for the information. True False 4. The duties of receiving cash, recording cash receipts transactions, and having custody of cash should be assigned to a single capable individual. True False 5. At the end of an accounting period, a debit balance of $99.00 in the Cash Over and Short account would be reported in the income statement as Miscellaneous Revenue. True False 6. A check is a written order signed by the depositor directing the bank to pay a specified sum of money to a designated recipient. True False 7. Cash proceeds collected by the bank for a depositor would be identified in the bank statement by a credit memorandum to explain the entry. True False 8. The lack of agreement between the balance per books and the balance per bank is due to time lags and errors by either party. True False 9. An outstanding check that was also outstanding the previous month should not be included in the reconciliation of the bank statement this month. True False 10. A postage due expense of $4.75 would be paid out of petty cash and the entry to record the transaction would reduce the balance of the Petty Cash account by that amount. True False Multiple Choice 1. Which of the following is a primary concern of internal control? Promote training programs and control incentives. a. b. Enhancing the accuracy and reliability of accounting data. c. Ensuring fairness of the financial statements. d. Encouraging adherence to prescribed managerial performance. 2. Each of the following is an attribute of internal control except a. segregation of duties. b. establishment of responsibility. c. independent internal verification. d. a sound marketing plan. 3. A company issues a check for $75 but records it incorrectly as $57. On the bank reconciliation, the $18 should be a. deducted from the balance per bank. added to the balance per bank. b. c. deducted from the balance per books. d. deducted from the balance per books and added to the balance per bank. 4. Irwin, Inc. has the following assets at the balance sheet date: Cash in bank-savings account $4,000 Amounts due from customers 7,000 Post-dated checks 2,000 Checking account balance 6,000 Which amount should be reported as cash in the balance sheet? a. $10,000. b. $6,000. C. $11,000. d. $13,000. 5. A $100 petty cash fund has cash of $17 and valid receipts for $81. The journal entry upon replenishment would include a a. credit to Cash for $81. b. credit to Cash Over and Short for $2. debit to Cash for $81. C. d. debit to Cash Over and Short for $2. ||

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 An effective system of internal control will segreg ate functions between individuals to reduce the potential for errors and fraud ANSWER True 2 Whe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started