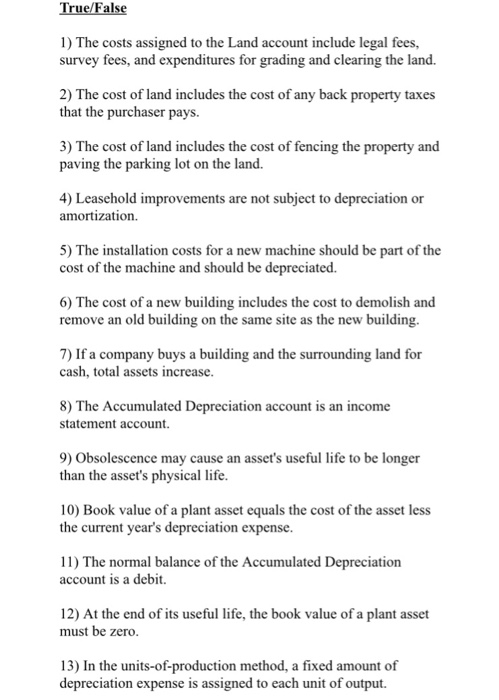

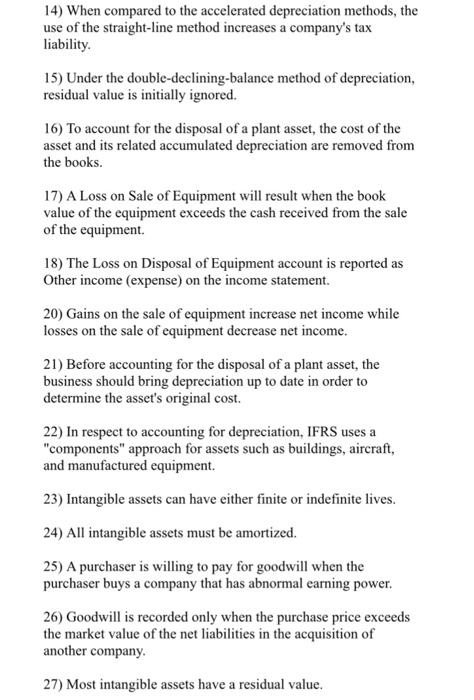

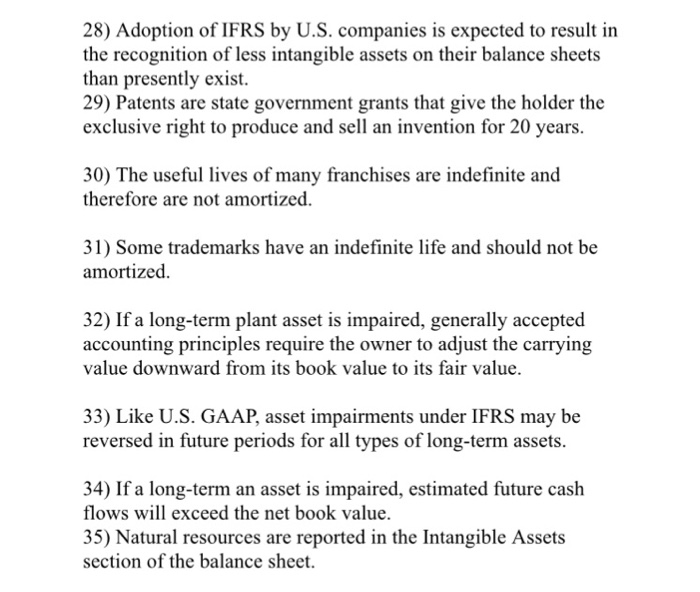

True/False 1) The costs assigned to the Land account include legal fees, survey fees, and expenditures for grading and clearing the land 2) The cost of land includes the cost of any back property taxes that the purchaser pays. 3) The cost of land includes the cost of fencing the property and paving the parking lot on the land. 4) Leasehold improvements are not subject to depreciation or amortization 5) The installation costs for a new machine should be part of the cost of the machine and should be depreciated. 6) The cost of a new building includes the cost to demolish and remove an old building on the same site as the new building. 7) If a company buys a building and the surrounding land for cash, total assets increase. 8) The Accumulated Depreciation account is an income statement account. 9) Obsolescence may cause an asset's useful life to be longer than the asset's physical life. 10) Book value of a plant asset equals the cost of the asset less the current year's depreciation expense. 11) The normal balance of the Accumulated Depreciation account is a debit. 12) At the end of its useful life, the book value of a plant asset must be zero. 13) In the units-of-production method, a fixed amount of depreciation expense is assigned to each unit of output. 14) When compared to the accelerated depreciation methods, the use of the straight-line method increases a company's tax liability 15) Under the double-declining-balance method of depreciation, residual value is initially ignored 16) To account for the disposal of a plant asset, the cost of the asset and its related accumulated depreciation are removed from the books. 17) A Loss on Sale of Equipment will result when the book value of the equipment exceeds the cash received from the sale of the equipment. 18) The Loss on Disposal of Equipment account is reported as Other income (expense) on the income statement. 20) Gains on the sale of equipment increase net income while losses on the sale of equipment decrease net income. 21) Before accounting for the disposal of a plant asset, the business should bring depreciation up to date in order to determine the asset's original cost. 22) In respect to accounting for depreciation, IFRS uses a "components" approach for assets such as buildings, aircraft, and manufactured equipment. 23) Intangible assets can have either finite or indefinite lives. 24) All intangible assets must be amortized. 25) A purchaser is willing to pay for goodwill when the purchaser buys a company that has abnormal earning power 26) Goodwil is recorded only when the purchase price exceeds the market value of the net liabilities in the acquisition of another company 27) Most intangible assets have a residual value 28) Adoption of IFRS by U.S. companies is expected to result in the recognition of less intangible assets on their balance sheets than presently exist. 29) Patents are state government grants that give the holder the exclusive right to produce and sell an invention for 20 years. 30) The useful lives of many franchises are indefinite and therefore are not amortized. 31) Some trademarks have an indefinite life and should not be amortized 32) If a long-term plant asset is impaired, generally accepted accounting principles require the owner to adjust the carrying value downward from its book value to its fair value 33) Like U.S. GAAP, asset impairments under IFRS may be reversed in future periods for all types of long-term assets. 34) If a long-term an asset is impaired, estimated future cash flows will exceed the net book value. 35) Natural resources are reported in the Intangible Assets section of the balance sheet