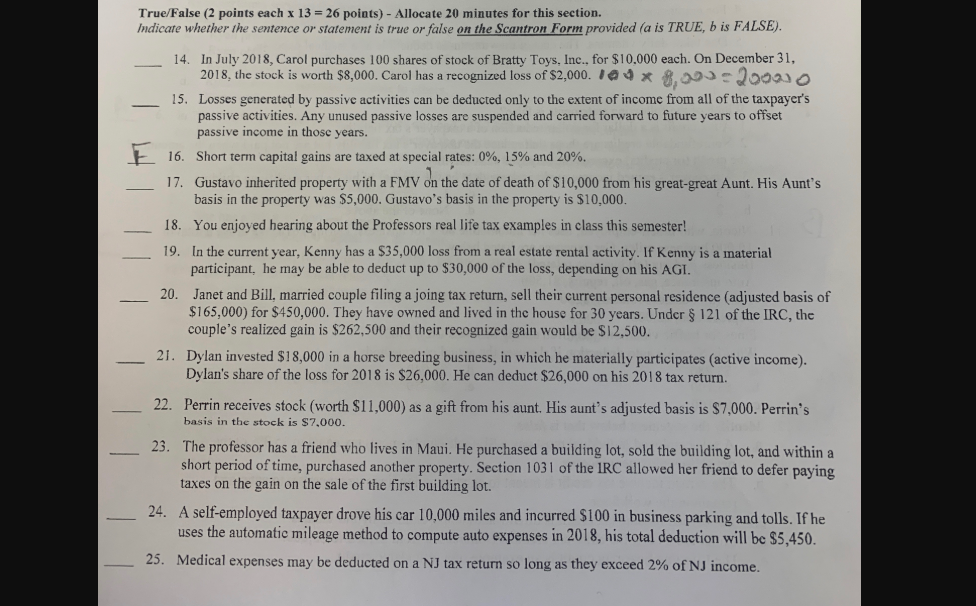

True/False (2 points each x 13-26 points) - Allocate 20 minutes for this section. ndicate whether the sentence or statement is true or false on the Scantron Form provided (a is TRUE, b is FALSE). In July 2018, Carol purchases 100 shares of stock of Bratty Toys, Inc., for $10.000 each. On December 31, 14. 2018, the stock is worth $8,000. Carol has a recognized loss of$2,000. , e x 8, Jooo 15. Losses generated by passive activities can be deducted only to the extent of income from all of the taxpayer's passive activities. Any unused passive losses are suspended and carried forward to future years to offset passive income in those years. 16. Short term capital gains are taxed at special rates: 0%, 15% and 20%. 17. Gustavo inherited property with a FMV on the date of death of $10,000 from his great-great Aunt. His Aunt's 18. You enjoyed hearing about the Professors real life tax examples in class this semester! 19. In the current year, Kenny has a $35,000 loss from a real estate rental activity. If Kenny is a material basis in the property was $5,000. Gustavo's basis in the property is $10,000. participant, he may be able to deduct up to $30,000 of the loss, depending on his AGI. 20. Janet and Bill, married couple filing a joing tax return, sell their current personal residence (adjusted basis of $165,000) for $450,000. They have owned and lived in the house for 30 years. Under 121 of the IRC, the couple's realized gain is $262,500 and their recognized gain would be S12,500. 21. Dylan invested S18,000 in a horse breeding business, in which he materially participates (active income) 22. Perrin receives stock (worth $11,000) as a gift from his aunt. His aunt's adjusted basis is $7,000. Perrin's 23. The professor has a friend who lives in Maui. He purchased a building lot, sold the building lot, and within a Dylan's share of the loss for 2018 is $26,000. He can deduct $26,000 on his 2018 tax return. basis in the stock is S7,000. short period of time, purchased another property. Section 1031 of the IRC allowed her friend to defer paying taxes on the gain on the sale of the first building lot. 24. A self-employed taxpayer drove his car 10,000 miles and incurred S100 in business parking and tolls. If he uses the automatic mileage method to compute auto expenses in 2018, his total deduction will be $5,450. Medical expenses may be deducted on a NJ tax return so long as they exceed 2% of NJ income. 25, True/False (2 points each x 13-26 points) - Allocate 20 minutes for this section. ndicate whether the sentence or statement is true or false on the Scantron Form provided (a is TRUE, b is FALSE). In July 2018, Carol purchases 100 shares of stock of Bratty Toys, Inc., for $10.000 each. On December 31, 14. 2018, the stock is worth $8,000. Carol has a recognized loss of$2,000. , e x 8, Jooo 15. Losses generated by passive activities can be deducted only to the extent of income from all of the taxpayer's passive activities. Any unused passive losses are suspended and carried forward to future years to offset passive income in those years. 16. Short term capital gains are taxed at special rates: 0%, 15% and 20%. 17. Gustavo inherited property with a FMV on the date of death of $10,000 from his great-great Aunt. His Aunt's 18. You enjoyed hearing about the Professors real life tax examples in class this semester! 19. In the current year, Kenny has a $35,000 loss from a real estate rental activity. If Kenny is a material basis in the property was $5,000. Gustavo's basis in the property is $10,000. participant, he may be able to deduct up to $30,000 of the loss, depending on his AGI. 20. Janet and Bill, married couple filing a joing tax return, sell their current personal residence (adjusted basis of $165,000) for $450,000. They have owned and lived in the house for 30 years. Under 121 of the IRC, the couple's realized gain is $262,500 and their recognized gain would be S12,500. 21. Dylan invested S18,000 in a horse breeding business, in which he materially participates (active income) 22. Perrin receives stock (worth $11,000) as a gift from his aunt. His aunt's adjusted basis is $7,000. Perrin's 23. The professor has a friend who lives in Maui. He purchased a building lot, sold the building lot, and within a Dylan's share of the loss for 2018 is $26,000. He can deduct $26,000 on his 2018 tax return. basis in the stock is S7,000. short period of time, purchased another property. Section 1031 of the IRC allowed her friend to defer paying taxes on the gain on the sale of the first building lot. 24. A self-employed taxpayer drove his car 10,000 miles and incurred S100 in business parking and tolls. If he uses the automatic mileage method to compute auto expenses in 2018, his total deduction will be $5,450. Medical expenses may be deducted on a NJ tax return so long as they exceed 2% of NJ income. 25