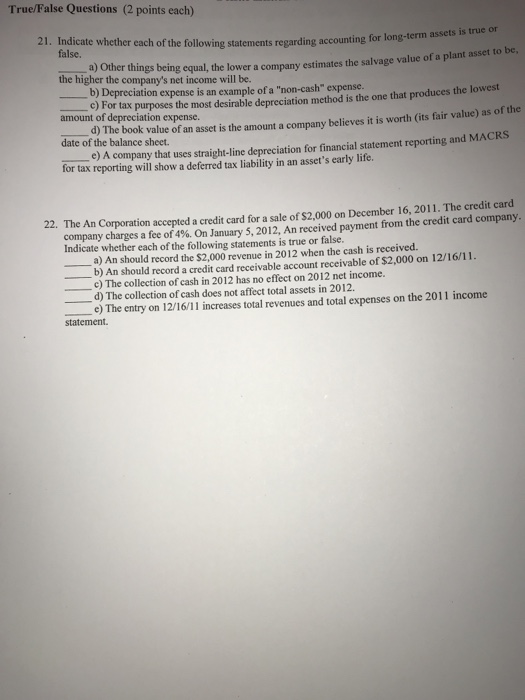

True/False Questions (2 points each) 21. Indicate whether each of the following statements regarding accounting for long-t true or erm assets is false. the higher the company's net income will be. amount of depreciation expense date of the balance sheet. things being equal, the lower a company estimates the salvage value of a plant asset to be, b) Depreciation expense is an example of a "non-cash" expense. c) For tax purposes the most desirable depreciation method is the one that produces the lowest d) The book value of an asset is the amount a company believes it is worth (its fair value) as of the e) A company that uses straight-line depreciation for financial statement reporting and MACRS for tax reporting will show a deferred tax liability in an asset's early life. 22 The An Corporation accepted a credit card for a sale of$2,000 on December 16, 2011 . The credit card company charges a fee of 4%. On January 5, 2012, An received payment from the credit card company. Indicate whether each of the following statements is true or false. a) An should record the S2,000revenue in 2012 when the cash is received. b) An should record a credit card receivable account receivable of $2,000 on 12/16/11 . c) The collection ofcash in 2012 has no effect on 2012 net income. d) The collection of cash does not affect total assets in 2012. eThe entr on 12/16/11 increases total revenues and total expenses on the 2011 income statement. True/False Questions (2 points each) 21. Indicate whether each of the following statements regarding accounting for long-t true or erm assets is false. the higher the company's net income will be. amount of depreciation expense date of the balance sheet. things being equal, the lower a company estimates the salvage value of a plant asset to be, b) Depreciation expense is an example of a "non-cash" expense. c) For tax purposes the most desirable depreciation method is the one that produces the lowest d) The book value of an asset is the amount a company believes it is worth (its fair value) as of the e) A company that uses straight-line depreciation for financial statement reporting and MACRS for tax reporting will show a deferred tax liability in an asset's early life. 22 The An Corporation accepted a credit card for a sale of$2,000 on December 16, 2011 . The credit card company charges a fee of 4%. On January 5, 2012, An received payment from the credit card company. Indicate whether each of the following statements is true or false. a) An should record the S2,000revenue in 2012 when the cash is received. b) An should record a credit card receivable account receivable of $2,000 on 12/16/11 . c) The collection ofcash in 2012 has no effect on 2012 net income. d) The collection of cash does not affect total assets in 2012. eThe entr on 12/16/11 increases total revenues and total expenses on the 2011 income statement