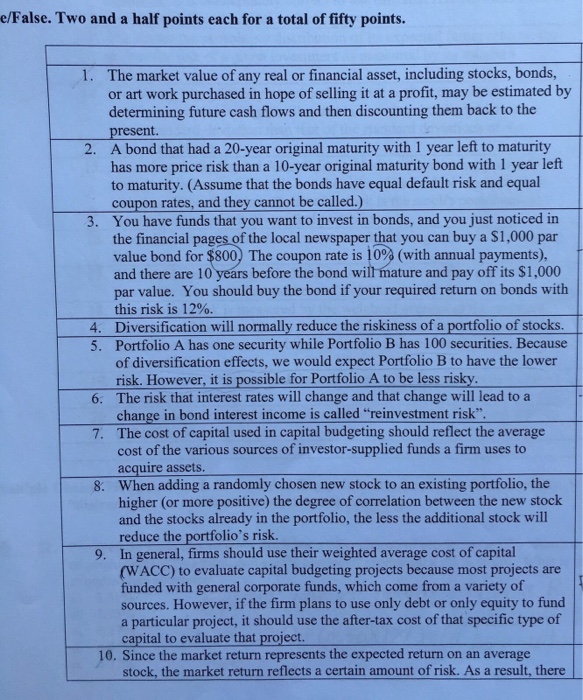

True/False. Two and a half points each for a total of fifty points. The market value of any real or financial asset, including stocks, bonds, or at work purchased in hope of selling it at a profit, may be estimated by determining future cash flows and then discounting them back to the present. A bond that had a 20-year original maturity with 1 year left to maturity has more price risk than a 10-year original maturity bond with 1 year left to maturity. (Assume that the bonds have equal default risk and equal coupon rates, and they cannot be called.) You have funds that you want to invest in bonds, and you just noticed in the financial pages of the local newspaper that you buy a $1,000 par value bond for $800. The coupon rate is 10% (with annual payments), and there are 10 years before the bond will mature and pay off its $1,000 par value. You should buy the bond if your required returns on bond with this risk is 12%. Diversification will normally reduce the riskiness of a portfolio of stocks. Portfolio A has one security while Portfolio B has 100 securities. Because of diversification effects, we would expect Portfolio B to have the lowest risk. However, it is possible for Portfolio A to be less risky. The risk that interest rates will change and that change will lead to a change in bond interest income is called "reinvestment risk". The cost of capital used in capital budgeting should reflect the average cost of the various sources of investor-supplied funds a firm uses to acquire assets, When adding a randomly chosen new stock to an existing portfolio, the higher (or more positive) the degree of correlation between the new stock and the stocks already in the portfolio, the less the additional stock will reduce the portfolio's risk. In general, firms should use their weighted average cost of capital (WACC) to evaluate capital budgeting projects because most projects are funded with general corporate funds, which come from a variety of sources. However, if the firm plans to use only debt or only equity to fund a particular project, it should use the after-tax cost of that specific type of capital to evaluate that project. Since the market return represents the expected return on an average stock, the market return reflects a certain amount of risk. As a result, there