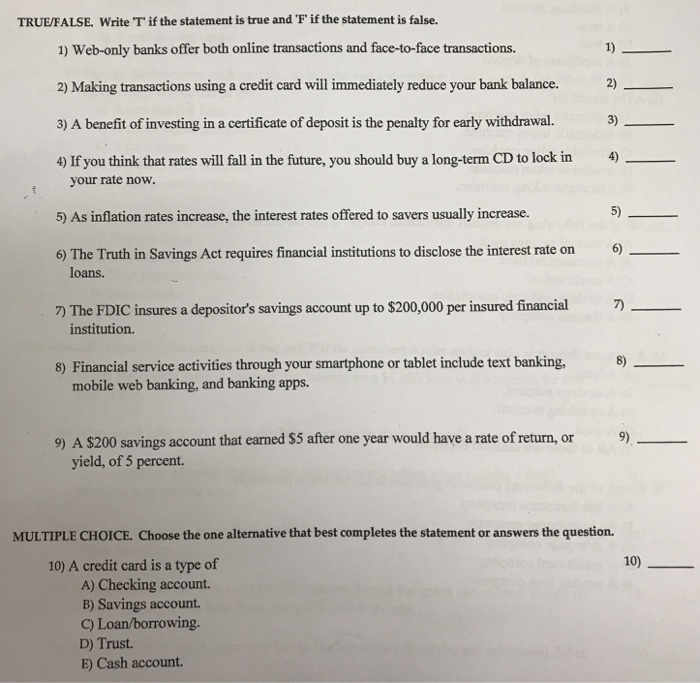

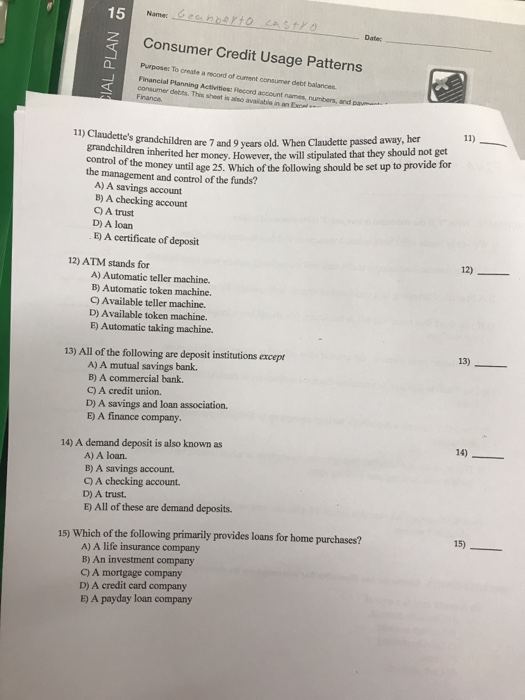

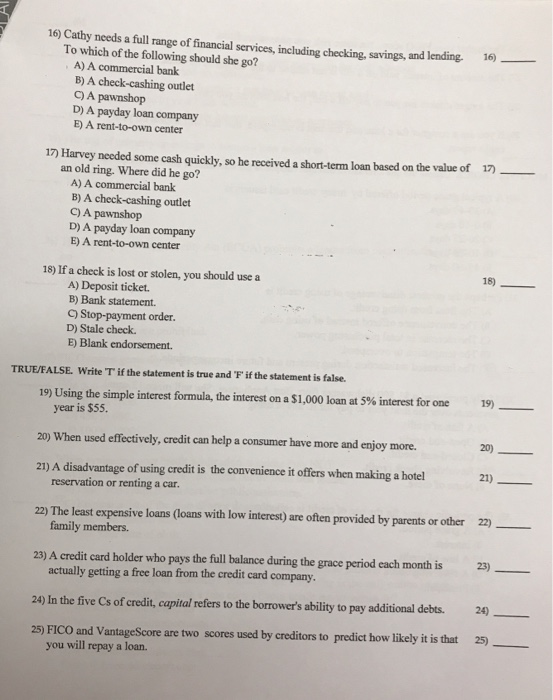

TRUE/FALSE. Write T if the statement is true and F if the statement is false. 1) Web-only banks offer both online transactions and face-to-face transactions. 2) Making transactions using a credit card will immediately reduce your bank balance. 2) 3) A benefit of investing in a certificate of deposit is the penalty for early withdrawal.3) 4) If you think that rates will fall in the future, you should buy a long-term CD to lock in 4) 1) your rate now. 5) As inflation rates increase, the interest rates offered to savers usually increase. 5) 6) The Truth in Savings Act requires financial institutions to disclose the interest rate on 6 loans. 7) 7) The FDIC insures a depositor's savings account up to $200,000 per insured financial institution. 8) Financial service activities through your smartphone or tablet include text banking, 8) mobile web banking, and banking apps. 9) A $200 savings account that earned $5 after one year would have a rate of return, or 9) yield, of 5 percent MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 10) A credit card is a type of 10) A) Checking account. B) Savings account. C) Loan/borrowing. D) Trust. E) Cash account 15 Date; Consumer Credit Usage Patterns Purpose: To create a record of current consumer debt balances consumer debes.This sheet is also avaiable in an Ex Planning Activities: Record account names, numbers, and 11) Claudette's nherited her money. However, the will stipulated that they should not get money until age 25. Which of the following should be set up to provide for are 7 and 9 years old. When Claudette passed away, her control of the the management and control of the funds? o A) A savings account B) A checking account C) A trust D) A loan E) A certificate of deposit 12) ATM stands for A) Automatic teller machine. B) Automatic token machine. C) Available teller machine. D) Available token machine. E) Automatic taking machine. 13) All of the following are deposit institutions except A) A mutual savings bank. B) A commercial bank. C) A credit union. D) A savings and loan association. E) A finance company 14) 14) A demand deposit is also known as A) A loan. B) A savings account. C) A checking account D) A trust E) All of these are demand deposits. 15) 15) Which of the following primarily provides loans for home purchases? A) A life insurance company B) An investment company C) A mortgage company D) A credit card company E) A payday loan company 16) Cathy needs a full range of financial services, including checking, savings , and lending, 16) To which of the following should she go? A) A commercial bank B) A check-cashing outlet C) A pawnshop D) A payday loan company E) A rent-to-own center 17) Harvey needed some cash quickly, so he received a short-term loan based on the value of 17) an old ring. Where did he go? A) A commercial bank B) A check-cashing outlet C) A pawnshop D) A payday loan company E) A rent-to-own center 18) If a check is lost or stolen, you should use a 18) A) Deposit ticket. B) Bank statement. C) Stop-payment order D) Stale check. E) Blank endorsement. TRUE/FALSE. Write T' if the statement is true and F if the statement is false. 19) 19) Using the simple interest formula, the interest on a $1,000 loan at 5% interest for one year is $55. 20) When used effectively, credit can help a consumer have more and enjoy more. 21) A disadvantage of using credit is the convenience it offers when making a hotel 20) 21) reservation or renting a car 22) The least expensive loans (loans with low interest) are often provided by parents or other 22) family members. 23) A credit card holder who pays the full balance during the grace period each month is 23) actually getting a free loan from the credit card company. 24) In the five Cs of credit, capital refers to the borrower's ability to pay additional debts. 2_ 25) FICO and VantageScore are two scores used by creditors to predict how likely it is that 25) you will repay a loan