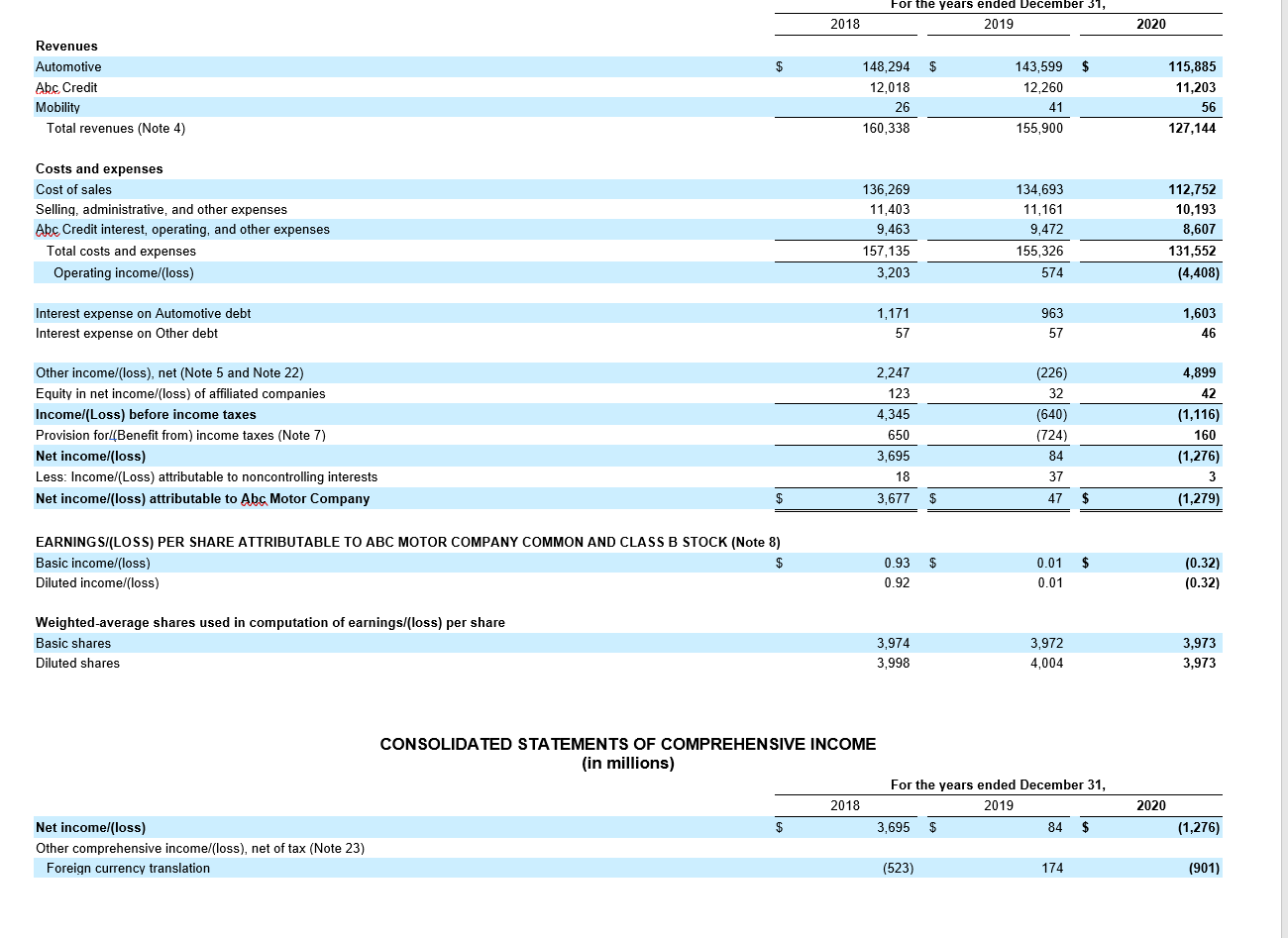

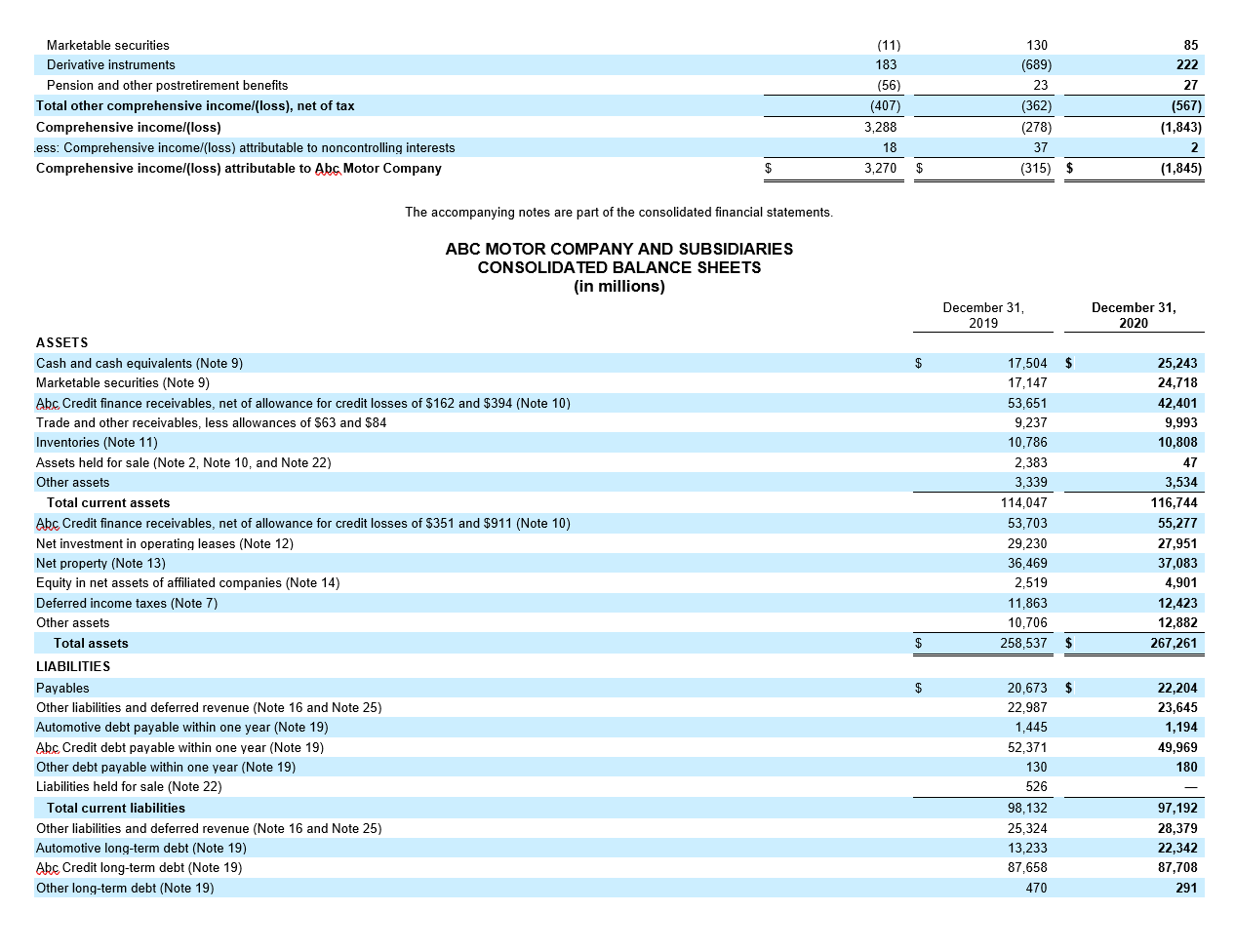

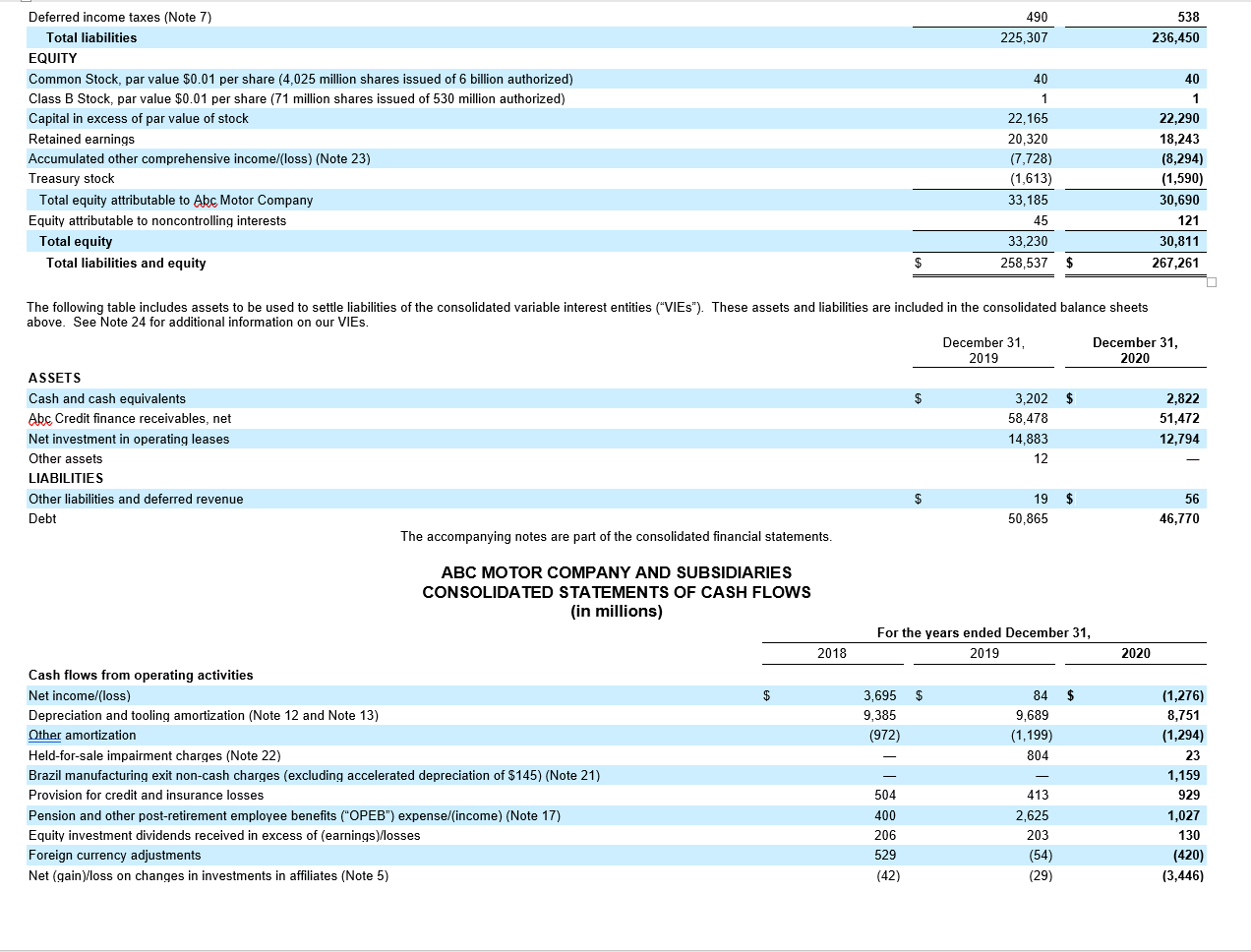

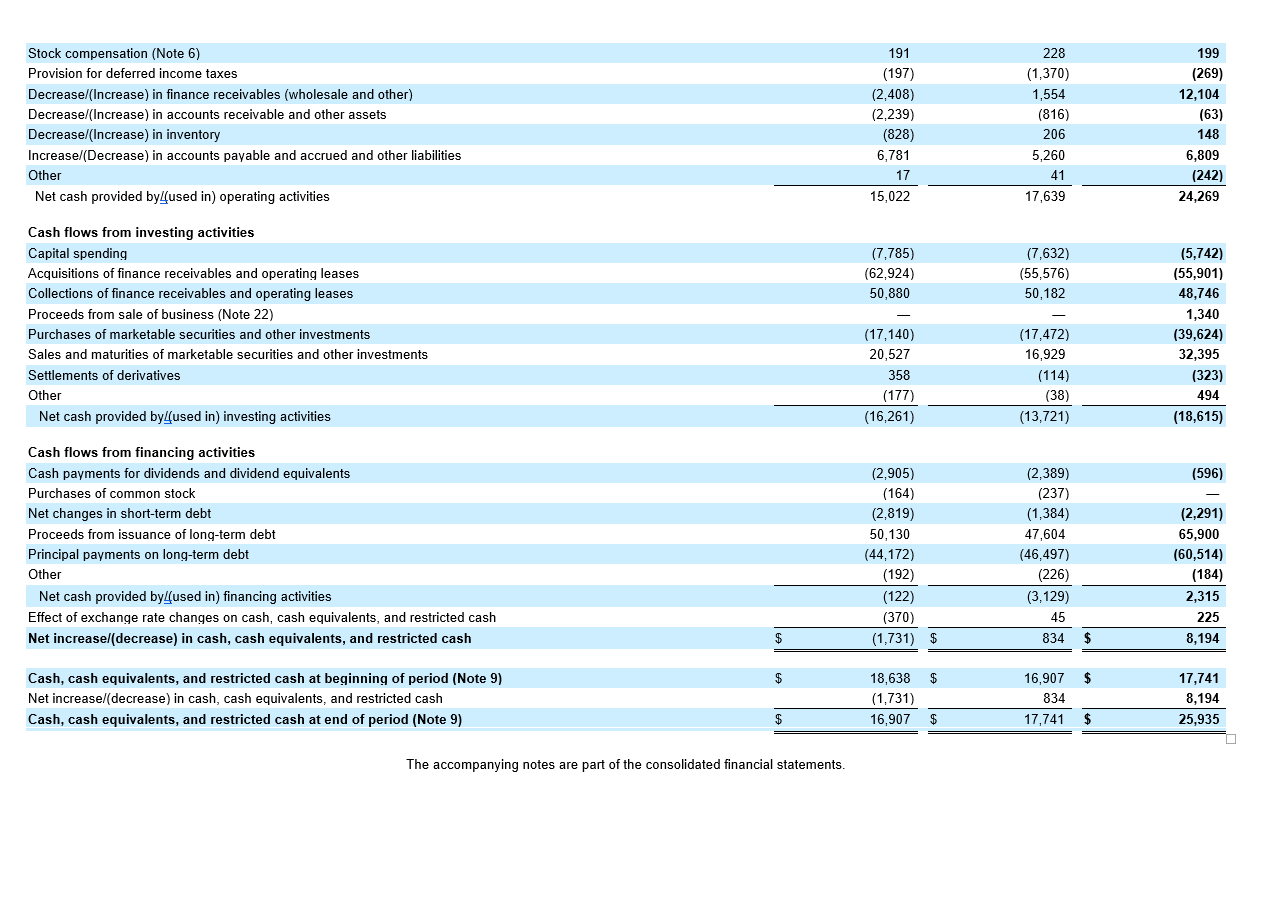

Try to check on the desktop, it is clear and fine to read.

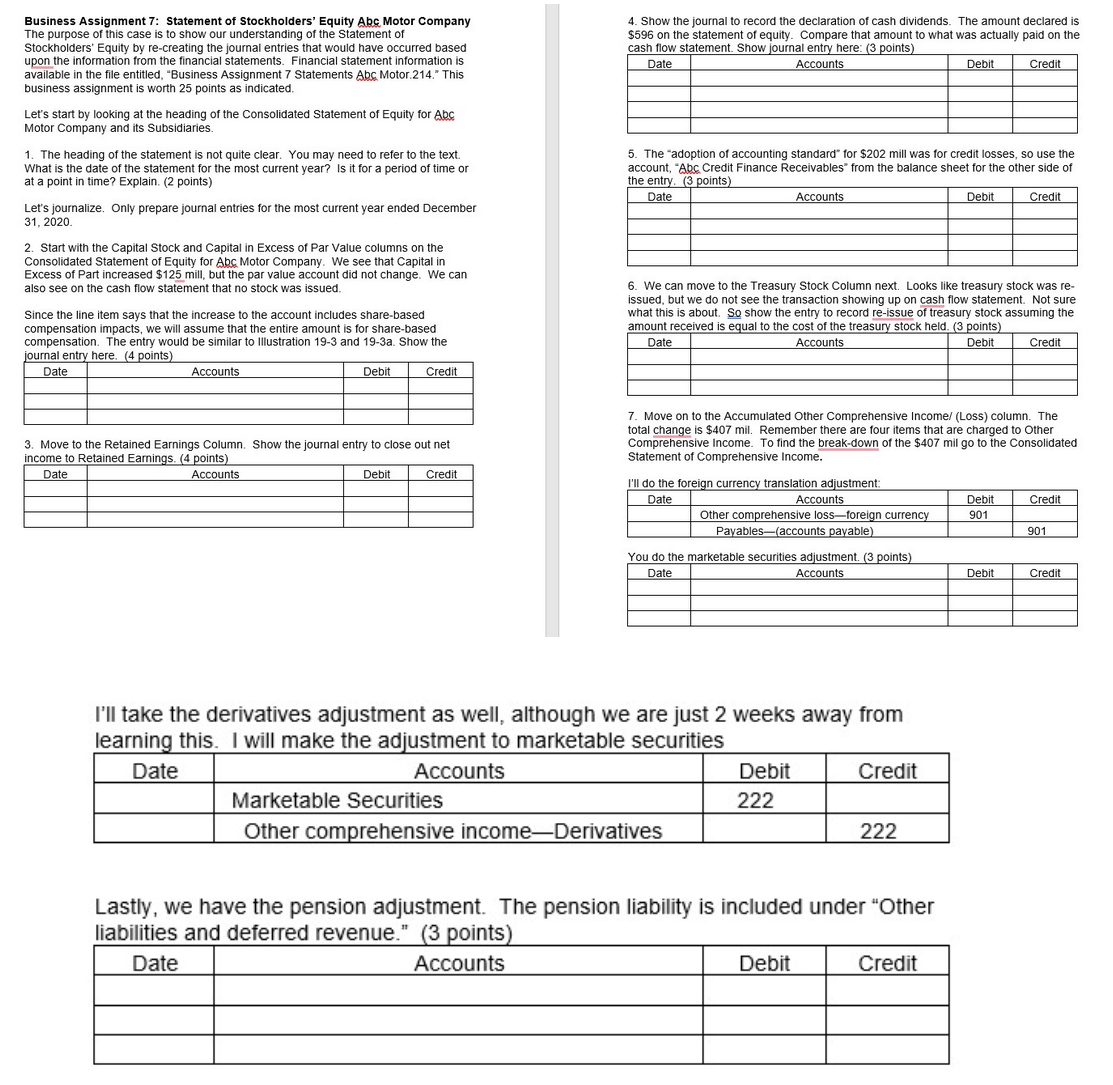

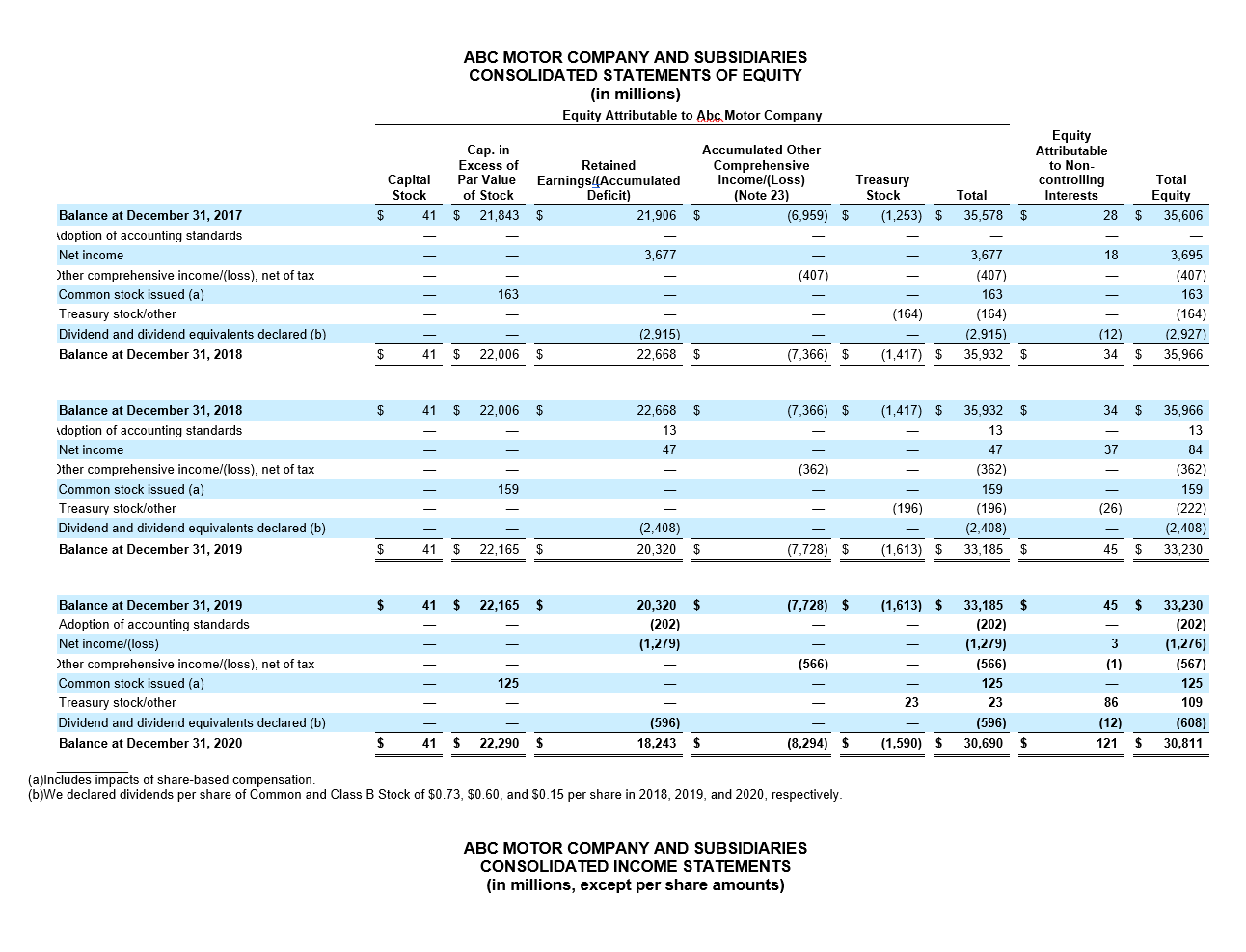

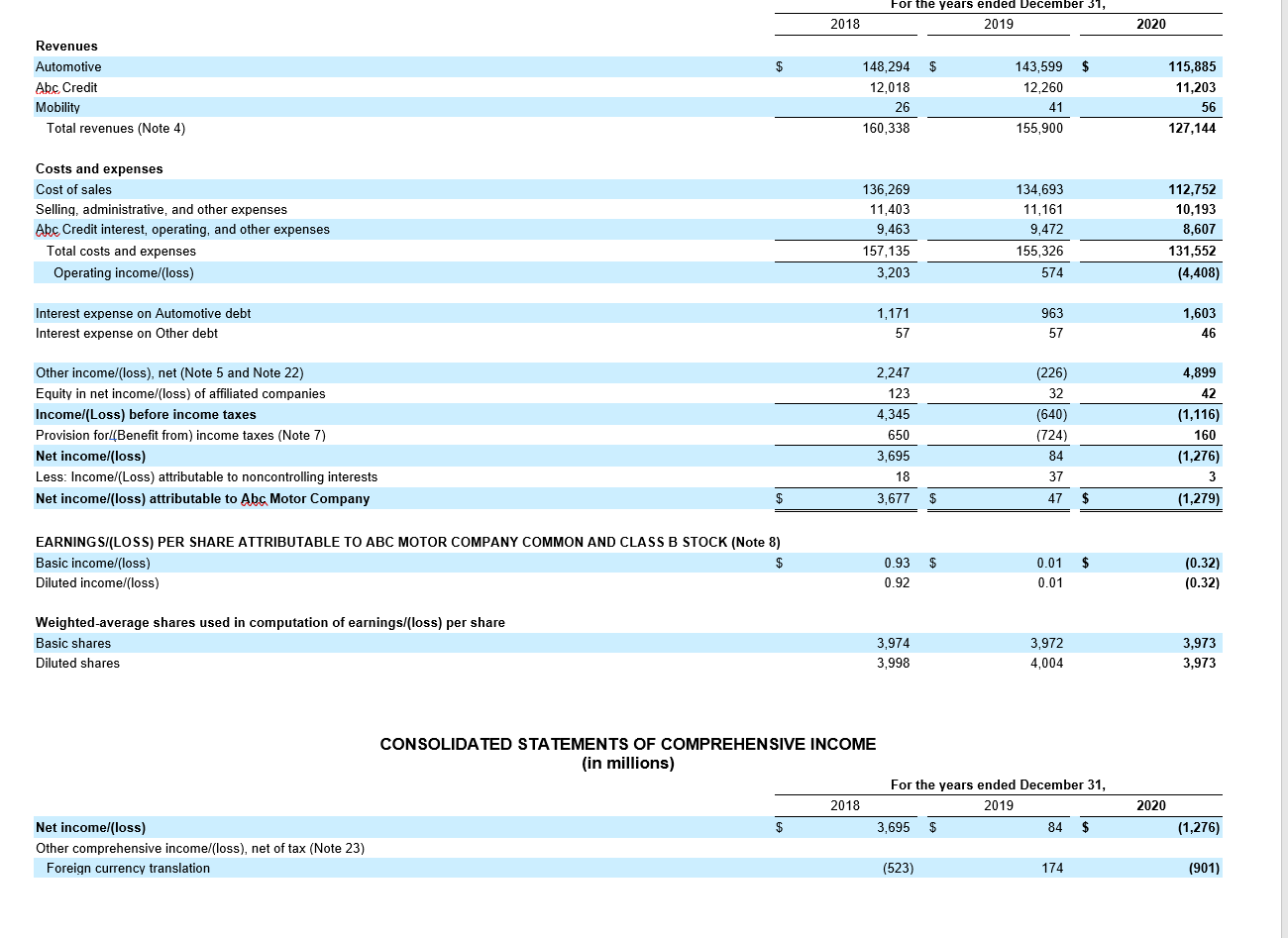

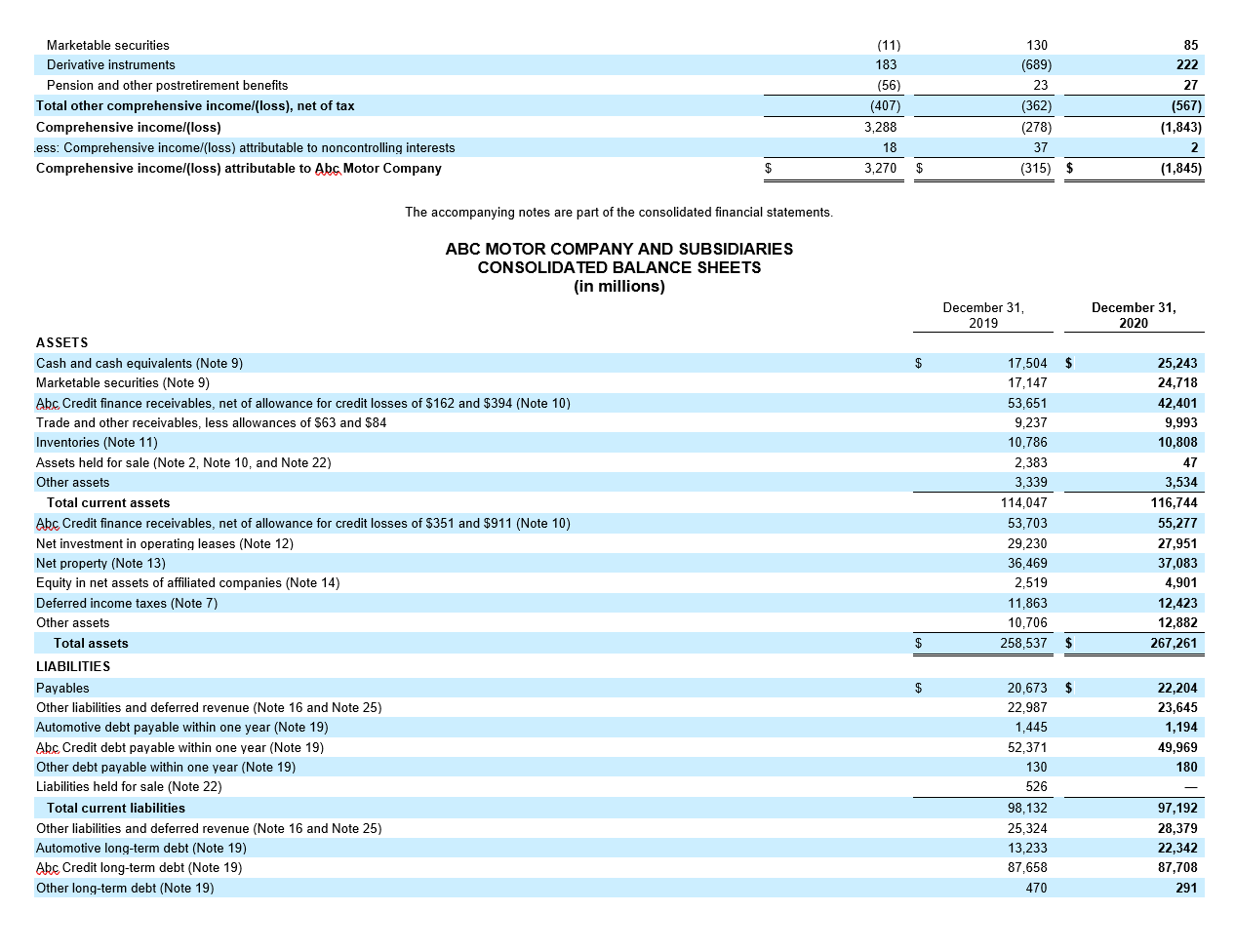

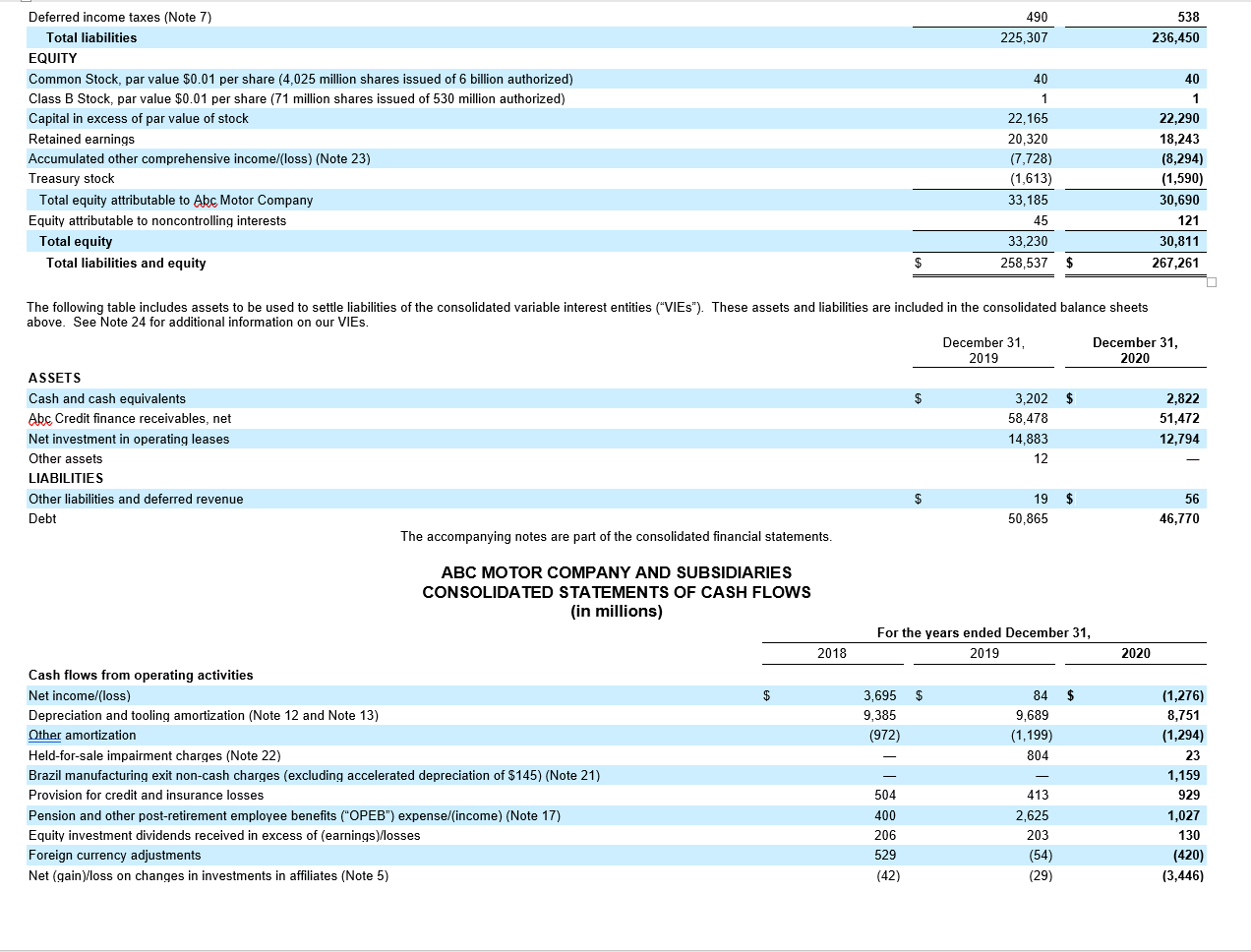

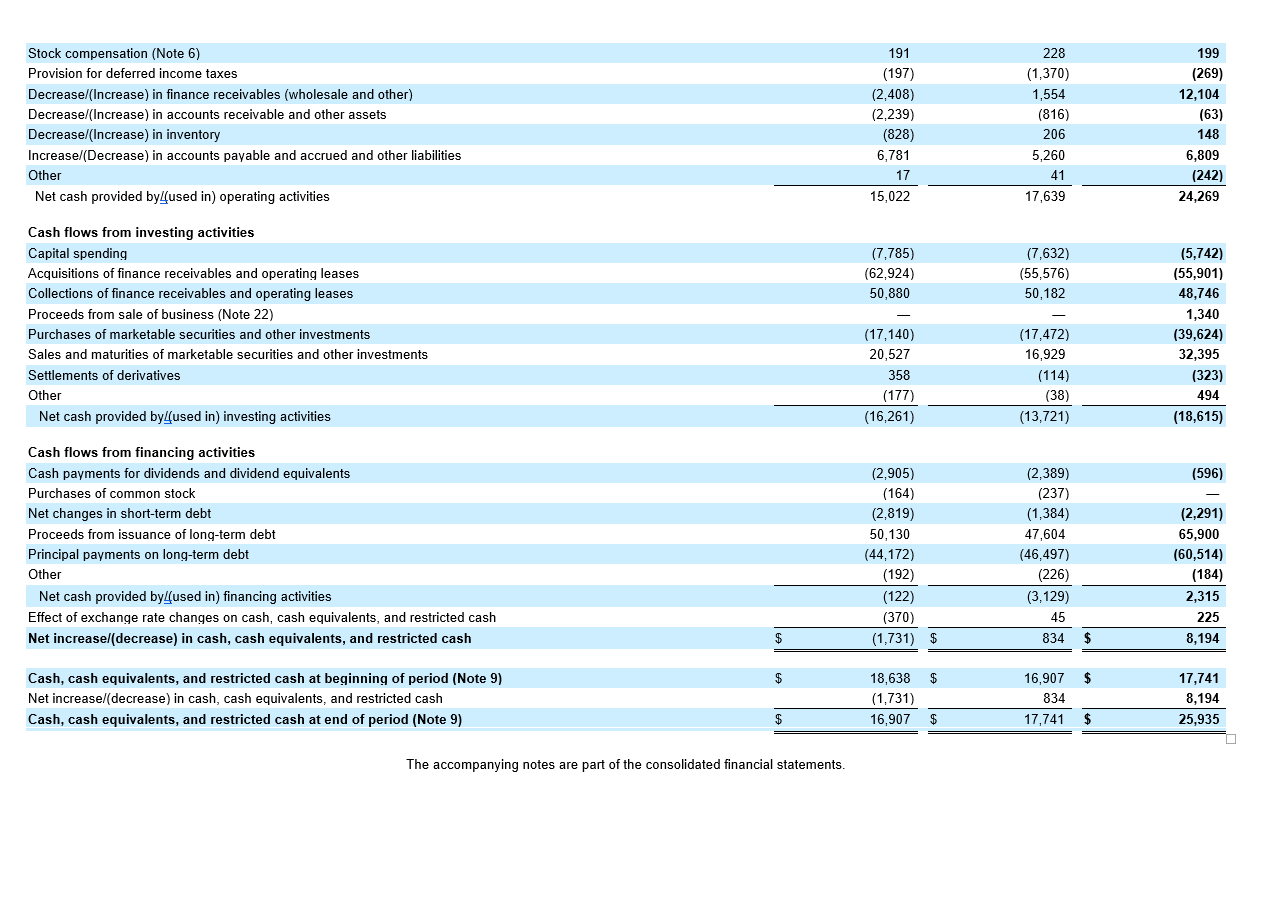

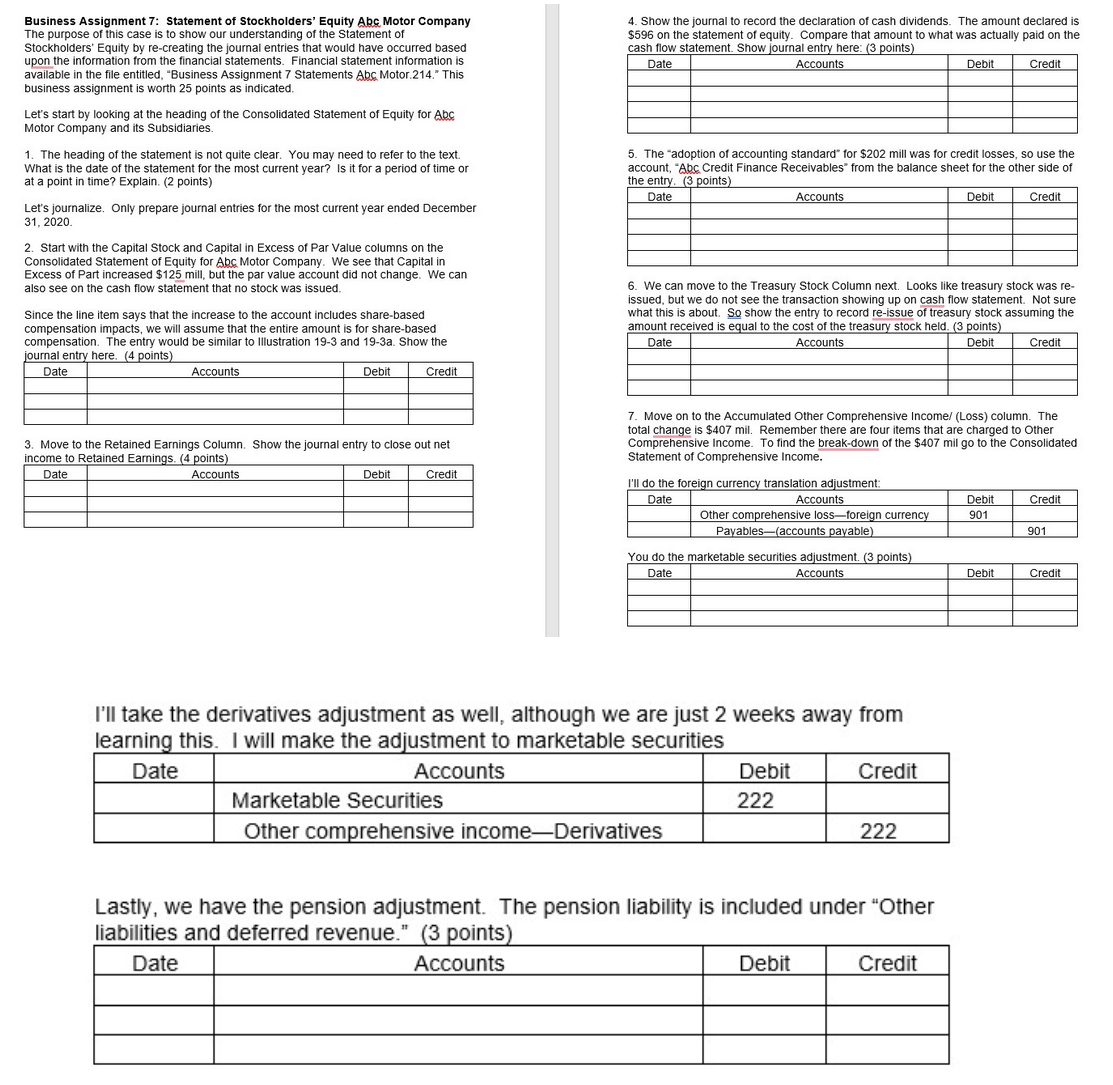

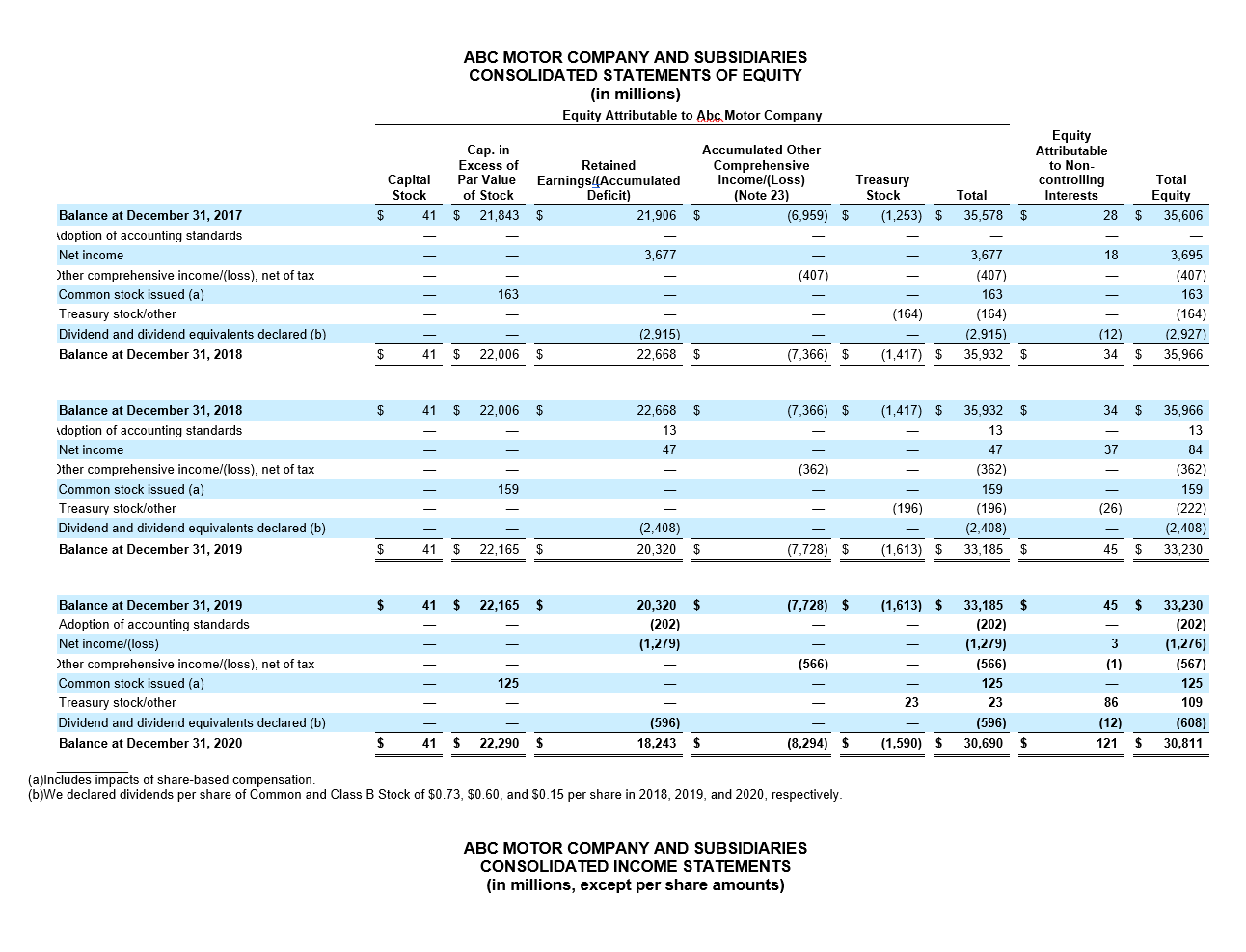

Business Assignment 7: Statement of Stockholders' Equity Als Motor Company 4. Show the journal to record the declaration of cash dividends. The amount declared is The purpose of this case is to show our understanding of the Statement of $596 on the statement of equity. Compare that amount to what was actually paid on the Stockholders' Equity by re-creating the journal entries that would have occurred based cash flow statement Show iournal entrv here: (3 noints) upon the information from the financial statements. Financial statement information is available in the file entitled, "Business Assignment 7 Statements Abc Motor.214." This business assignment is worth 25 points as indicated Let's start by looking at the heading of the Consolidated Statement of Equity for AbC Motor Company and its Subsidiaries. 1. The heading of the statement is not quite clear. You may need to refer to the text. 5. The "adoption of accounting standard" for $202 mill was for credit losses, so use the What is the date of the statement for the most current year? Is it for a period of time or account, "Abc Credit Finance Receivables" from the balance sheet for the other side of at a point in time? Explain. (2 points) the entrv (3 noints) Let's journalize. Only prepare journal entries for the most current year ended December 31,2020 2. Start with the Capital Stock and Capital in Excess of Par Value columns on the Consolidated Statement of Equity for Abc Motor Company. We see that Capital in Excess of Part increased $125 mill, but the par value account did not change. We can also see on the cash flow statement that no stock was issued. 6. We can move to the Treasury Stock Column next. Looks like treasury stock was reissued, but we do not see the transaction showing up on cash flow statement. Not sure Since the line item says that the increase to the account includes share-based what this is about. So show the entry to record re-issue of treasury stock assuming the compensation impacts, we will assume that the entire amount is for share-based amount received is eaulal to the cost of the treasurv stor.k held (3 noints) compensation. The entry would be similar to Illustration 19-3 and 19-3a. Show the inurnal entry here ( 4 nnints) 7. Move on to the Accumulated Other Comprehensive Income/ (Loss) column. The total change is $407 mil. Remember there are four items that are charged to Other 3. Move to the Retained Earnings Column. Show the journal entry to close out net Comprehensive Income. To find the break-down of the $407 mil go to the Consolidated incnme to Retainet Farninne is nnintel Statement of Comprehensive Income. You do the marketable securities adiustment. (3 points) I'll take the derivatives adjustment as well, although we are just 2 weeks away from learning this. I will make the adjustment to marketable securities Lastly, we have the pension adjustment. The pension liability is included under "Other liabilities and deferred revenue." ( 3 points) ABC MOTOR COMPANY AND SUBSIDIARIES CONSOI In TFR ST A TFMFNTS OF FOIIIT (a) (b) ABC MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions, except per share amounts) Revenues Automotive Abc, Credit Mobility Total revenues (Note 4) Costs and expenses Cost of sales Selling, administrative, and other expenses Abc Credit interest, operating, and other expenses Total costs and expenses Operating income/(loss) Interest expense on Automotive debt Interest expense on Other debt Other income/(loss), net (Note 5 and Note 22) Equity in net income/(loss) of affiliated companies Income/(Loss) before income taxes Provision forlBenefit from) income taxes (Note 7) Net income/(loss) Less: Income/(Loss) attributable to noncontrolling interests Net income/(loss) attributable to Abc Motor Company EARNINGS/(LOSS) PER SHARE ATTRIBUTABLE TO ABC MOTOR COMPANY COMMON AND CLASS B STOCK (Note 8) Basic income/(loss) Diluted income/(loss) (0.32) (0.32) Weighted-average shares used in computation of earnings/(loss) per share Basic shares Diluted shares CONSOLIDA TED STA TEMENTS OF COMPREHENSIVE INCOME (in millions) For the years ended December 31 , Net income/(loss) Other comprehensive income/(loss), net of tax (Note 23) Foreign currency translation (523) 174 (901) The accompanying notes are part of the consolidated financial statements. ABC MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) ASSETS Cash and cash equivalents (Note 9 ) Marketable securities (Note 9 ) Abc. Credit finance receivables, net of allowance for credit losses of $162 and $394 (Note 10) Trade and other receivables, less allowances of $63 and $84 Inventories (Note 11) Assets held for sale (Note 2, Note 10, and Note 22) Other assets Total current assets Abc Credit finance receivables, net of allowance for credit losses of $351 and $911 (Note 10) Net investment in operating leases (Note 12) Net property (Note 13) Equity in net assets of affiliated companies (Note 14) Deferred income taxes (Note 7) Other assets Total assets LIABILITIES Payables Other liabilities and deferred revenue (Note 16 and Note 25) Automotive debt payable within one year (Note 19) Abc, Credit debt payable within one year (Note 19) Other debt payable within one year (Note 19) Liabilities held for sale (Note 22) Total current liabilities Other liabilities and deferred revenue (Note 16 and Note 25) Automotive long-term debt (Note 19) Abc Credit long-term debt (Note 19) Other long-term debt (Note 19) Deferred income taxes (Note 7) Total liabilities 225,307490236,450538 EQUITY Common Stock, par value $0.01 per share (4,025 million shares issued of 6 billion authorized) Class B Stock, par value $0.01 per share ( 71 million shares issued of 530 million authorized) Capital in excess of par value of stock Retained earnings Accumulated other comprehensive income/(loss) (Note 23) Treasury stock Total equity attributable to Abc Motor Company Equity attributable to noncontrolling interests Total equity Total liabilities and equity Total liabilities and equity above. See Note 24 for additional information on our VIEs. ASSETS Cash and cash equivalents Abs Credit finance receivables, net Net investment in operating leases Other assets LIABILITIES Other liabilities and deferred revenue Debt ANY AND SUBSIDIARIES (in millions) For the years ended December 31 , Cash flows from operating activities Net income/(loss) Depreciation and tooling amortization (Note 12 and Note 13) Other amortization Held-for-sale impairment charges (Note 22) Brazil manufacturing exit non-cash charges (excluding accelerated depreciation of $145 ) (Note 21) Provision for credit and insurance losses Pension and other post-retirement employee benefits ("OPEB") expense/(income) (Note 17) Equity investment dividends received in excess of (earnings)/losses Foreign currency adjustments Net (gain)/loss on changes in investments in affiliates (Note 5) Cash flows from investing activities Cash flows from financing activities Cash payments for dividends and dividend equivalents Purchases of common stock Net changes in short-term debt Proceeds from issuance of long-term debt Principal payments on long-term debt Other Net cash provided by (used in) financing activities Effect of exchange rate changes on cash, cash equivalents, and restricted cash Net increase/(decrease) in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at beginning of period (Note 9) Net increase/(decrease) in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at end of period (Note 9) The accompanying notes are part of the consolidated financial statements. Business Assignment 7: Statement of Stockholders' Equity Als Motor Company 4. Show the journal to record the declaration of cash dividends. The amount declared is The purpose of this case is to show our understanding of the Statement of $596 on the statement of equity. Compare that amount to what was actually paid on the Stockholders' Equity by re-creating the journal entries that would have occurred based cash flow statement Show iournal entrv here: (3 noints) upon the information from the financial statements. Financial statement information is available in the file entitled, "Business Assignment 7 Statements Abc Motor.214." This business assignment is worth 25 points as indicated Let's start by looking at the heading of the Consolidated Statement of Equity for AbC Motor Company and its Subsidiaries. 1. The heading of the statement is not quite clear. You may need to refer to the text. 5. The "adoption of accounting standard" for $202 mill was for credit losses, so use the What is the date of the statement for the most current year? Is it for a period of time or account, "Abc Credit Finance Receivables" from the balance sheet for the other side of at a point in time? Explain. (2 points) the entrv (3 noints) Let's journalize. Only prepare journal entries for the most current year ended December 31,2020 2. Start with the Capital Stock and Capital in Excess of Par Value columns on the Consolidated Statement of Equity for Abc Motor Company. We see that Capital in Excess of Part increased $125 mill, but the par value account did not change. We can also see on the cash flow statement that no stock was issued. 6. We can move to the Treasury Stock Column next. Looks like treasury stock was reissued, but we do not see the transaction showing up on cash flow statement. Not sure Since the line item says that the increase to the account includes share-based what this is about. So show the entry to record re-issue of treasury stock assuming the compensation impacts, we will assume that the entire amount is for share-based amount received is eaulal to the cost of the treasurv stor.k held (3 noints) compensation. The entry would be similar to Illustration 19-3 and 19-3a. Show the inurnal entry here ( 4 nnints) 7. Move on to the Accumulated Other Comprehensive Income/ (Loss) column. The total change is $407 mil. Remember there are four items that are charged to Other 3. Move to the Retained Earnings Column. Show the journal entry to close out net Comprehensive Income. To find the break-down of the $407 mil go to the Consolidated incnme to Retainet Farninne is nnintel Statement of Comprehensive Income. You do the marketable securities adiustment. (3 points) I'll take the derivatives adjustment as well, although we are just 2 weeks away from learning this. I will make the adjustment to marketable securities Lastly, we have the pension adjustment. The pension liability is included under "Other liabilities and deferred revenue." ( 3 points) ABC MOTOR COMPANY AND SUBSIDIARIES CONSOI In TFR ST A TFMFNTS OF FOIIIT (a) (b) ABC MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions, except per share amounts) Revenues Automotive Abc, Credit Mobility Total revenues (Note 4) Costs and expenses Cost of sales Selling, administrative, and other expenses Abc Credit interest, operating, and other expenses Total costs and expenses Operating income/(loss) Interest expense on Automotive debt Interest expense on Other debt Other income/(loss), net (Note 5 and Note 22) Equity in net income/(loss) of affiliated companies Income/(Loss) before income taxes Provision forlBenefit from) income taxes (Note 7) Net income/(loss) Less: Income/(Loss) attributable to noncontrolling interests Net income/(loss) attributable to Abc Motor Company EARNINGS/(LOSS) PER SHARE ATTRIBUTABLE TO ABC MOTOR COMPANY COMMON AND CLASS B STOCK (Note 8) Basic income/(loss) Diluted income/(loss) (0.32) (0.32) Weighted-average shares used in computation of earnings/(loss) per share Basic shares Diluted shares CONSOLIDA TED STA TEMENTS OF COMPREHENSIVE INCOME (in millions) For the years ended December 31 , Net income/(loss) Other comprehensive income/(loss), net of tax (Note 23) Foreign currency translation (523) 174 (901) The accompanying notes are part of the consolidated financial statements. ABC MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) ASSETS Cash and cash equivalents (Note 9 ) Marketable securities (Note 9 ) Abc. Credit finance receivables, net of allowance for credit losses of $162 and $394 (Note 10) Trade and other receivables, less allowances of $63 and $84 Inventories (Note 11) Assets held for sale (Note 2, Note 10, and Note 22) Other assets Total current assets Abc Credit finance receivables, net of allowance for credit losses of $351 and $911 (Note 10) Net investment in operating leases (Note 12) Net property (Note 13) Equity in net assets of affiliated companies (Note 14) Deferred income taxes (Note 7) Other assets Total assets LIABILITIES Payables Other liabilities and deferred revenue (Note 16 and Note 25) Automotive debt payable within one year (Note 19) Abc, Credit debt payable within one year (Note 19) Other debt payable within one year (Note 19) Liabilities held for sale (Note 22) Total current liabilities Other liabilities and deferred revenue (Note 16 and Note 25) Automotive long-term debt (Note 19) Abc Credit long-term debt (Note 19) Other long-term debt (Note 19) Deferred income taxes (Note 7) Total liabilities 225,307490236,450538 EQUITY Common Stock, par value $0.01 per share (4,025 million shares issued of 6 billion authorized) Class B Stock, par value $0.01 per share ( 71 million shares issued of 530 million authorized) Capital in excess of par value of stock Retained earnings Accumulated other comprehensive income/(loss) (Note 23) Treasury stock Total equity attributable to Abc Motor Company Equity attributable to noncontrolling interests Total equity Total liabilities and equity Total liabilities and equity above. See Note 24 for additional information on our VIEs. ASSETS Cash and cash equivalents Abs Credit finance receivables, net Net investment in operating leases Other assets LIABILITIES Other liabilities and deferred revenue Debt ANY AND SUBSIDIARIES (in millions) For the years ended December 31 , Cash flows from operating activities Net income/(loss) Depreciation and tooling amortization (Note 12 and Note 13) Other amortization Held-for-sale impairment charges (Note 22) Brazil manufacturing exit non-cash charges (excluding accelerated depreciation of $145 ) (Note 21) Provision for credit and insurance losses Pension and other post-retirement employee benefits ("OPEB") expense/(income) (Note 17) Equity investment dividends received in excess of (earnings)/losses Foreign currency adjustments Net (gain)/loss on changes in investments in affiliates (Note 5) Cash flows from investing activities Cash flows from financing activities Cash payments for dividends and dividend equivalents Purchases of common stock Net changes in short-term debt Proceeds from issuance of long-term debt Principal payments on long-term debt Other Net cash provided by (used in) financing activities Effect of exchange rate changes on cash, cash equivalents, and restricted cash Net increase/(decrease) in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at beginning of period (Note 9) Net increase/(decrease) in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at end of period (Note 9) The accompanying notes are part of the consolidated financial statements