Try to do it in any way possible thnks

hi i uploaded second photo please check it's clear

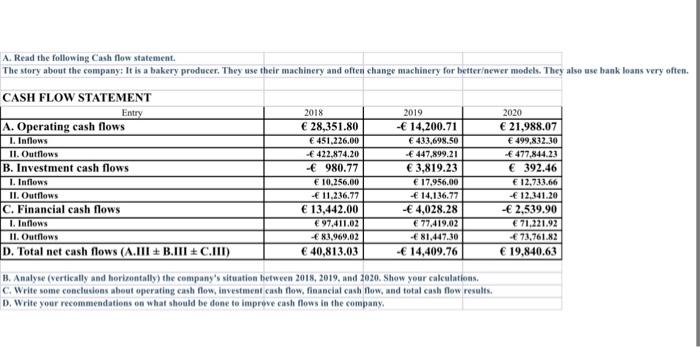

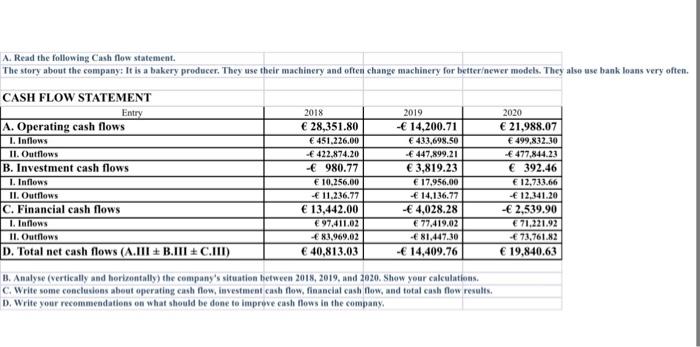

| A. Read the following Cash flow statement. | | | |

| The story about the company: It is a bakery producer. They use their machinery and often change machinery for betterewer models. They also use bank loans very often. | | |

| | | |

| CASH FLOW STATEMENT | | | |

| Entry | 2018 | 2019 | 2020 |

| A. Operating cash flows | 28 351,80 | - 14 200,71 | 21 988,07 |

| I. Inflows | 451 226,00 | 433 698,50 | 499 832,30 |

| II. Outflows | - 422 874,20 | - 447 899,21 | - 477 844,23 |

| B. Investment cash flows | - 980,77 | 3 819,23 | 392,46 |

| I. Inflows | 10 256,00 | 17 956,00 | 12 733,66 |

| II. Outflows | - 11 236,77 | - 14 136,77 | - 12 341,20 |

| C. Financial cash flows | 13 442,00 | - 4 028,28 | - 2 539,90 |

| I. Inflows | 97 411,02 | 77 419,02 | 71 221,92 |

| II. Outflows | - 83 969,02 | - 81 447,30 | - 73 761,82 |

| D. Total net cash flows (A.III B.III C.III) | 40 813,03 | - 14 409,76 | 19 840,63 |

| | | |

| B. Analyse (vertically and horizontally) the company's situation between 2018, 2019, and 2020. Show your calculations. | | | |

| C. Write some conclusions about operating cash flow, investment cash flow, financial cash flow, and total cash flow results. | | | |

| D. Write your recommendations on what should be done to improve cash flows in the company. | | | |

| | | |

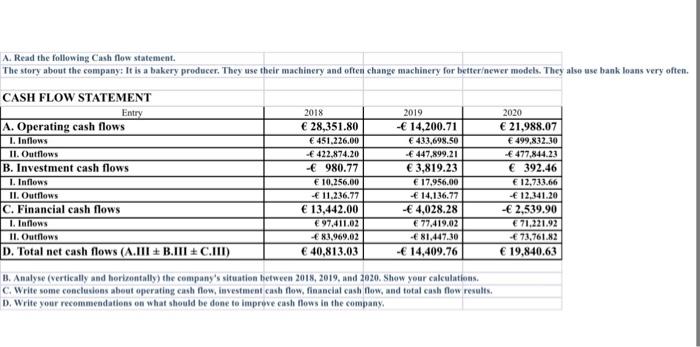

| A. Read the following Cash flow statement. | | | |

| The story about the company: It is a bakery producer. They use their machinery and often change machinery for betterewer models. They also use bank loans very often. | | |

| | | |

| CASH FLOW STATEMENT | | | |

| Entry | 2018 | 2019 | 2020 |

| A. Operating cash flows | 28 351,80 | - 14 200,71 | 21 988,07 |

| I. Inflows | 451 226,00 | 433 698,50 | 499 832,30 |

| II. Outflows | - 422 874,20 | - 447 899,21 | - 477 844,23 |

| B. Investment cash flows | - 980,77 | 3 819,23 | 392,46 |

| I. Inflows | 10 256,00 | 17 956,00 | 12 733,66 |

| II. Outflows | - 11 236,77 | - 14 136,77 | - 12 341,20 |

| C. Financial cash flows | 13 442,00 | - 4 028,28 | - 2 539,90 |

| I. Inflows | 97 411,02 | 77 419,02 | 71 221,92 |

| II. Outflows | - 83 969,02 | - 81 447,30 | - 73 761,82 |

| D. Total net cash flows (A.III B.III C.III) | 40 813,03 | - 14 409,76 | 19 840,63 |

| | | |

| B. Analyse (vertically and horizontally) the company's situation between 2018, 2019, and 2020. Show your calculations. | | | |

| C. Write some conclusions about operating cash flow, investment cash flow, financial cash flow, and total cash flow results. | | | |

| D. Write your recommendations on what should be done to improve cash flows in the company. | | | |

21:39 LTE X 2021.05.13 Assignment 2. Cash fi... CASHFLOW STATEMENT THE TO TE lis IR LESED . OTHER BE HI m. Tutall or cash LUANG GIRARDO A. Read the following Cash flow statement. The story about the company: It is a bakery producer. They use their machinery and often change machinery for betterewer models. They also use bank loans very often. CASH FLOW STATEMENT Entry 2018 2019 2020 A. Operating cash flows 28,351.80 - 14,200.71 21,988.07 1. Inflows 451,226.00 433,698.50 499,832.30 II. Outflows - 422.874.20 - 447.899.21 - 477.844.23 B. Investment cash flows - 980.77 3,819.23 392.46 L. Inflows 10.256.00 17,956.00 12.733.66 11. Outflows 11,236.77 - 14,136.77 12.341.20 c. Financial cash flows 13,442.00 - 4,028.28 - 2,539.90 1. Inflows 97.411.02 77.419.02 71.221.92 IL Outflows - 83,969.02 - 81,447.30 - 73,761.N2 D. Total net cash flows (A.III B.IIIC.III) 40,813.03 - 14,409.76 19,840.63 1. Analyse (vertically and horizontally) the company's situation between 2018, 2019, and 2020. Show your calentations, C. Write some conclusions about operating cash flow, investment cash flow, financial cash flow, and total cash flow results. D. Write your recommendations on what should be done to improve cash flows in the company. A. Read the following Cash flow statement The story about the company: It is a bakery producer, They use their machinery and often change machinery for betterewer models. They also use bank loans very often. CASH FLOW STATEMENT Entry 2018 2019 2020 A. Operating cash flows 28,351.80 - 14,200.71 21,988.07 1. Inflows 451.226.00 433,698.50 499,832.30 11. Outflows - 422.874.20 - 447,899.21 477.844.23 B. Investment cash flows - 980.77 3,819.23 392.46 L. Inflows 10,256,00 17,956.00 12.733.66 IL Outflows - 11.236.77 - 14,136.77 12.341.20 C. Financial cash flows 13,442.00 - 4,028.28 - 2,539.90 1. Inflows 97,411.02 77.419.02 71.221.92 11. Outflows 83,969.02 - 81,447.30 - 73,761.82 D. Total net cash flows (A.III B.IIIC.III) 40.813.03 - 14,409.76 19,840.63 B. Analyse (vertically and horizontally) the company's situation between 2018, 2019, and 2020. Show your caleulations C. Write some conclusions about operating cash flow, investment cash flow, financial cash flow, and total cash flow results. D. Write your recommendations on what should be done to improve eash flows in the company. I posted 4 times it is very Clear, Check the copy Pasteplease last one here 21:39 LTE X 2021.05.13 Assignment 2. Cash fi... CASHFLOW STATEMENT THE TO TE lis IR LESED . OTHER BE HI m. Tutall or cash LUANG GIRARDO A. Read the following Cash flow statement. The story about the company: It is a bakery producer. They use their machinery and often change machinery for betterewer models. They also use bank loans very often. CASH FLOW STATEMENT Entry 2018 2019 2020 A. Operating cash flows 28,351.80 - 14,200.71 21,988.07 1. Inflows 451,226.00 433,698.50 499,832.30 II. Outflows - 422.874.20 - 447.899.21 - 477.844.23 B. Investment cash flows - 980.77 3,819.23 392.46 L. Inflows 10.256.00 17,956.00 12.733.66 11. Outflows 11,236.77 - 14,136.77 12.341.20 c. Financial cash flows 13,442.00 - 4,028.28 - 2,539.90 1. Inflows 97.411.02 77.419.02 71.221.92 IL Outflows - 83,969.02 - 81,447.30 - 73,761.N2 D. Total net cash flows (A.III B.IIIC.III) 40,813.03 - 14,409.76 19,840.63 1. Analyse (vertically and horizontally) the company's situation between 2018, 2019, and 2020. Show your calentations, C. Write some conclusions about operating cash flow, investment cash flow, financial cash flow, and total cash flow results. D. Write your recommendations on what should be done to improve cash flows in the company. A. Read the following Cash flow statement The story about the company: It is a bakery producer, They use their machinery and often change machinery for betterewer models. They also use bank loans very often. CASH FLOW STATEMENT Entry 2018 2019 2020 A. Operating cash flows 28,351.80 - 14,200.71 21,988.07 1. Inflows 451.226.00 433,698.50 499,832.30 11. Outflows - 422.874.20 - 447,899.21 477.844.23 B. Investment cash flows - 980.77 3,819.23 392.46 L. Inflows 10,256,00 17,956.00 12.733.66 IL Outflows - 11.236.77 - 14,136.77 12.341.20 C. Financial cash flows 13,442.00 - 4,028.28 - 2,539.90 1. Inflows 97,411.02 77.419.02 71.221.92 11. Outflows 83,969.02 - 81,447.30 - 73,761.82 D. Total net cash flows (A.III B.IIIC.III) 40.813.03 - 14,409.76 19,840.63 B. Analyse (vertically and horizontally) the company's situation between 2018, 2019, and 2020. Show your caleulations C. Write some conclusions about operating cash flow, investment cash flow, financial cash flow, and total cash flow results. D. Write your recommendations on what should be done to improve eash flows in the company. I posted 4 times it is very Clear, Check the copy Pasteplease last one here