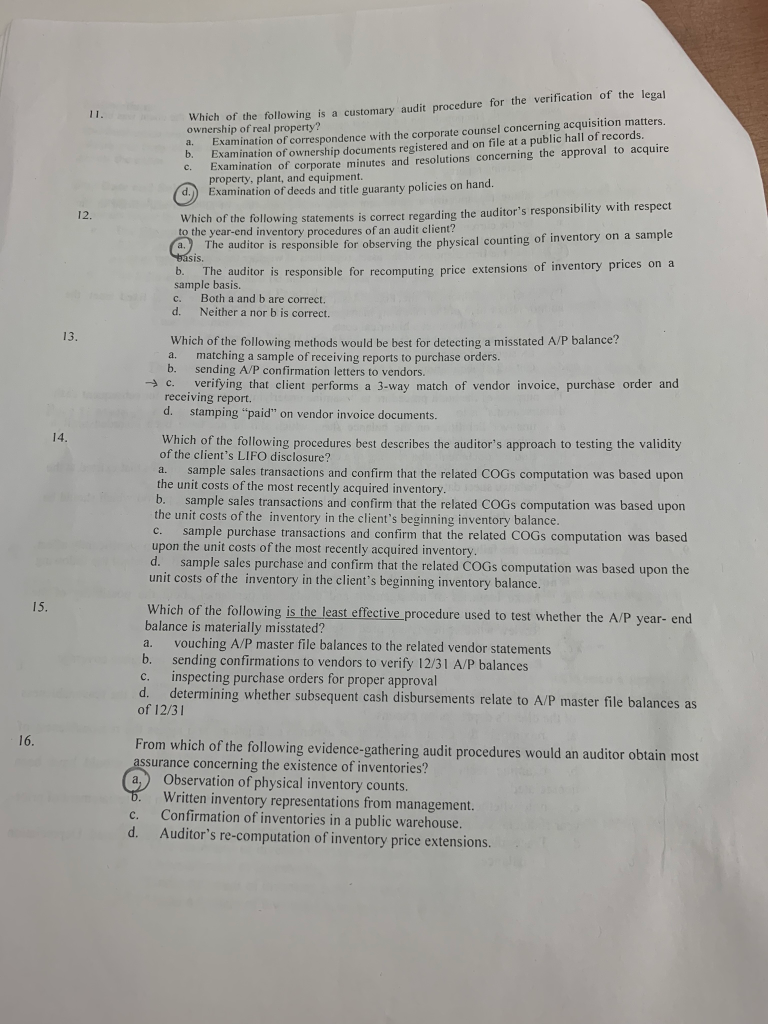

trying to complete this practice test from book need help. please answer all even the ones i guessed on. Thanks!

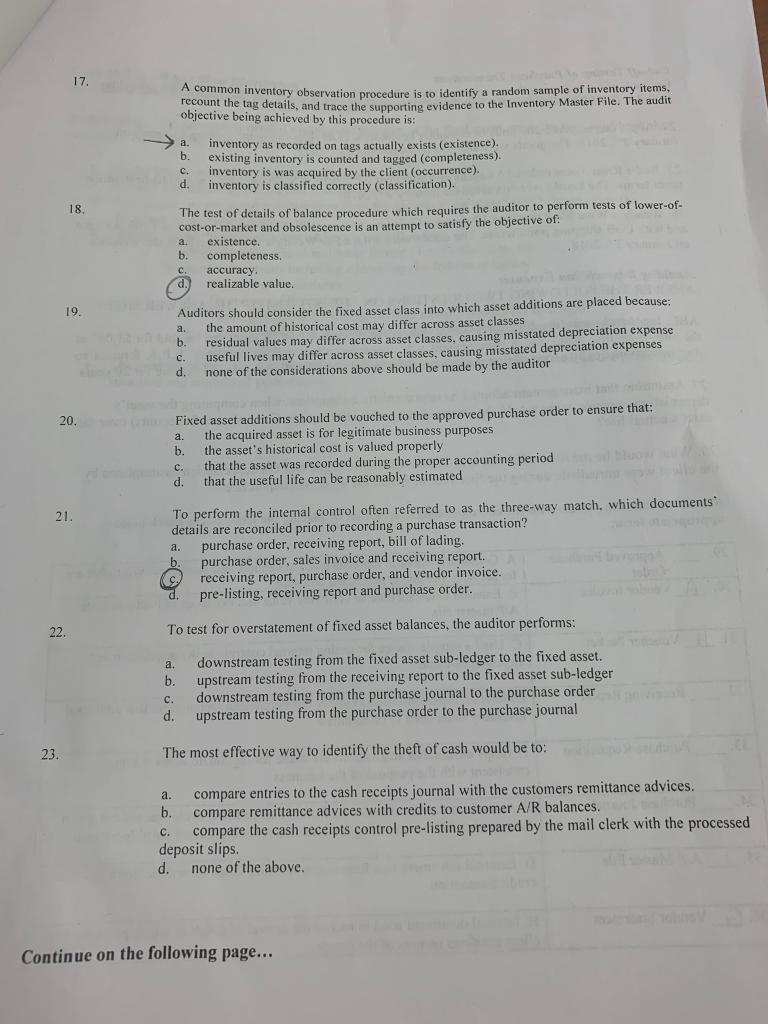

Which of the following is a customary audit procedure for the verification of the legal ownership of real property Examination of correspondence with the corporate counsel concerning acquisition matters. a. Examination of corporate minutes and resolutions concerning the approval to acquire property, plant, and equipment. b. Examination of ownership documents registered and on file at a public hall of records c. Examination of deeds and title guaranty policies on hand. d of the following statements is correct regarding the auditor's responsibility with respect tor is responsible for observing the physical counting of inventory on a sample 12. Which to the year-end inventory procedures of an audit client? a.) The audi b.The auditor is responsible for recomputing price extensions of inventory sample basis c. d. Both a and b are correct. Neither a nor b is correct. 13. Which of the following methods would be best for detecting a misstated A/P balance? matching a sample of receiving reports to purchase orders. a. b. sending A/P confirmation letters to vendors. - c. , verifying that client performs a 3-way match of vendor invoice, purchase order and receiving report. d. stamping "paid" on vendor invoice documents. 14. Which of the following procedures best describes the auditor's approach to testing the validity of the client's LIFO disclosure? a. the unit costs of the most recently acquired inventory b. sample sales transactions and confirm that the related COGs computation was based upon sample sales transactions and confirm that the related COGs computation was based upon e unit costs of the inventory in the client's beginning inventory balance. sample purchase transactions and confirm that the related COGs computation was based c. upon the unit costs of the most recently acquired inventory d. sample sales purchase and confirm that the related COGs computation was based upon the unit costs of the inventory in the client's beginning inventory balance. 15. Which of the following is the least effective procedure used to test whether the A/P year- end balance is materially misstated? a. vouching A/P master file balances to the related vendor statements b. sending confirmations to vendors to verify 12/31 A/P balances c. inspecting purchase orders for proper approval d. determining whether subsequent cash disbursements relate to A/P master file balances as of 12/31 16. From which of the following evidence-gathering audit procedures would an auditor obtain most assurance concerning the existence of inventories? a,) Observation of physical inventory counts. Written inventory representations from management Confirmation of inventories in a public warehouse. Auditor's re-computation of inventory price extensions. c. d. 17 rvation procedure is to identify a random sample of inventory items, ce the supporting evidence to the Inventory Master File. The audit recount the tag details, and tra objective being achieved by this procedure is inventory as recorded on tags actually exists (existence) existing inventory is counted and tagged (completeness) inventory is was acquired by the client (occurrence). inventory is classified correctly (classification) a. b. c. d. The test of details of balance procedure which requires the auditor to perform tests of lower-of cost-or-market and obsolescence is an attempt to satisfy the objective of 18. a. existence, b. completeness. C. accuracy d realizable value. tors should consider the fixed asset class into which asset additions are placed because a. the amount of historical cost may differ across asset classes b. residual values may differ across asset classes, causing misstated depreciation expense C. useful lives may differ across asset classes, causing misstated depreciation expenses d. 19. Audit none of the considerations above should be made by the auditor Fixed asset additions should be vouched to the approved purchase order to ensure that: a. the acquired asset is for legitimate business purposes b. the asset's historical cost is valued properly c. that the asset was recorded during the proper accounting period d. that the useful life can be reasonably estimated 20. To perform the internal control often referred to as the three-way match. which documents details are reconciled prior to recording a purchase transaction? a. purchase order, receiving report, bill of lading. 21 purchase order, sales invoice and receiving report. c receiving report, purchase order, and vendor invoice pre-listing, receiving report and purchase order. To test for overstatement of fixed asset balances, the auditor performs: 22. a. downstream testing from the fixed asset sub-ledger to the fixed asset. b. upstream testing from the receiving report to the fixed asset sub-ledger c. downstream testing from the purchase journal to the purchase order d. upstream testing from the purchase order to the purchase journal The most effective way to identify the theft of cash would be to: 23. a. compare entries to the cash receipts journal with the customers remittance advices b. compare remittance advices with credits to customer A/R balances. c. compare the cash receipts control pre-listing prepared by the mail clerk with the processed deposit slips. d. none of the above. Continue on the following page