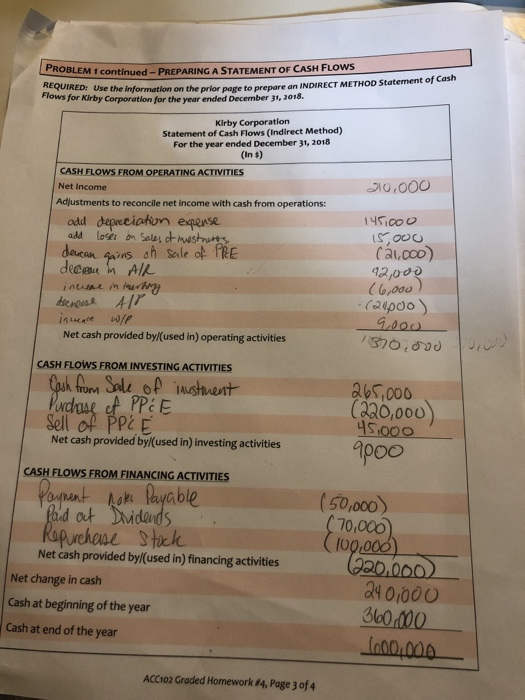

Trying to figure out where I messed up creating my cash flow statement. Attached is my statement of cash flows with the income statement, balance sheet, and additional notes. Please help

My

Numbers arent adding up!!

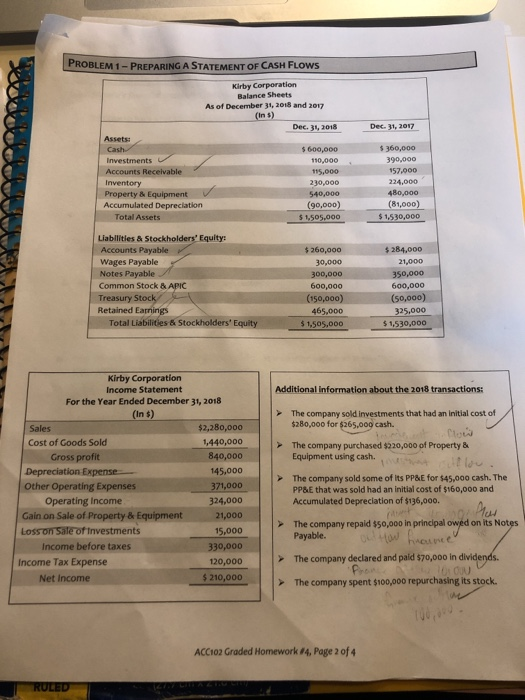

ws PROBLEM 1 continued-PREPARING A STATEMENT OF CASH FLOWS the information on the prior page to prepare an INDIRECT METHOD Statement of Cash lows for Kirby Corporation for the year ended December 31, 2o18. Kirby Corporation Statement of Cash Flows (Indirect Method) For the year ended December 31, 2018 (In s) CASH FLOWS FROM OPERATING ACTIVITIES Net Income Adjustments to reconcile net income with cash from operations: 145100 C odd depecicahon egense dacan sains ah Sale of FRE decan AlL 2000 (6,000 (apoo Net cash provided by/(used in) operating activities CASH FLOWS FROM INVESTING ACTIVITIES yS,000 ,000 Sell of PPlE Net cash provided by/(used in) investing activities CASH FLOWS FROM FINANCING ACTIVITIES 50,000 out Dvidds Purehone thek 70,000 lO Net cash provided by/(used in) financing activities Net change in cash Cash at beginning of the year Cash at end of the year 040000 3l00 ACC102 Graded Homework 4, Page 3 of4 PROBLEM 1-PREPARING A STATEMENT OF CASH FLOws Kirby Corporation Balance Sheets As of December 31, 2018 and 2017 In $ Dec. 31, 2018 Dec:31, 2017 Assets: 600,000 110,000 115,000 230,000 540,000 (9o,o00) $ 1,505,000 $ 360,000 390,000 57,000 224,000 Investments nventory Property & Equipment Accumulated Depreciation (81,000) $1,530,000 Total Assets Liabllitles & Stockholders' Equity Accounts Payable Wages Payable Notes Payable Common Stock & APIC Treasury Stock Retained Earnings $284,000 21,000 $260,000 30,000 300,000 600,000 (150,000) 465,000 600,000 (50,000 325,000 $ 1,530,0oo Total Liabilities & Stockholders Kirby Corporation Income Statement For the Year Ended December 31, 2018 (In $) Additional information about the 2018 transactions: The company sold investments that had an initial cost of $280,00o for $26s,000 cash. $2,280,000 1,440,000 840,000 145,000 371,000 324,000 21,000 15,000 330,000 120,000 $ 210,000 Sales Cost of Goods Sold The company purchased $220,000 of Property & Equipment using cash. Gross profit The company sold some of its PP&E for $45,000 cash. The PP&E that was sold had an initial cost of $160,ooo and Accumulated Depreclation of $136,000. Other Operating Expenses Operating Income Gain on Sale of Property & Equipment Loss on Sate of Investments The company repaid $5o,ooo in principal owed on its Notes Payable. Income before taxes The company declared and paid $70,000 in dividends. Income Tax Expense Net Income The company spent $100,000 repurchasing its stock. ACC102 Graded Homework #4, Page 2 of 4