Trying to find the ending balance sheet.

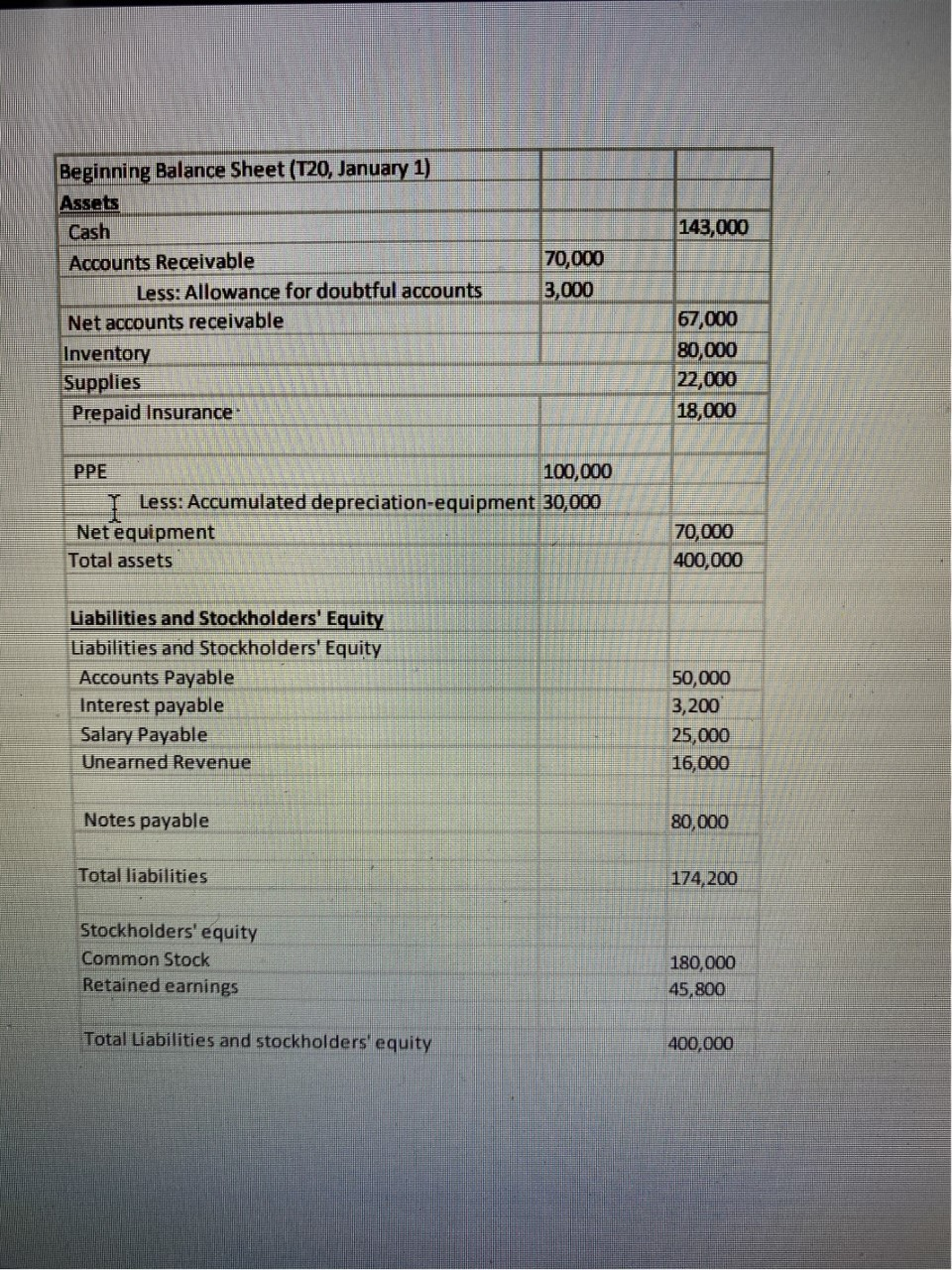

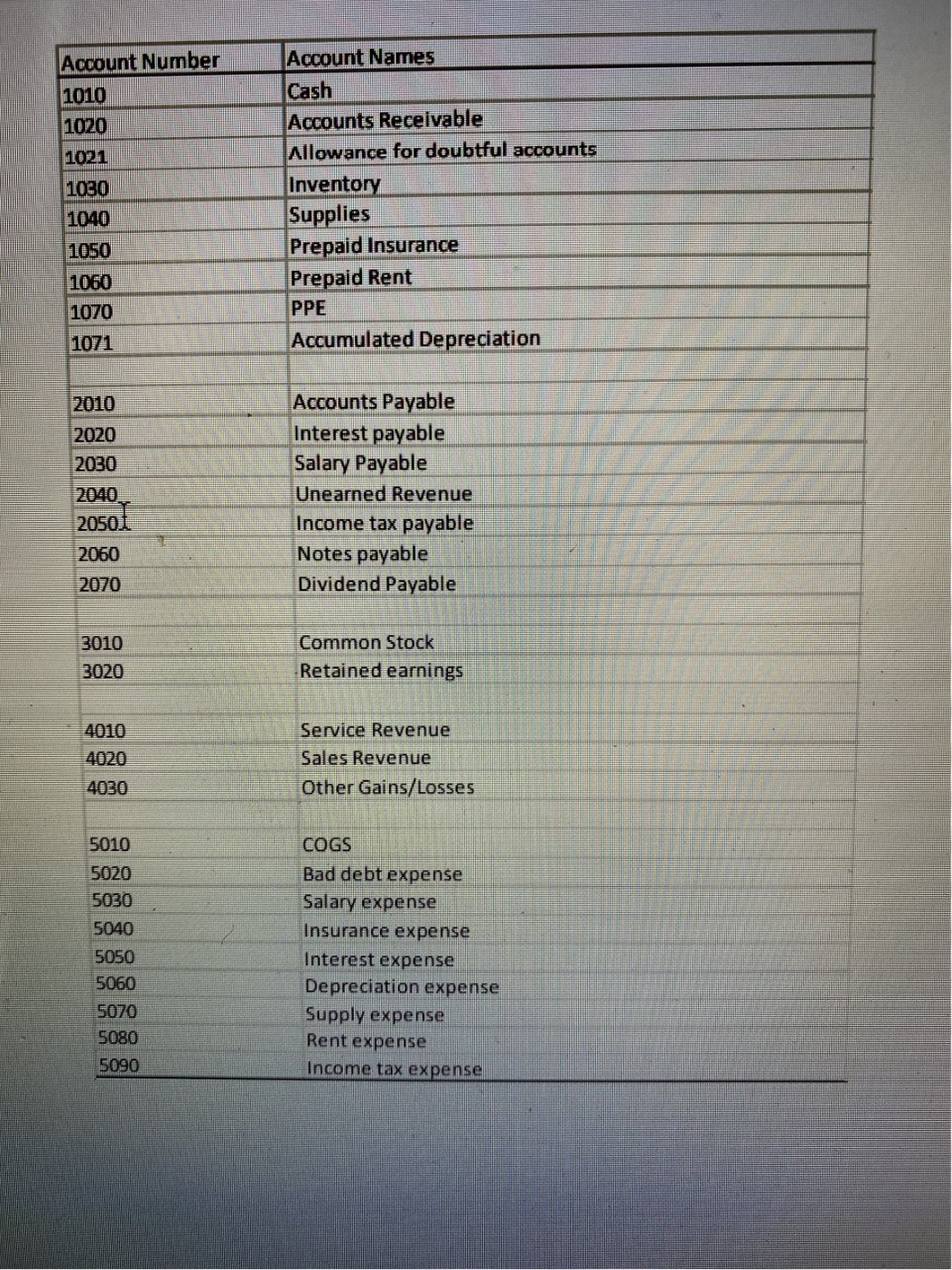

Project Number: T20 Ace is a local company sales computers to schools, municipalities and also provides IT services. During the year, accounting events are the following: On Jan. 2, Ace paid three year rent in advance with a total amount of $85,800 On Jan. 14, Ace paid out salary owed to employees for the prior year in the amount of $25,000 On Jan, 25, stockholders invested additional $40,000 cash Into the company On Feb. 14, Ace purchased office equipment costing $40,000 by signing a 6-month, 10% notes payable On Feb. 28, Ace performed IT service of $12,000 for a client which was contracted during the prior year On March 15, Ace sold computers and software in the amount of $72,000 on account for $180,000 On Apr. 1, Ace collected cash for inventory previously sold for $207,000 On May 3, Ace purchased Inventory in the amount of $400,000 on account On May 31, Ace received cash in advance for the maintenance service contract in the amount of $720,000, out of which $540,000 was performed this year On June 4, Ace sold computers and software in the amount of $340,000 on account for $816,000 On July 1, Ace partially paid-off inventory purchased on May 3 in the amount of $380,000 On Aug. 14, Ace paid off the notes payable of $40,000 borrowed on Feb. 14 plus interest On Sept. 1, Ace sold an equipment with original cost of $55,000 and accumulated depreciation of $24,000 for $38,750 On Oct. 1, Ace renewed the yearly insurance policy for $26,400 which expired on Sept. 30 On Nov. 1, Ace collected cash for inventory previously sold for $734,400 On Nov. 15, Ace decided that the bad debt expense for the entire year is $35,000, and wroti off $28,000 from account receivable June 4, Over the entire year, Salary and wage expense are $300,000, of which $276,000 was paid Depreciation expense is $14,875 Additional interest expense is $2,000, of which $1,800 was paid Supply expense is $17,600 Income tax expense is $360,000, of which $306,000 was paid Ace declared and paid cash dividend in the amount of $22.900 143,000 Beginning Balance Sheet (T20, January 1) Assets Cash Accounts Receivable Less: Allowance for doubtful accounts Net accounts receivable Inventory Supplies Prepaid Insurance 70,000 3,000 67,000 80,000 22,000 18,000 PPE 100,000 I Less: Accumulated depreciation-equipment 30,000 Net equipment Total assets 70,000 400,000 Liabilities and Stockholders' Equity Liabilities and Stockholders' Equity Accounts Payable Interest payable Salary Payable Unearned Revenue 50,000 3,200 25,000 16,000 Notes payable 80,000 Total liabilities 174,200 Stockholders' equity Common Stock Retained earnings 180,000 45,800 Total Liabilities and stockholders' equity 400,000 Account Number 1010 1020 1021 1030 1040 1050 1060 1070 1071 Account Names Cash Accounts Receivable Allowance for doubtful accounts Inventory Supplies Prepaid Insurance Prepaid Rent PPE Accumulated Depreciation 2010 2020 2030 2040 20501 2060 2070 Accounts Payable Interest payable Salary Payable Unearned Revenue Income tax payable Notes payable Dividend Payable 3010 3020 Common Stock Retained earnings 4010 4020 4030 Service Revenue Sales Revenue Other Gains/Losses 5010 5020 5030 5040 5050 5060 5070 5080 COGS Bad debt expense Salary expense Insurance expense Interest expense Depreciation expense Supply expense Rent expense Income tax expense 5090 Project Number: T20 Ace is a local company sales computers to schools, municipalities and also provides IT services. During the year, accounting events are the following: On Jan. 2, Ace paid three year rent in advance with a total amount of $85,800 On Jan. 14, Ace paid out salary owed to employees for the prior year in the amount of $25,000 On Jan, 25, stockholders invested additional $40,000 cash Into the company On Feb. 14, Ace purchased office equipment costing $40,000 by signing a 6-month, 10% notes payable On Feb. 28, Ace performed IT service of $12,000 for a client which was contracted during the prior year On March 15, Ace sold computers and software in the amount of $72,000 on account for $180,000 On Apr. 1, Ace collected cash for inventory previously sold for $207,000 On May 3, Ace purchased Inventory in the amount of $400,000 on account On May 31, Ace received cash in advance for the maintenance service contract in the amount of $720,000, out of which $540,000 was performed this year On June 4, Ace sold computers and software in the amount of $340,000 on account for $816,000 On July 1, Ace partially paid-off inventory purchased on May 3 in the amount of $380,000 On Aug. 14, Ace paid off the notes payable of $40,000 borrowed on Feb. 14 plus interest On Sept. 1, Ace sold an equipment with original cost of $55,000 and accumulated depreciation of $24,000 for $38,750 On Oct. 1, Ace renewed the yearly insurance policy for $26,400 which expired on Sept. 30 On Nov. 1, Ace collected cash for inventory previously sold for $734,400 On Nov. 15, Ace decided that the bad debt expense for the entire year is $35,000, and wroti off $28,000 from account receivable June 4, Over the entire year, Salary and wage expense are $300,000, of which $276,000 was paid Depreciation expense is $14,875 Additional interest expense is $2,000, of which $1,800 was paid Supply expense is $17,600 Income tax expense is $360,000, of which $306,000 was paid Ace declared and paid cash dividend in the amount of $22.900 143,000 Beginning Balance Sheet (T20, January 1) Assets Cash Accounts Receivable Less: Allowance for doubtful accounts Net accounts receivable Inventory Supplies Prepaid Insurance 70,000 3,000 67,000 80,000 22,000 18,000 PPE 100,000 I Less: Accumulated depreciation-equipment 30,000 Net equipment Total assets 70,000 400,000 Liabilities and Stockholders' Equity Liabilities and Stockholders' Equity Accounts Payable Interest payable Salary Payable Unearned Revenue 50,000 3,200 25,000 16,000 Notes payable 80,000 Total liabilities 174,200 Stockholders' equity Common Stock Retained earnings 180,000 45,800 Total Liabilities and stockholders' equity 400,000 Account Number 1010 1020 1021 1030 1040 1050 1060 1070 1071 Account Names Cash Accounts Receivable Allowance for doubtful accounts Inventory Supplies Prepaid Insurance Prepaid Rent PPE Accumulated Depreciation 2010 2020 2030 2040 20501 2060 2070 Accounts Payable Interest payable Salary Payable Unearned Revenue Income tax payable Notes payable Dividend Payable 3010 3020 Common Stock Retained earnings 4010 4020 4030 Service Revenue Sales Revenue Other Gains/Losses 5010 5020 5030 5040 5050 5060 5070 5080 COGS Bad debt expense Salary expense Insurance expense Interest expense Depreciation expense Supply expense Rent expense Income tax expense 5090