Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ts Question 23 My company is going to lease a scissor lift from A-1 Equipment that will help us clean the windows on our buildings.

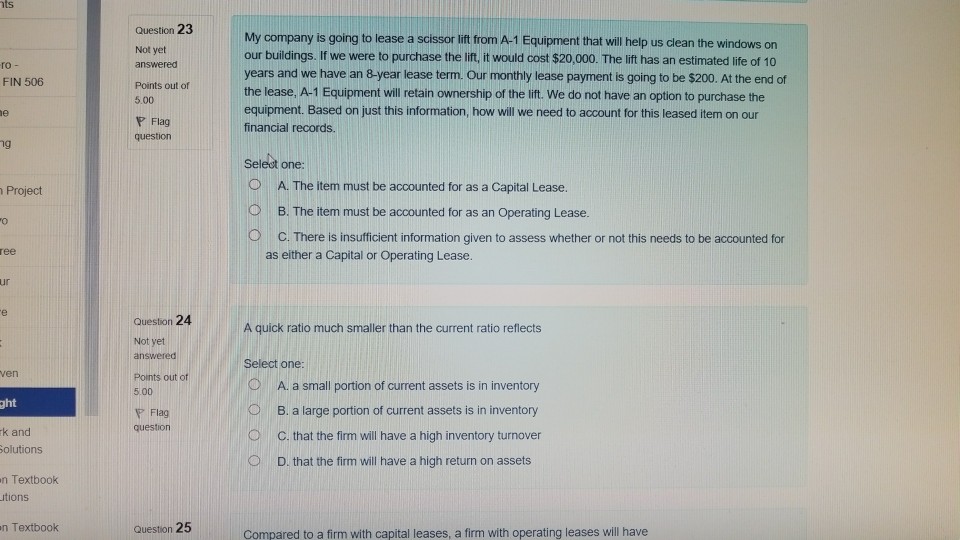

ts Question 23 My company is going to lease a scissor lift from A-1 Equipment that will help us clean the windows on our buildings. If we were to purchase the ift, it would cost $20,000. The lift has an estimated life of 10 years and we have an 8-year lease term. Our monthly lease payment is going to be $200. At the end of the lease, A-1 Equipment will retain ownership of the lift. We do not have an option to purchase the equipment. Based on just this information, how will we need to account for this leased item on our financial records. Not yet ro FIN 506 Points out of 5.00 P Flag ng Select one: O A. The item must be accounted for as a Capital Lease. B. The item must be accounted for as an Operating Lease. Project O C. There is insufficient information given to assess whether or not this needs to be accounted for ree as either a Capital or Operating Lease. ur Question 24 Not yet A quick ratio much smaller than the current ratio reflects Select one: ven Points out of 5.00 A. a small portion of current assets is in inventory ght B. a large portion of current assets is in inventony C. that the firm will have a high inventory turnover 0 D. that the firm will have a high return on assets Flag question k and n Textbook tions n Textbook Question 25 Compared to a firm with capital leases, a firm with operating leases will have

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started