Answered step by step

Verified Expert Solution

Question

1 Approved Answer

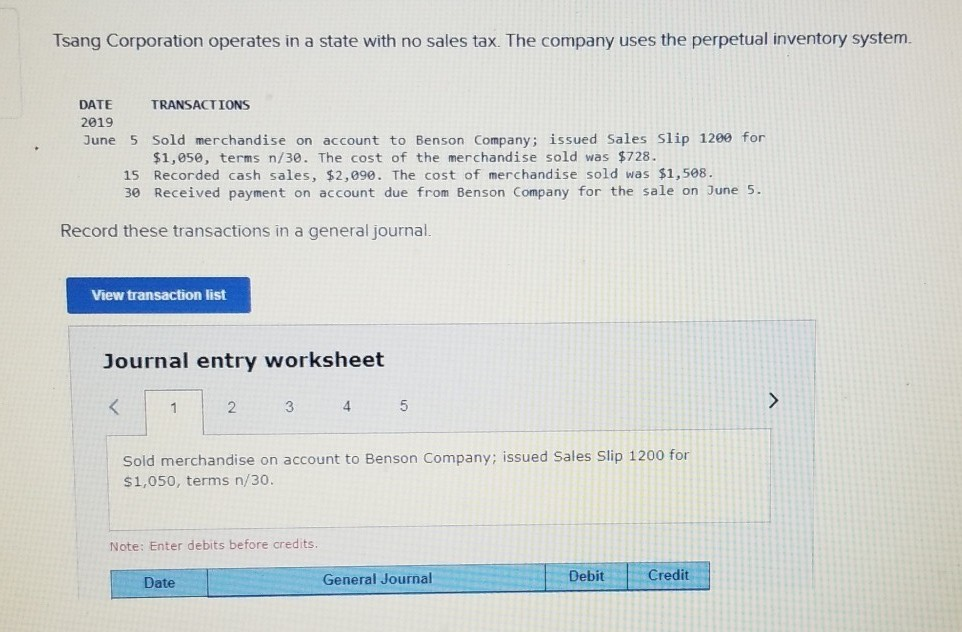

Tsang Corporation operates in a state with no sales tax. The company uses the perpetual inventory system. DATE TRANSACTIONS 2019 June 5 Sold merchandise on

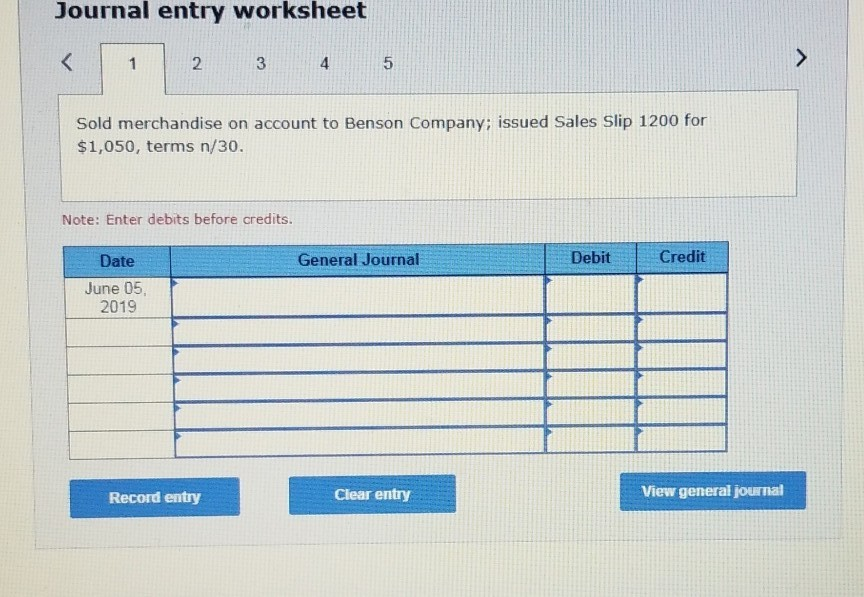

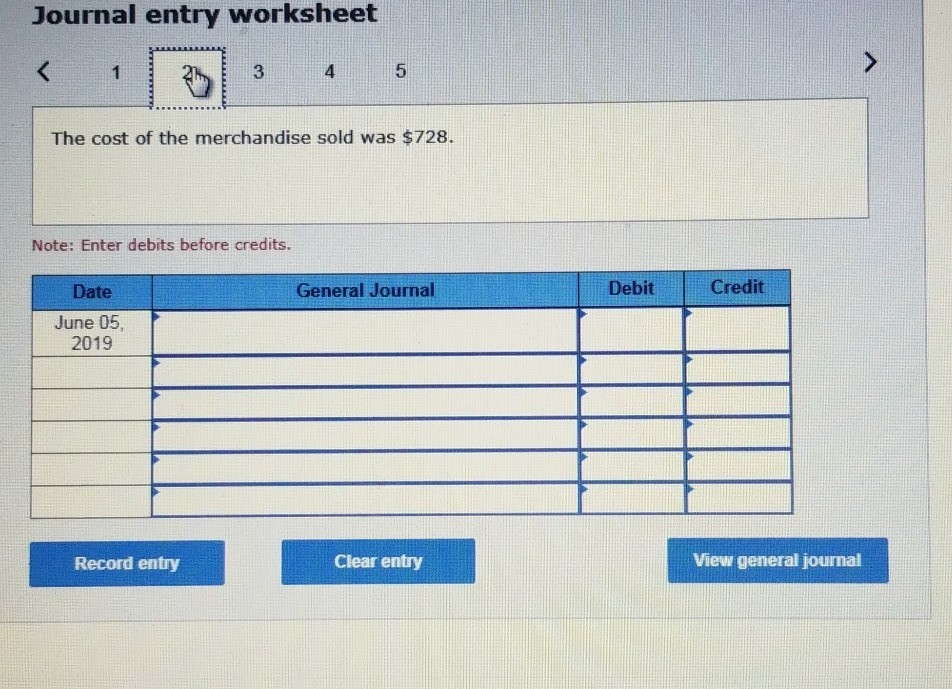

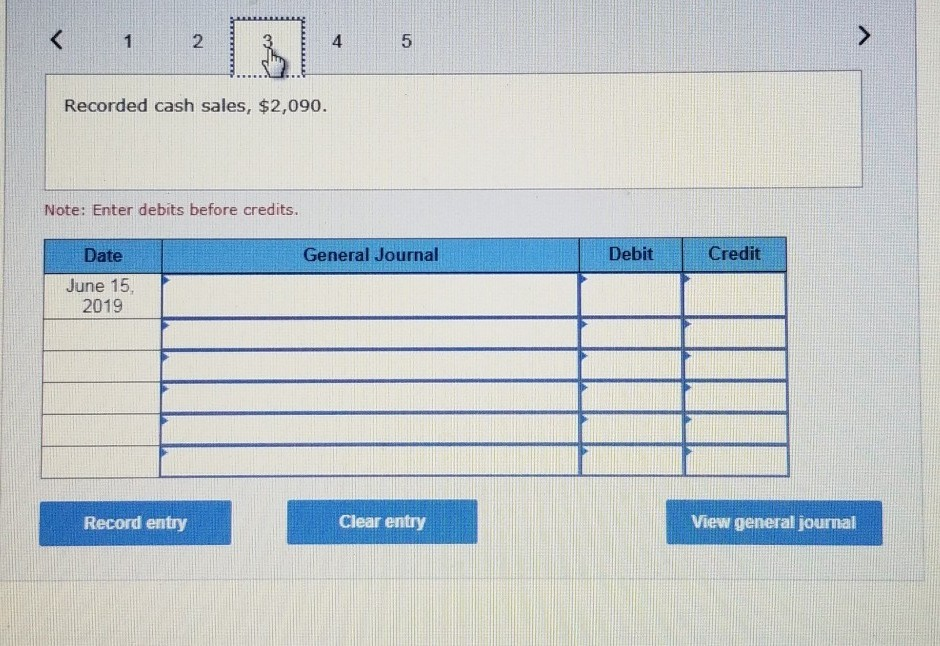

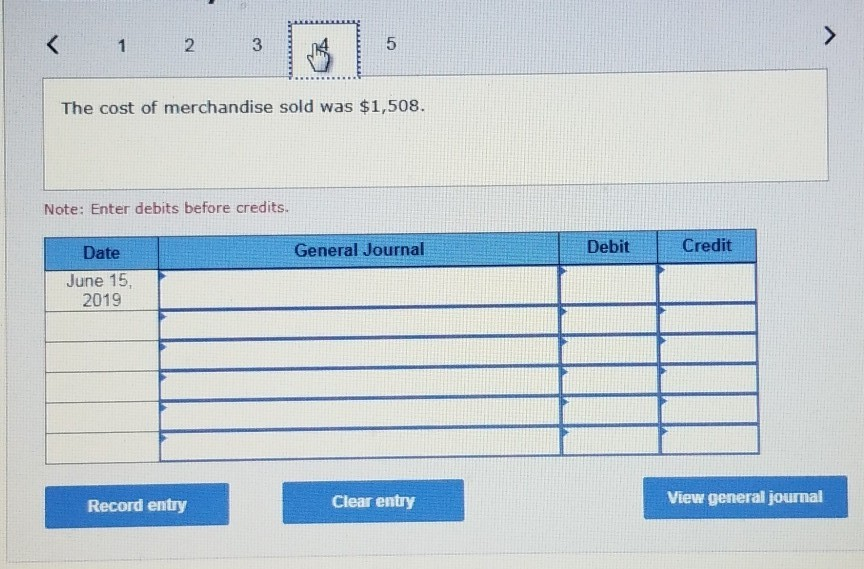

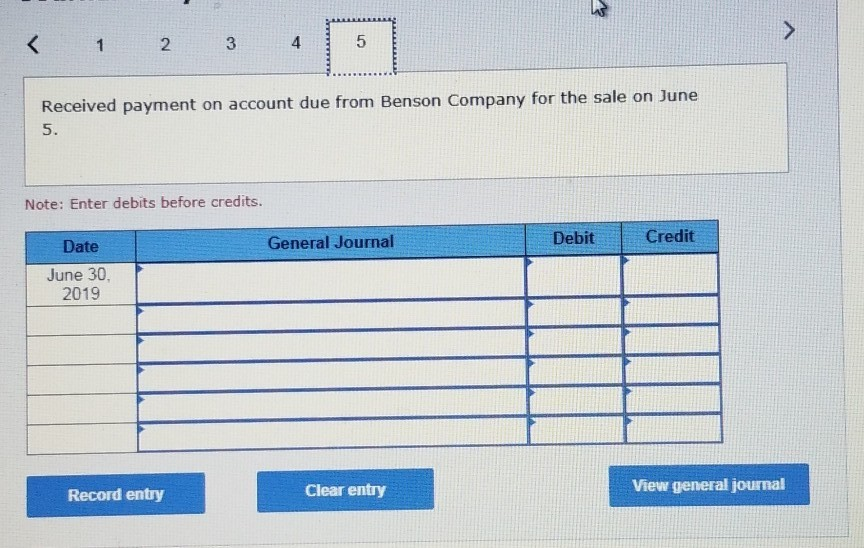

Tsang Corporation operates in a state with no sales tax. The company uses the perpetual inventory system. DATE TRANSACTIONS 2019 June 5 Sold merchandise on account to Benson Company; issued Sales Slip 1289 for $1,050, terms n/30. The cost of the merchandise sold was $728. 15 Recorded cash sales, $2,090. The cost of merchandise sold was $1,508. 30 Received payment on account due from Benson Company for the sale on June 5. Record these transactions in a general journal. View transaction list Journal entry worksheet 2 3 4 5 Sold merchandise on account to Benson Company; issued Sales Slip 1200 for $1,050, terms n/30. Note: Enter debits before credits. Date General Journal Debit Cred Journal entry worksheet 2 3 4 5 Sold merchandise on account to Benson Company; issued Sales Slip 1200 for $1,050, terms n/30. Note: Enter debits before credits. General Journal Debit Credit Date June 05 2019 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started