Answered step by step

Verified Expert Solution

Question

1 Approved Answer

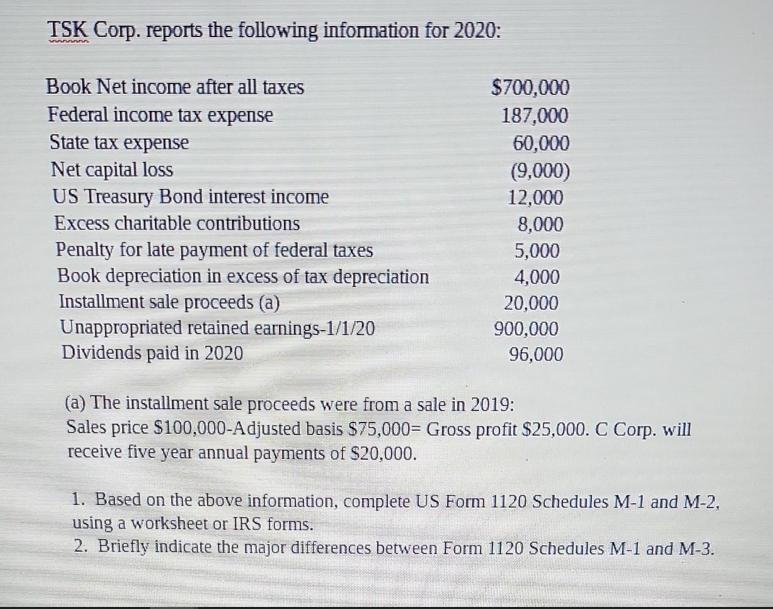

TSK Corp. reports the following information for 2020: www Book Net income after all taxes Federal income tax expense State tax expense Net capital

TSK Corp. reports the following information for 2020: www Book Net income after all taxes Federal income tax expense State tax expense Net capital loss US Treasury Bond interest income Excess charitable contributions Penalty for late payment of federal taxes Book depreciation in excess of tax depreciation Installment sale proceeds (a) Unappropriated retained earnings-1/1/20 Dividends paid in 2020 $700,000 187,000 60,000 (9,000) 12,000 8,000 5,000 4,000 20,000 900,000 96,000 (a) The installment sale proceeds were from a sale in 2019: Sales price $100,000-Adjusted basis $75,000= Gross profit $25,000. C Corp. will receive five year annual payments of $20,000. 1. Based on the above information, complete US Form 1120 Schedules M-1 and M-2, using a worksheet or IRS forms. 2. Briefly indicate the major differences between Form 1120 Schedules M-1 and M-3.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 US Form 1120 Schedules M1 and M2 Schedule M1 The purpose of Schedule M1 is to reconcile the net income reported on the corporations books to the tax...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started