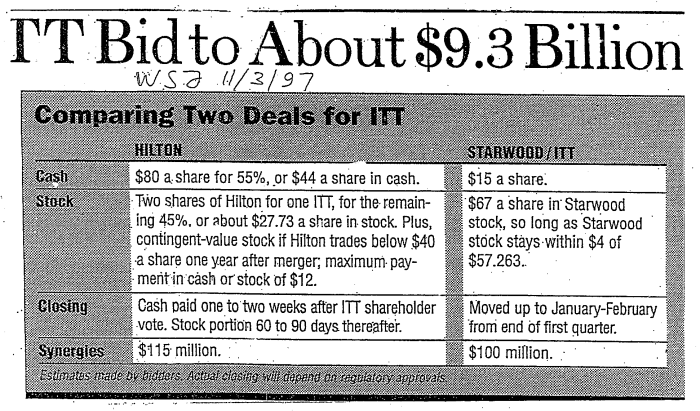

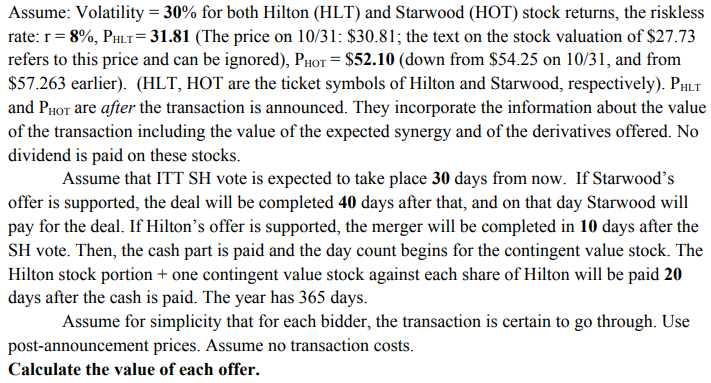

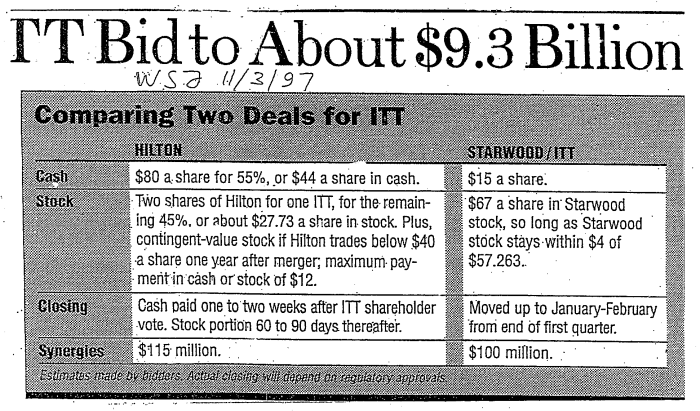

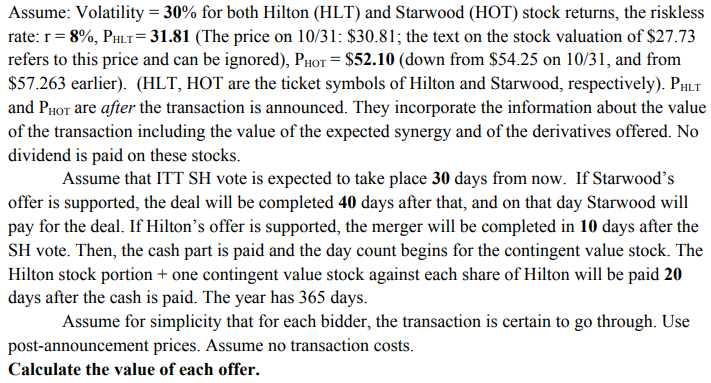

TT Bid to About $9.3 Billion W.SH/3/97 Comparing Two Deals for ITT HILTON Cash $80 a share for 55%, or $44 a share in cash. Stock Two shares of Hilton for one ITT, for the remain- ing 45%, or about $27.73 a share in stock. Plus, contingent-value stock if Hilton trades below $40 a share one year after merger, maximum pay- merit in cash or stock of $12. Closing Cash paid one to two weeks after ITT shareholder vote. Stock portion 60 to 90 days thereafter. Synergies $115 million. Esumates made by bidders. Actual clasing will depend on regulatory approvals. STARWOOD/ITT $15 a share. $67 a share in Starwood stock, so long as Starwood stock stays within $4 of $57.263. a Moved up to January-February from end of first quarter. $100 million. Assume: Volatility = 30% for both Hilton (HLT) and Starwood (HOT) stock returns, the riskless rate: r = 8%, Palt= 31.81 (The price on 10/31: $30.81; the text on the stock valuation of $27.73 refers to this price and can be ignored), Phot = $52.10 (down from $54.25 on 10/31, and from $57.263 earlier). (HLT, HOT are the ticket symbols of Hilton and Starwood, respectively). Pilt and Phot are after the transaction is announced. They incorporate the information about the value of the transaction including the value of the expected synergy and of the derivatives offered. No dividend is paid on these stocks. Assume that ITT SH vote is expected to take place 30 days from now. If Starwood's offer is supported, the deal will be completed 40 days after that, and on that day Starwood will pay for the deal. If Hilton's offer is supported, the merger will be completed in 10 days after the SH vote. Then, the cash part is paid and the day count begins for the contingent value stock. The Hilton stock portion + one contingent value stock against each share of Hilton will be paid 20 days after the cash is paid. The year has 365 days. Assume for simplicity that for each bidder, the transaction is certain to go through. Use post-announcement prices. Assume no transaction costs. Calculate the value of each offer. TT Bid to About $9.3 Billion W.SH/3/97 Comparing Two Deals for ITT HILTON Cash $80 a share for 55%, or $44 a share in cash. Stock Two shares of Hilton for one ITT, for the remain- ing 45%, or about $27.73 a share in stock. Plus, contingent-value stock if Hilton trades below $40 a share one year after merger, maximum pay- merit in cash or stock of $12. Closing Cash paid one to two weeks after ITT shareholder vote. Stock portion 60 to 90 days thereafter. Synergies $115 million. Esumates made by bidders. Actual clasing will depend on regulatory approvals. STARWOOD/ITT $15 a share. $67 a share in Starwood stock, so long as Starwood stock stays within $4 of $57.263. a Moved up to January-February from end of first quarter. $100 million. Assume: Volatility = 30% for both Hilton (HLT) and Starwood (HOT) stock returns, the riskless rate: r = 8%, Palt= 31.81 (The price on 10/31: $30.81; the text on the stock valuation of $27.73 refers to this price and can be ignored), Phot = $52.10 (down from $54.25 on 10/31, and from $57.263 earlier). (HLT, HOT are the ticket symbols of Hilton and Starwood, respectively). Pilt and Phot are after the transaction is announced. They incorporate the information about the value of the transaction including the value of the expected synergy and of the derivatives offered. No dividend is paid on these stocks. Assume that ITT SH vote is expected to take place 30 days from now. If Starwood's offer is supported, the deal will be completed 40 days after that, and on that day Starwood will pay for the deal. If Hilton's offer is supported, the merger will be completed in 10 days after the SH vote. Then, the cash part is paid and the day count begins for the contingent value stock. The Hilton stock portion + one contingent value stock against each share of Hilton will be paid 20 days after the cash is paid. The year has 365 days. Assume for simplicity that for each bidder, the transaction is certain to go through. Use post-announcement prices. Assume no transaction costs. Calculate the value of each offer