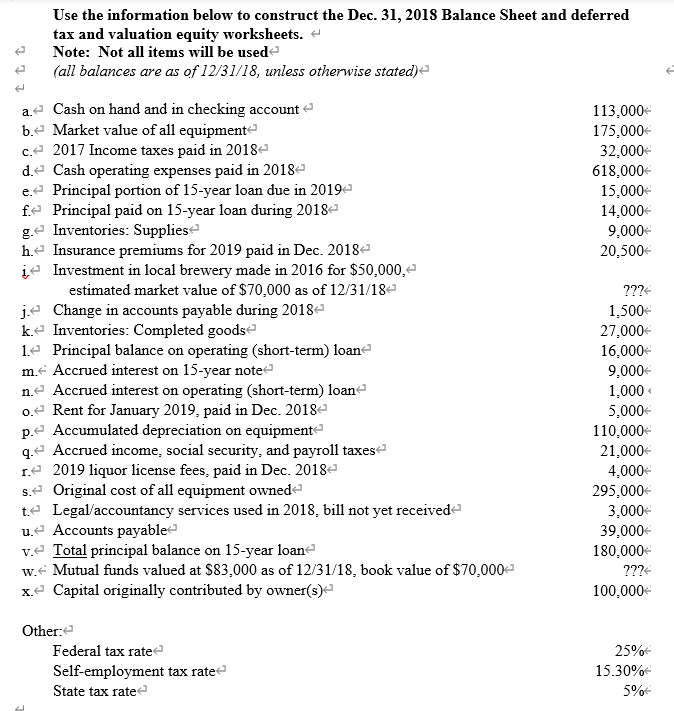

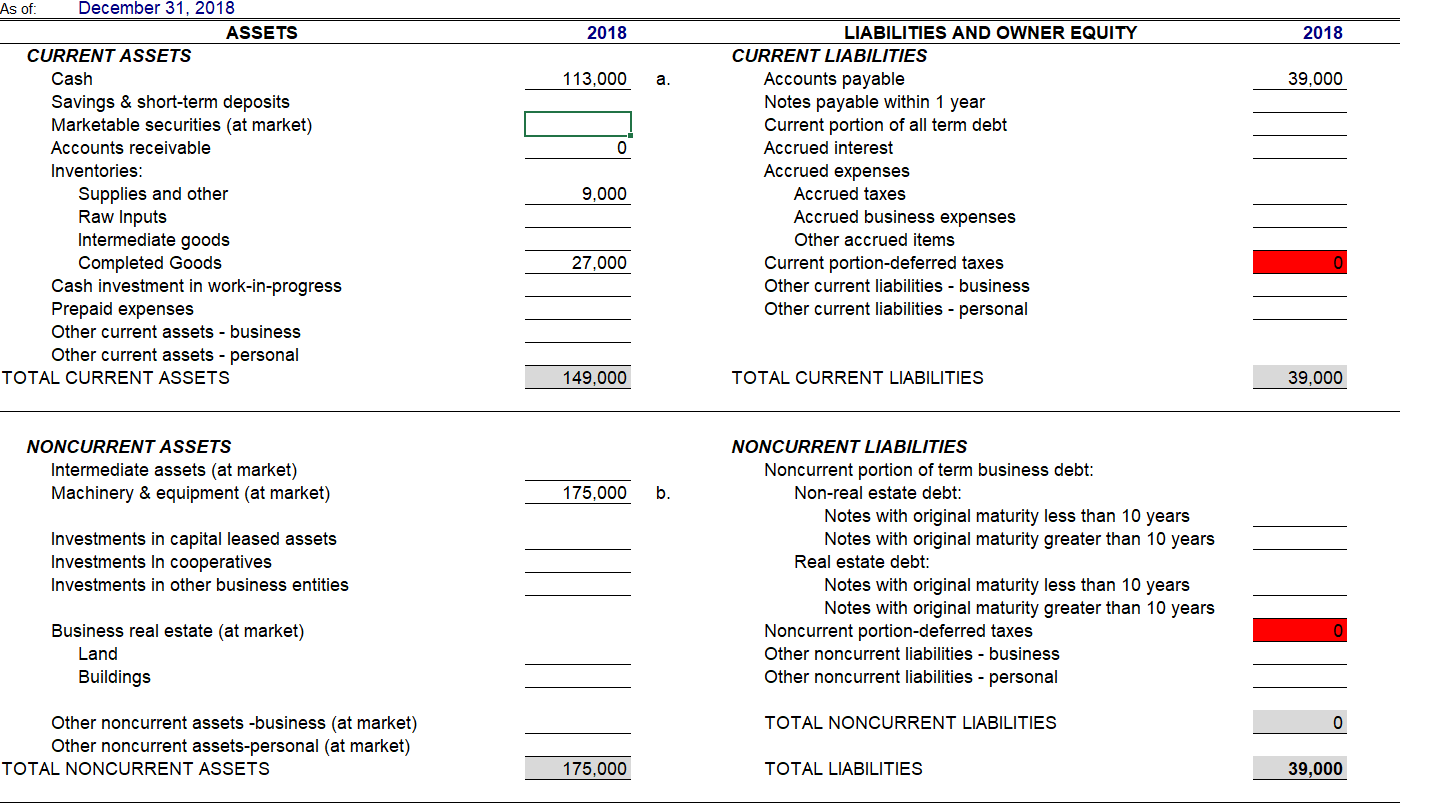

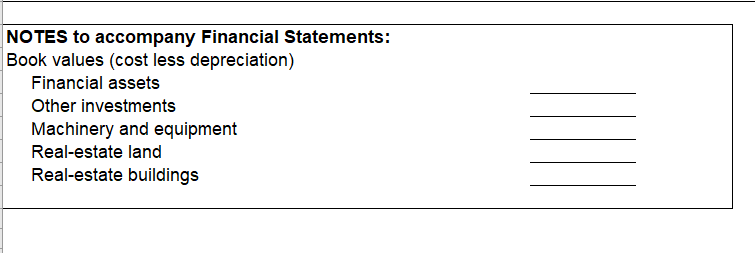

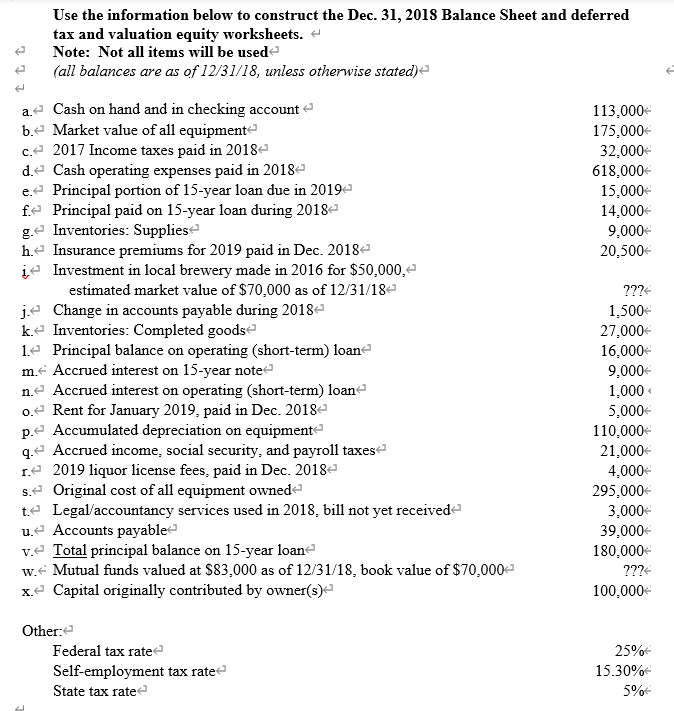

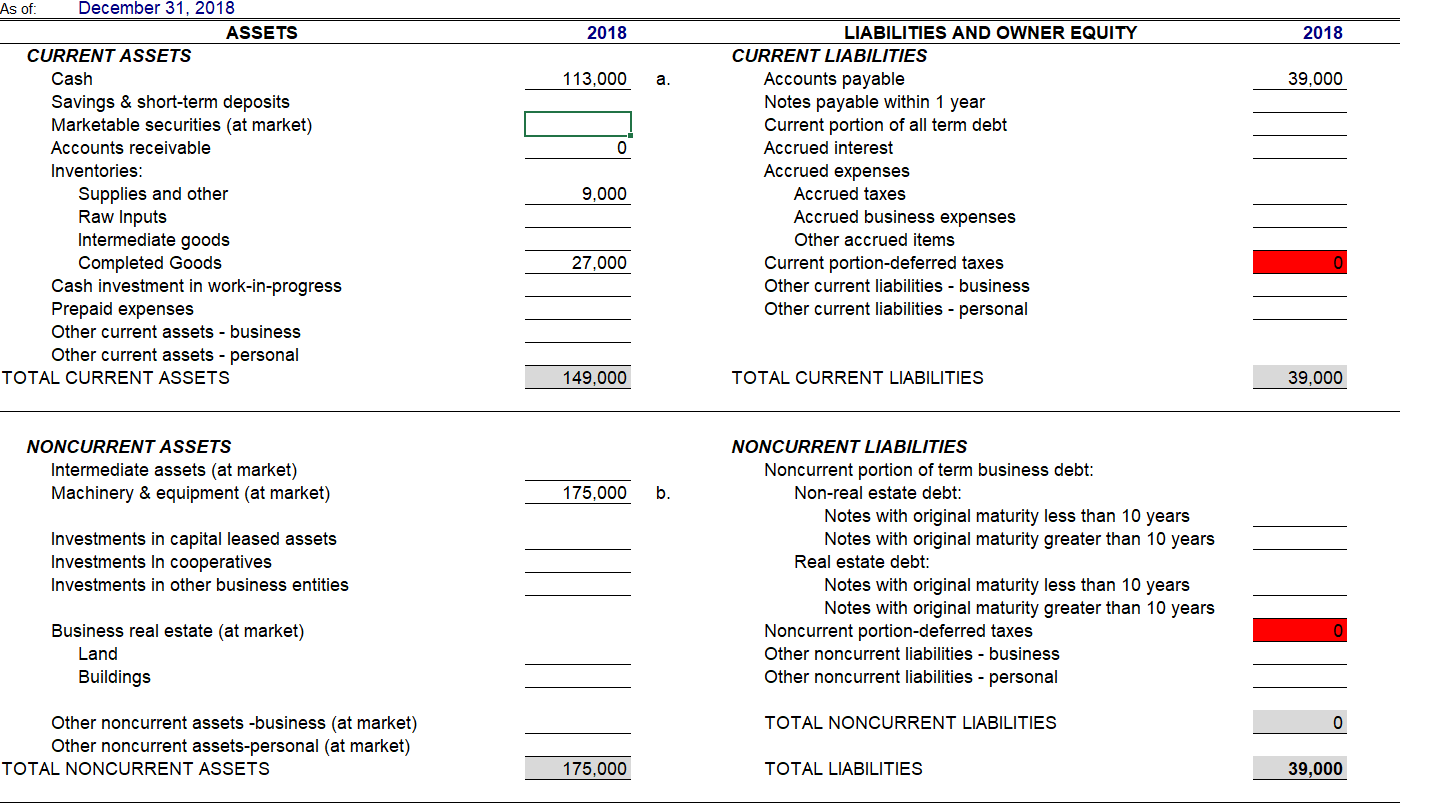

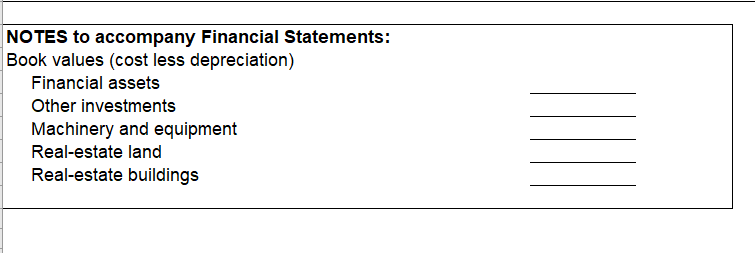

tt Use the information below to construct the Dec. 31, 2018 Balance Sheet and deferred tax and valuation equity worksheets. Note: Not all items will be used (all balances are as of 12/31/18, unless otherwise stated) a.- Cash on hand and in checking account - 113,000 b. Market value of all equipment 175,000+ c.- 2017 Income taxes paid in 2018 32,000+ de Cash operating expenses paid in 2018 618,000 e. Principal portion of 15-year loan due in 2019- 15,000+ fe Principal paid on 15-year loan during 2018 14,000+ g. Inventories: Supplies 9,000 h. Insurance premiums for 2019 paid in Dec. 2018 20,500 je Investment in local brewery made in 2016 for $50,000,- estimated market value of $70,000 as of 12/31/18 ??? je Change in accounts payable during 2018 1,500 ke Inventories: Completed goods 27,000+ 1- Principal balance on operating (short-term) loan 16,000 m. Accrued interest on 15-year note 9,000+ n.- Accrued interest on operating (short-term) loan 1,000 0.- Rent for January 2019, paid in Dec. 2018 5,000+ p. Accumulated depreciation on equipment 110,000+ 4. Accrued income, social security, and payroll taxes 21,000+ 1.-2019 liquor license fees, paid in Dec. 2018- 4,000+ s. Original cost of all equipment owned 295,000 te Legal/accountancy services used in 2018, bill not yet received 3.000 u. Accounts payable" 39,000+ v. Total principal balance on 15-year loan 180,000 w. Mutual funds valued at $83,000 as of 12/31/18, book value of $70,000 ??? x.- Capital originally contributed by owner(s) 100,000+ Othere Federal tax rate Self-employment tax rate State tax rate 25% 15.30% 5% 2018 2018 113,000 a. 39,000 0 As of: December 31, 2018 ASSETS CURRENT ASSETS Cash Savings & short-term deposits Marketable securities (at market) Accounts receivable Inventories: Supplies and other Raw Inputs Intermediate goods Completed Goods Cash investment in work-in-progress Prepaid expenses Other current assets - business Other current assets - personal TOTAL CURRENT ASSETS LIABILITIES AND OWNER EQUITY CURRENT LIABILITIES Accounts payable Notes payable within 1 year Current portion of all term debt Accrued interest Accrued expenses Accrued taxes Accrued business expenses Other accrued items Current portion-deferred taxes Other current liabilities - business Other current liabilities - personal 9,000 27,000 149,000 TOTAL CURRENT LIABILITIES 39,000 NONCURRENT ASSETS Intermediate assets (at market) Machinery & equipment (at market) 175,000 b. Investments in capital leased assets Investments in cooperatives Investments in other business entities NONCURRENT LIABILITIES Noncurrent portion of term business debt: Non-real estate debt: Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Real estate debt: Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Noncurrent portion-deferred taxes Other noncurrent liabilities - business Other noncurrent liabilities - personal Business real estate (at market) Land Buildings TOTAL NONCURRENT LIABILITIES 0 Other noncurrent assets -business (at market) Other noncurrent assets-personal (at market) TOTAL NONCURRENT ASSETS 175,000 TOTAL LIABILITIES 39,000 NOTES to accompany Financial Statements: Book values (cost less depreciation) Financial assets Other investments Machinery and equipment Real-estate land Real-estate buildings tt Use the information below to construct the Dec. 31, 2018 Balance Sheet and deferred tax and valuation equity worksheets. Note: Not all items will be used (all balances are as of 12/31/18, unless otherwise stated) a.- Cash on hand and in checking account - 113,000 b. Market value of all equipment 175,000+ c.- 2017 Income taxes paid in 2018 32,000+ de Cash operating expenses paid in 2018 618,000 e. Principal portion of 15-year loan due in 2019- 15,000+ fe Principal paid on 15-year loan during 2018 14,000+ g. Inventories: Supplies 9,000 h. Insurance premiums for 2019 paid in Dec. 2018 20,500 je Investment in local brewery made in 2016 for $50,000,- estimated market value of $70,000 as of 12/31/18 ??? je Change in accounts payable during 2018 1,500 ke Inventories: Completed goods 27,000+ 1- Principal balance on operating (short-term) loan 16,000 m. Accrued interest on 15-year note 9,000+ n.- Accrued interest on operating (short-term) loan 1,000 0.- Rent for January 2019, paid in Dec. 2018 5,000+ p. Accumulated depreciation on equipment 110,000+ 4. Accrued income, social security, and payroll taxes 21,000+ 1.-2019 liquor license fees, paid in Dec. 2018- 4,000+ s. Original cost of all equipment owned 295,000 te Legal/accountancy services used in 2018, bill not yet received 3.000 u. Accounts payable" 39,000+ v. Total principal balance on 15-year loan 180,000 w. Mutual funds valued at $83,000 as of 12/31/18, book value of $70,000 ??? x.- Capital originally contributed by owner(s) 100,000+ Othere Federal tax rate Self-employment tax rate State tax rate 25% 15.30% 5% 2018 2018 113,000 a. 39,000 0 As of: December 31, 2018 ASSETS CURRENT ASSETS Cash Savings & short-term deposits Marketable securities (at market) Accounts receivable Inventories: Supplies and other Raw Inputs Intermediate goods Completed Goods Cash investment in work-in-progress Prepaid expenses Other current assets - business Other current assets - personal TOTAL CURRENT ASSETS LIABILITIES AND OWNER EQUITY CURRENT LIABILITIES Accounts payable Notes payable within 1 year Current portion of all term debt Accrued interest Accrued expenses Accrued taxes Accrued business expenses Other accrued items Current portion-deferred taxes Other current liabilities - business Other current liabilities - personal 9,000 27,000 149,000 TOTAL CURRENT LIABILITIES 39,000 NONCURRENT ASSETS Intermediate assets (at market) Machinery & equipment (at market) 175,000 b. Investments in capital leased assets Investments in cooperatives Investments in other business entities NONCURRENT LIABILITIES Noncurrent portion of term business debt: Non-real estate debt: Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Real estate debt: Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Noncurrent portion-deferred taxes Other noncurrent liabilities - business Other noncurrent liabilities - personal Business real estate (at market) Land Buildings TOTAL NONCURRENT LIABILITIES 0 Other noncurrent assets -business (at market) Other noncurrent assets-personal (at market) TOTAL NONCURRENT ASSETS 175,000 TOTAL LIABILITIES 39,000 NOTES to accompany Financial Statements: Book values (cost less depreciation) Financial assets Other investments Machinery and equipment Real-estate land Real-estate buildings