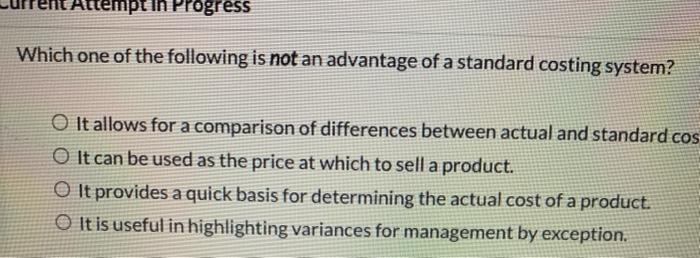

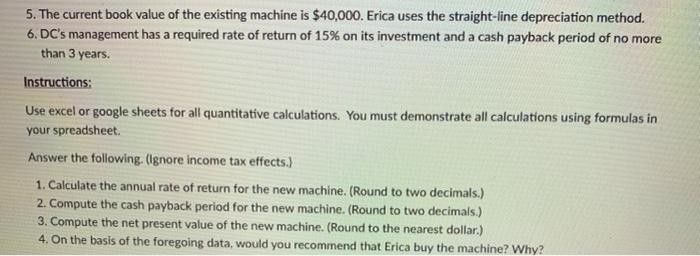

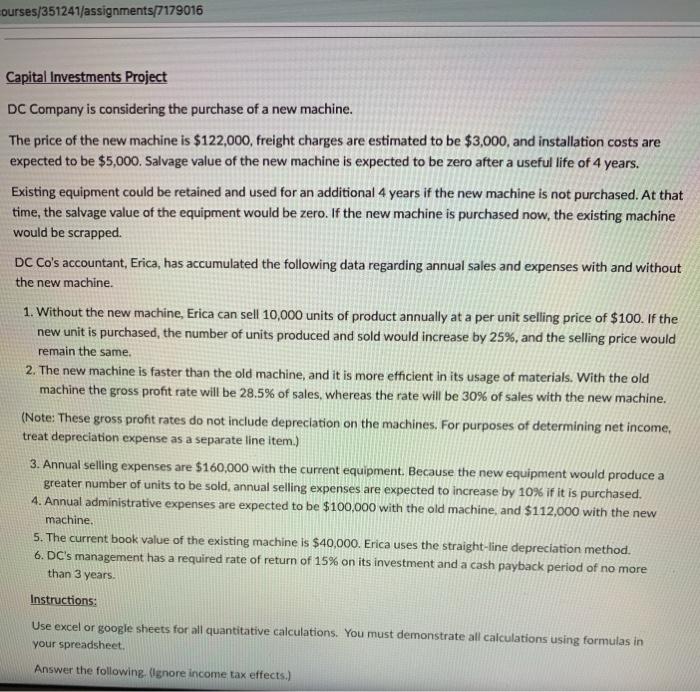

ttempt in Progress Which one of the following is not an advantage of a standard costing system? O It allows for a comparison of differences between actual and standard cos O It can be used as the price at which to sell a product. o It provides a quick basis for determining the actual cost of a product. O It is useful in highlighting variances for management by exception. 5. The current book value of the existing machine is $40,000. Erica uses the straight-line depreciation method. 6. DC's management has a required rate of return of 15% on its investment and a cash payback period of no more than 3 years. Instructions: Use excel or google sheets for all quantitative calculations. You must demonstrate all calculations using formulas in your spreadsheet Answer the following. (Ignore income tax effects.) 1. Calculate the annual rate of return for the new machine. (Round to two decimals.) 2. Compute the cash payback period for the new machine. (Round to two decimals.) 3. Compute the net present value of the new machine. (Round to the nearest dollar.) 4. On the basis of the foregoing data, would you recommend that Erica buy the machine? Why? courses/351241/assignments/7179016 Capital Investments Project DC Company is considering the purchase of a new machine. The price of the new machine is $122,000, freight charges are estimated to be $3,000, and installation costs are expected to be $5,000. Salvage value of the new machine is expected to be zero after a useful life of 4 years. Existing equipment could be retained and used for an additional 4 years if the new machine is not purchased. At that time, the salvage value of the equipment would be zero. If the new machine is purchased now, the existing machine would be scrapped DC Co's accountant, Erica, has accumulated the following data regarding annual sales and expenses with and without the new machine. 1. Without the new machine, Erica can sell 10,000 units of product annually at a per unit selling price of $100. If the new unit is purchased, the number of units produced and sold would increase by 25%, and the selling price would remain the same. 2. The new machine is faster than the old machine, and it is more efficient in its usage of materials. With the old machine the gross profit rate will be 28.5% of sales, whereas the rate will be 30% of sales with the new machine. (Note: These gross profit rates do not include depreciation on the machines. For purposes of determining net income. treat depreciation expense as a separate line item.) 3. Annual selling expenses are $160,000 with the current equipment. Because the new equipment would produce a greater number of units to be sold, annual selling expenses are expected to increase by 10% if it is purchased. 4. Annual administrative expenses are expected to be $100,000 with the old machine, and $112,000 with the new machine, 5. The current book value of the existing machine is $40,000. Erica uses the straight-line depreciation method. 6. DC's management has a required rate of return of 15% on its investment and a cash payback period of no more than 3 years. Instructions: Use excel or google sheets for all quantitative calculations. You must demonstrate all calculations using formulas in your spreadsheet Answer the following. Ognore income tax effects.)