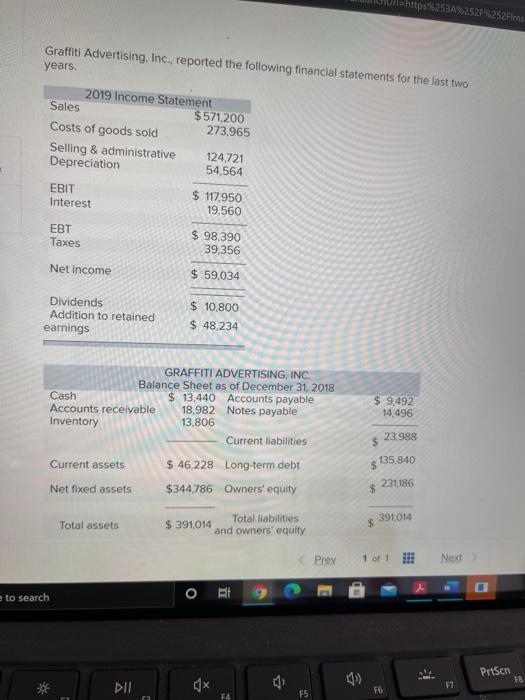

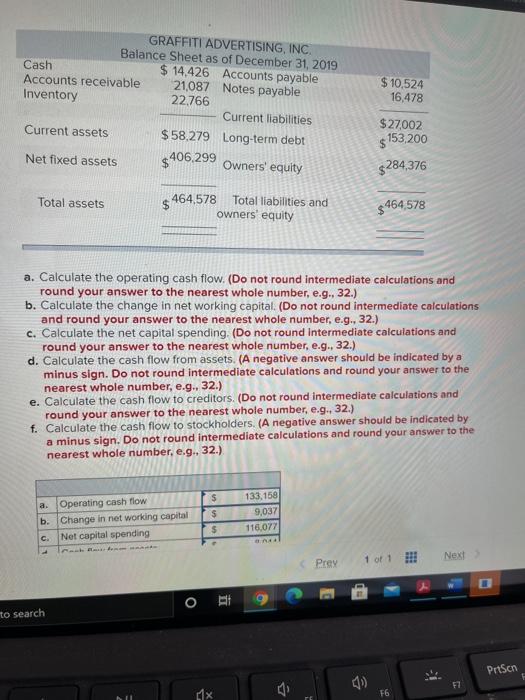

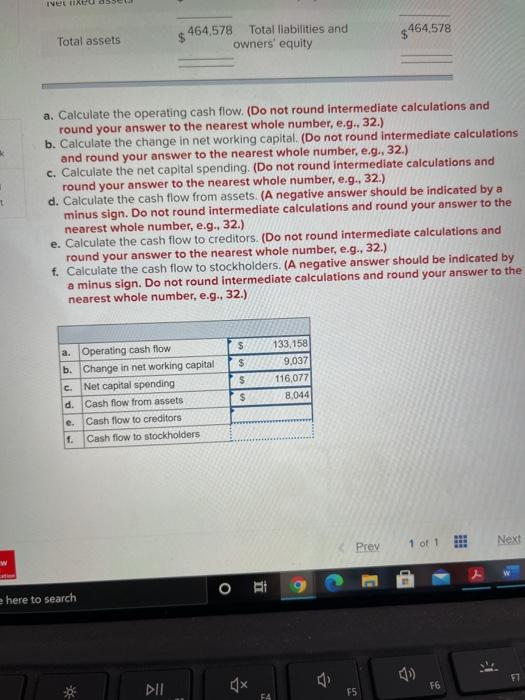

ttps%253A%252F%252Fms Graffiti Advertising, Inc., reported the following financial statements for the last two years. 2019 Income Statement Sales $571,200 Costs of goods sold 273,965 Selling & administrative 124,721 Depreciation 54,564 EBIT Interest $ 117,950 19,560 EBT Taxes $ 98,390 39,356 Net Income $ 59,034 Dividends Addition to retained earnings $ 10,800 $ 48,234 GRAFFITI ADVERTISING, INC. Balance Sheet as of December 31, 2018 Cash $ 13,440 Accounts payable Accounts receivable 18,982 Notes payable Inventory 13,806 Current Habilities $ 9,492 14,496 23.988 $ 135.840 Current assets $ 46,228 Long-term debt $344.786 Owners' equity Net fixed assets $ 231186 391,014 Total assets Total liabilities $ 391.014 and owners' equity Prey 1 of 1 !!! Next to search ORE Prson TE DII F1 F4 F5 F6 GRAFFITI ADVERTISING, INC. Balance Sheet as of December 31, 2019 Cash $ 14,426 Accounts payable Accounts receivable 21,087 Notes payable Inventory 22.766 Current liabilities Current assets $ 58,279 Long-term debt Net fixed assets $ 406,299 Owners' equity $ 10,524 16,478 $27,002 $ 153,200 $284,376 Total assets 464,578 Total liabilities and $ owners' equity $464,578 a. Calculate the operating cash flow. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Calculate the change in net working capital. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. Calculate the net capital spending. (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d. Calculate the cash flow from assets. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32.) e. Calculate the cash flow to creditors. (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g. 32.) f. Calculate the cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.). a. Operating cash flow b. Change in net working capital Net capital spending S $ $ 133,158 9,037 116.077 Prey 1 of 1 Next to search Prtsen 00 12 x 76 Ivet ke 464,578 Total liabilities and owners' equity $464,578 Total assets a. Calculate the operating cash flow. (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Calculate the change in net working capital. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. Calculate the net capital spending. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d. Calculate the cash flow from assets. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) e. Calculate the cash flow to creditors. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) f. Calculate the cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32.) $ $ $ a. Operating cash flow b. Change in net working capital c. Net capital spending d. Cash flow from assets e. Cash flow to creditors f. Cash flow to stockholders 133,158 9,037 116,077 8044 $ Prey 1 of 1 Next ORE here to search F1 F6 ES FA