Answered step by step

Verified Expert Solution

Question

1 Approved Answer

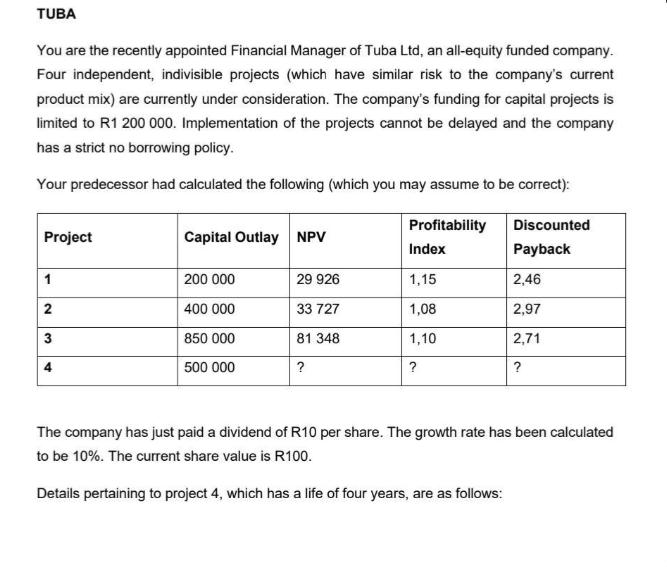

TUBA You are the recently appointed Financial Manager of Tuba Ltd, an all-equity funded company. Four independent, indivisible projects (which have similar risk to

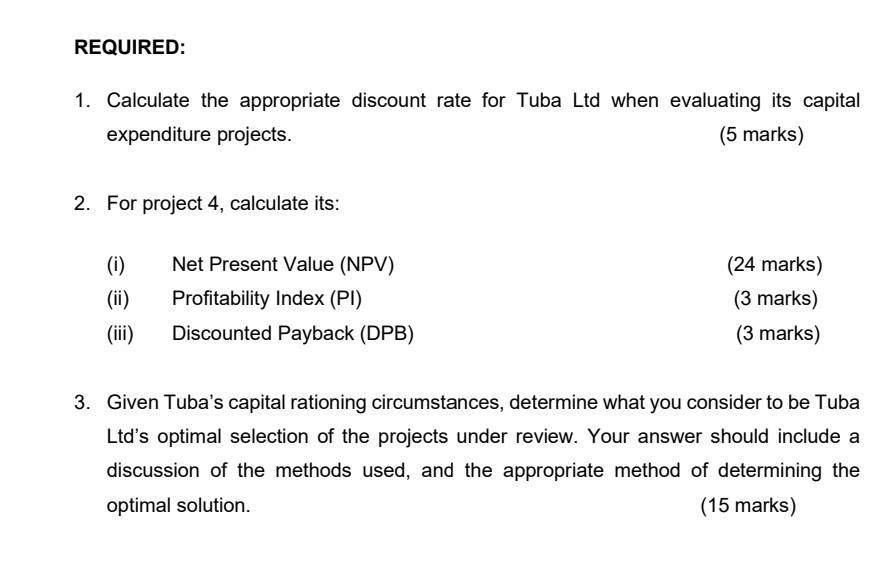

TUBA You are the recently appointed Financial Manager of Tuba Ltd, an all-equity funded company. Four independent, indivisible projects (which have similar risk to the company's current product mix) are currently under consideration. The company's funding for capital projects is limited to R1 200 000. Implementation of the projects cannot be delayed and the company has a strict no borrowing policy. Your predecessor had calculated the following (which you may assume to be correct): Project 1 2 Capital Outlay NPV 200 000 400 000 850 000 500 000 29 926 33 727 81 348 ? Profitability Index 1,15 1,08 1,10 ? Discounted Payback 2,46 2,97 2,71 ? The company has just paid a dividend of R10 per share. The growth rate has been calculated to be 10%. The current share value is R100. Details pertaining to project 4, which has a life of four years, are as follows: 1. Estimate sales units are: Year 1 1000 Year 2 - 1050 Year 3 1100 Year 41150 2. 3. Unit contribution is R300, which will remain consistent over the four year period. The company has a policy of apportioning a general fixed overhead charge of R10 per unit to each product sold. Specific annual fixed costs for project 4 are R50 000 per annum commencing in Year 1. 4. At the commencement of the project (Year 0), a machine costing R500 000 (which has useful life of 5 years) will be acquired and written off on a straight line basis at 20% per annum, ignoring any expected disposal value. At the end of year 4, the machine will be sold for R50 000. 5. Additional net working capital requirements will be R30 000 in year 1, plus R30 000 in year 2. No further increases in working capital are anticipated in Year 3 and Year 4. 6. Immediate (i.e. Year 0) stock requirements are available from existing stock, which if used for project 4, will not be replaced. Should project 4 be rejected, then this stock will be sold immediately for R20 000. (Note: any tax implications pertaining to the sale of this stock may be ignored). Tuba Ltd is a tax-paying position. The rate is 30% and there is no time lag in the payment of taxes (i.e. taxes are paid in the year profits accrue). You may ignore inflation and the opportunity cost of capital implications of rejecting any of the four projects. Assume all cash flows occur at the end of the relevant year, unless stated otherwise. REQUIRED: 1. Calculate the appropriate discount rate for Tuba Ltd when evaluating its capital expenditure projects. (5 marks) 2. For project 4, calculate its: (i) (ii) (iii) Net Present Value (NPV) Profitability Index (PI) Discounted Payback (DPB) (24 marks) (3 marks) (3 marks) 3. Given Tuba's capital rationing circumstances, determine what you consider to be Tuba Ltd's optimal selection of the projects under review. Your answer should include a discussion of the methods used, and the appropriate method of determining the optimal solution. (15 marks)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Given Company is allequity funded Current share value is R100 Dividend paid is R10 per share Growt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started