Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tucation.com/ext/map/index.html_con-con&external browser=0&launchurl=https%253A%252F%252Fnewconnectmheducation.com%252F/actwity/question-group/kEZASBEPSdnsru9wc2U2W_SCH-ZOXevdCkUSUZ4IpVDTLLKOJH7u55q Pay Salutions BILL.COM QuickBooks Login 5 VSP cd Phone NSU Books Virtual Doc O OKTAP SOSOK Filing Connect Sign in T Top Hat

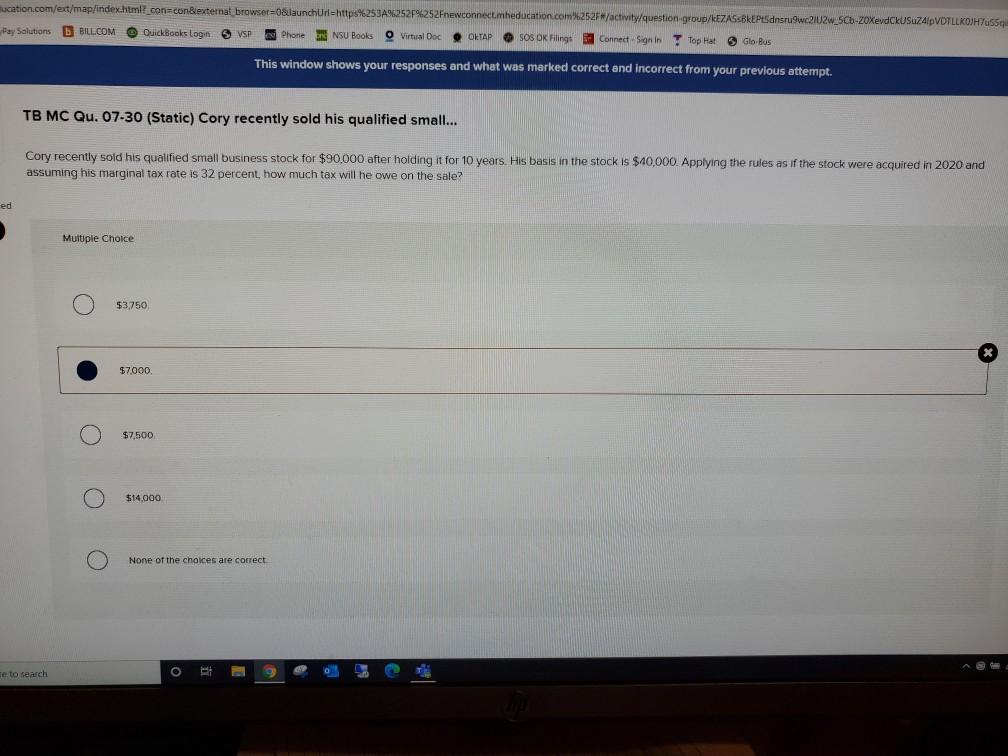

tucation.com/ext/map/index.html_con-con&external browser=0&launchurl=https%253A%252F%252Fnewconnectmheducation.com%252F/actwity/question-group/kEZASBEPSdnsru9wc2U2W_SCH-ZOXevdCkUSUZ4IpVDTLLKOJH7u55q Pay Salutions BILL.COM QuickBooks Login 5 VSP cd Phone NSU Books Virtual Doc O OKTAP SOSOK Filing Connect Sign in T Top Hat Glo Bog This window shows your responses and what was marked correct and incorrect from your previous attempt. TB MC Qu. 07-30 (Static) Cory recently sold his qualified small... Cory recently sold his qualified small business stock for $90,000 after holding it for 10 years. His basis in the stock is $40,000. Applying the rules as if the stock were acquired in 2020 and assuming his marginal tax rate is 32 percent how much tax will he owe on the sale? ed Multiple Choice $3,750 $7,000 $7,500 $14,000 None of the choices are correct O Te to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started