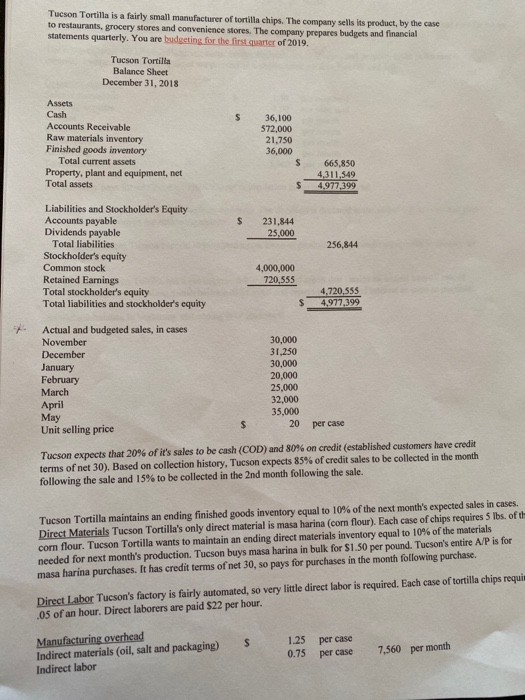

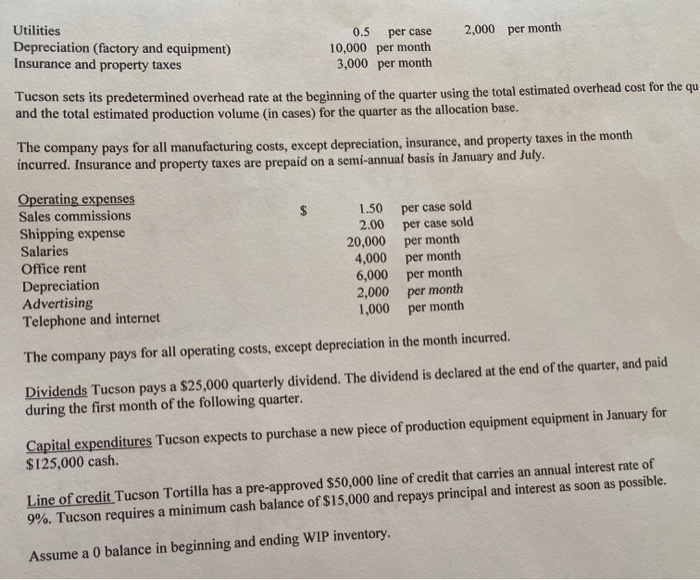

Tucson Tortilla is a fairly small manufacturer of tortilla chips. The company sells its product, by the case to restaurants, grocery stores and convenience stores. The company prepares budgets and financial statements quarterly. You are budgeting for the first quarter of 2019. Tucson Tortilla Balance Sheet December 31, 2018 Assets Cash 36,100 572,000 21,750 36,000 Accounts Receivable Raw materials inventory Finished goods inventory Total current assets Property, plant and equipment, net Total assets 665,850 4,311,549 4,977,399 Liabilities and Stockholder's Equity Accounts payable Dividends payable Total liabilities Stockholder's equity Common stock Retained Earnings Total stockholder's equity Total liabilities and stockholder's equity 231,844 25,000 256,844 4,000,000 720,555 4,720,555 4,977,399 Actual and budgeted sales, in cases November 30,000 31,250 30,000 December January February 20,000 25,000 March 32,000 35,000 April May Unit selling price 20 %24 per case Tucson expects that 20% of it's sales to be cash (COD) and 80% on credit (established customers have credit terms of net 30). Based on collection history, Tucson expects 85% of credit sales to be collected in the month following the sale and 15% to be collected in the 2nd month following the sale. Tucson Tortilla maintains an ending finished goods inventory equal to 10% of the next month's expected sales in cases. Direct Materials Tucson Tortilla's only direct material is masa harina (com flour). Each case of chips requires 5 Ibs. of the corn flour. Tucson Tortilla wants to maintain an ending direct materials inventory equal to 10% of the materials needed for next month's production. Tucson buys masa harina in bulk for $1.50 per pound. Tucson's entire A/P is for masa harina purchases. It has credit terms of net 30, so pays for purchases in the month following purchase. Direct Labor Tucson's factory is fairly automated, so very little direct labor is required. Each case of tortilla chips requis 05 of an hour. Direct laborers are paid $22 per hour. Manufacturing overhead Indirect materials (oil, salt and packaging) Indirect labor 1.25 per case 7,560 per month 0.75 per case Utilities 0.5 2,000 per month per case 10,000 per month 3,000 per month Depreciation (factory and equipment) Insurance and property taxes Tucson sets its predetermined overhead rate at the beginning of the quarter using the total estimated overhead cost for the qu and the total estimated production volume (in cases) for the quarter as the allocation base. The company pays for all manufacturing costs, except depreciation, insurance, and property taxes in the month incurred. Insurance and property taxes are prepaid on a semi-annual basis in January and July. Operating expenses Sales commissions per case sold per case sold 1.50 Shipping expense Salaries Office rent Depreciation Advertising Telephone and internet 2.00 per month per month per month per month per month 20,000 4,000 6,000 2,000 1,000 The company pays for all operating costs, except depreciation in the month incurred. Dividends Tucson pays a $25,000 quarterly dividend. The dividend is declared at the end of the quarter, and paid during the first month of the following quarter. Capital expenditures Tucson expects to purchase a new piece of production equipment equipment in January for $125,000 cash. Line of credit Tucson Tortilla has a pre-approved $50,000 line of credit that carries an annual interest rate of 9%. Tucson requires a minimum cash balance of $15,000 and repays principal and interest as soon as possible. Assume a 0 balance in beginning and ending WIP inventory