Answered step by step

Verified Expert Solution

Question

1 Approved Answer

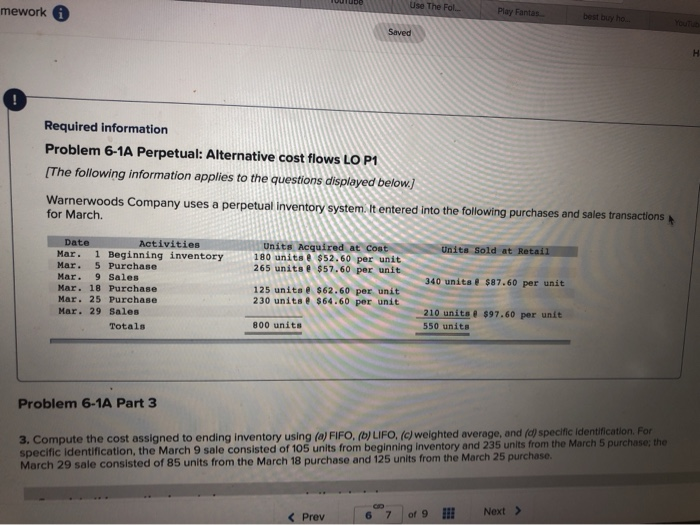

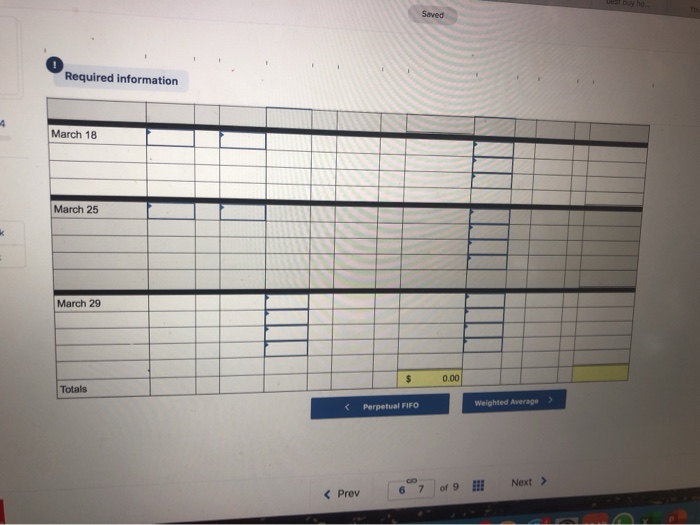

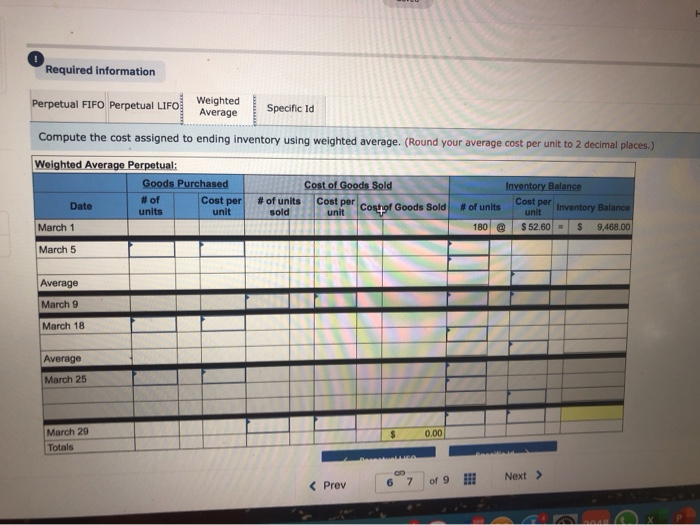

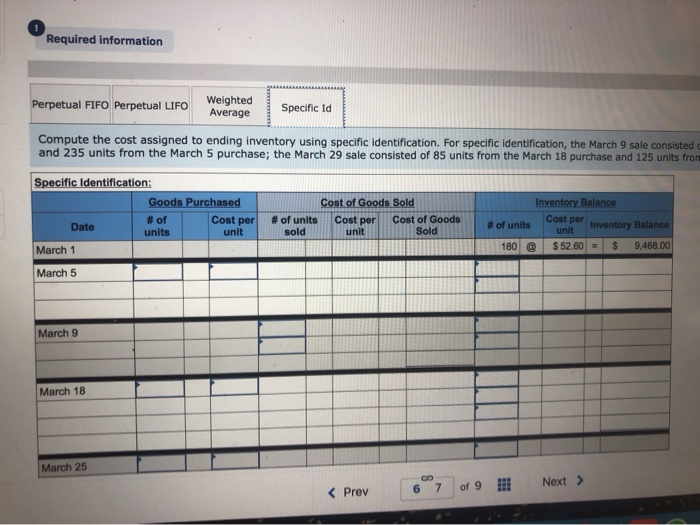

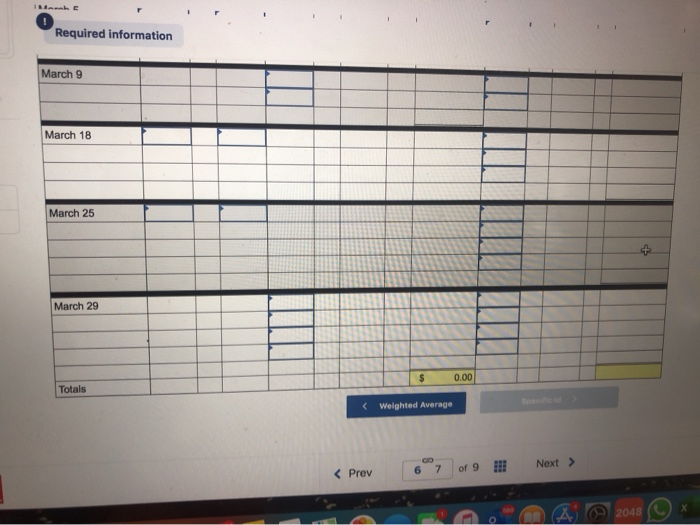

TUDe Use The Fol mework Play Fantas best buy ho YouTub Saved Required information Problem 6-1A Perpetual: Alternative cost flows LO P1 [The following information

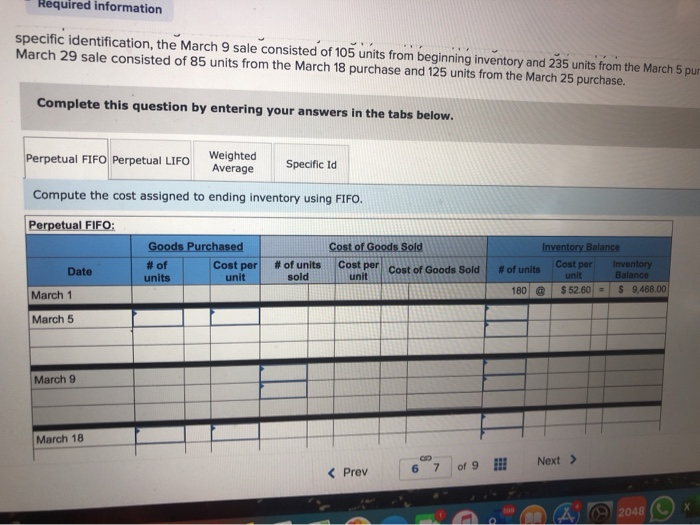

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

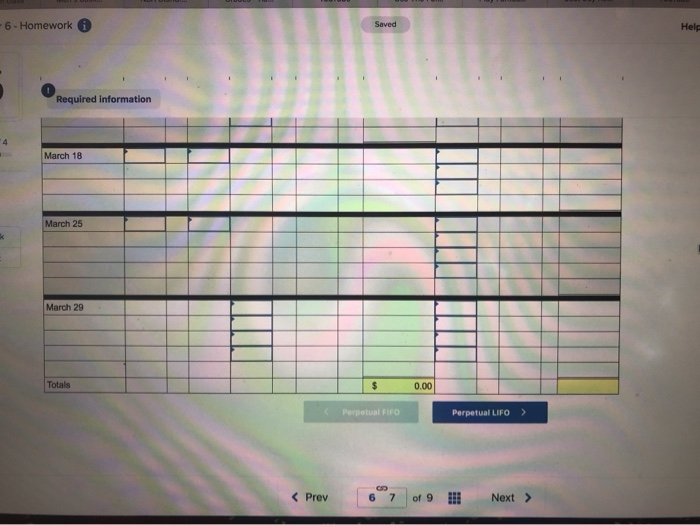

Step: 2

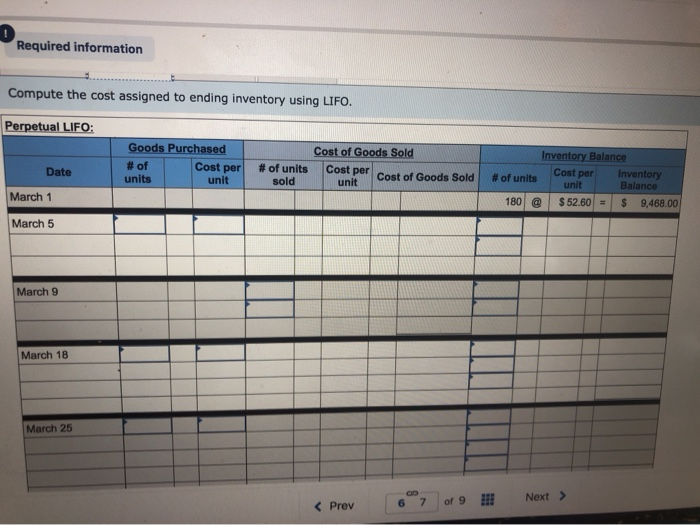

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started