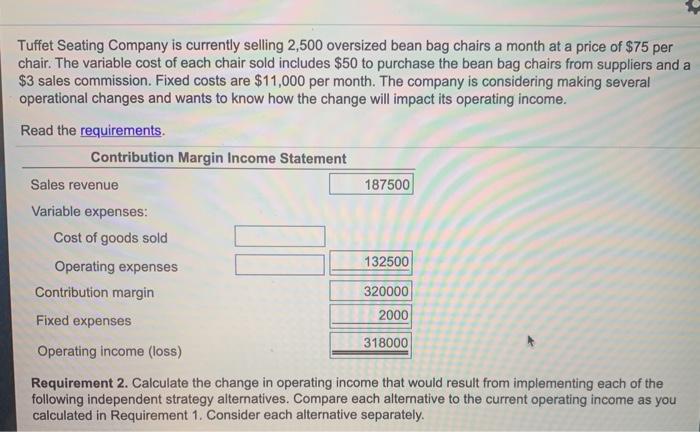

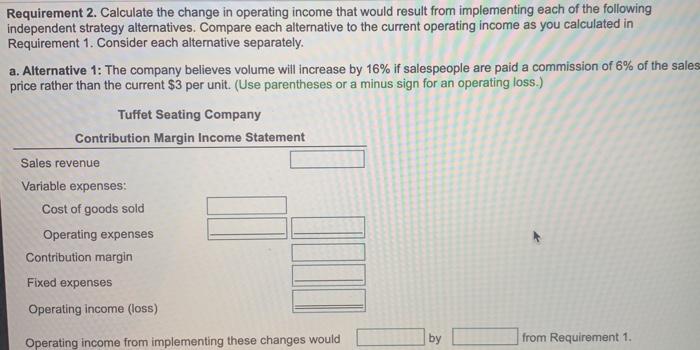

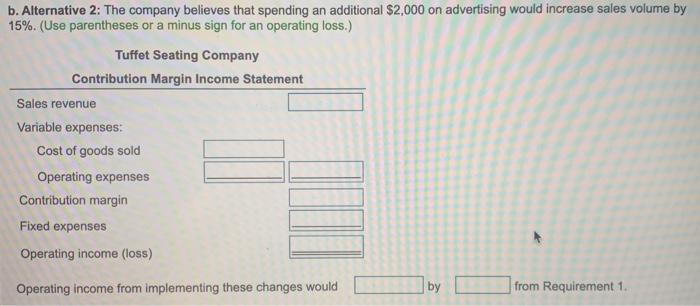

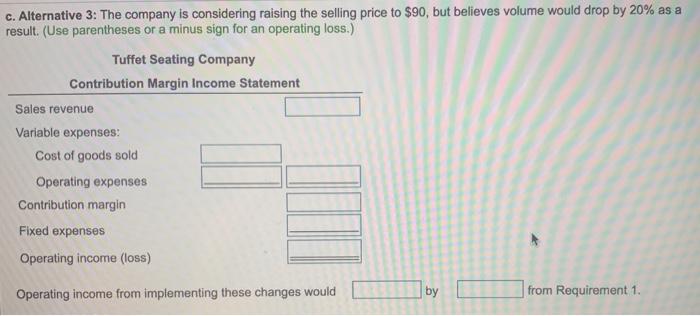

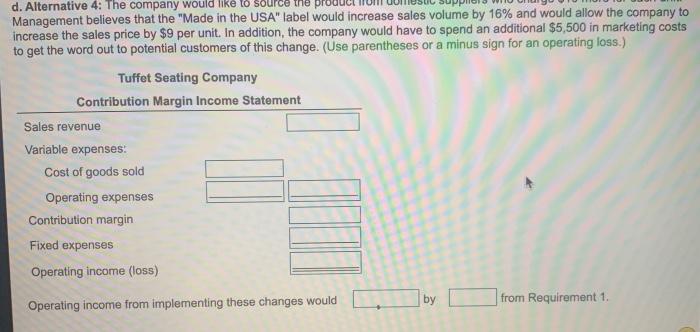

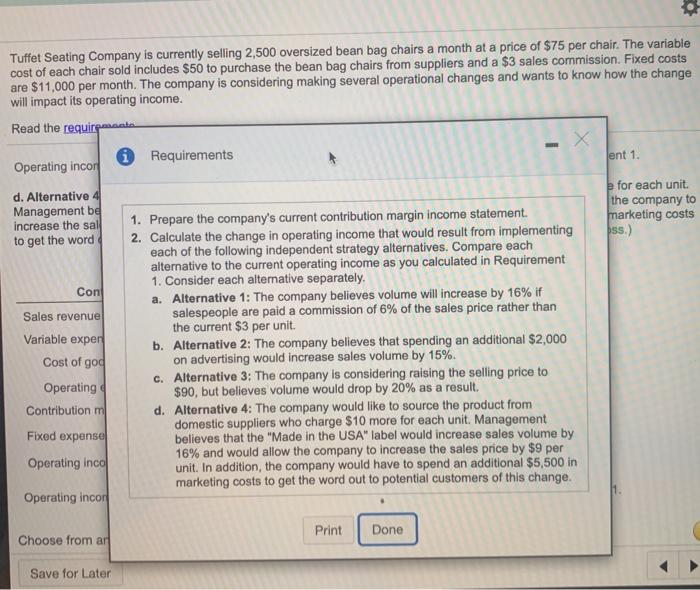

Tuffet Seating Company is currently selling 2,500 oversized bean bag chairs a month at a price of $75 per chair. The variable cost of each chair sold includes $50 to purchase the bean bag chairs from suppliers and a $3 sales commission. Fixed costs are $11,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income. Read the requirements. Contribution Margin Income Statement Sales revenue 187500 Variable expenses: Cost of goods sold 132500 Operating expenses Contribution margin 320000 2000 Fixed expenses 318000 Operating income (loss) Requirement 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. Requirement 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 16% if salespeople are paid a commission of 6% of the sales price rather than the current $3 per unit. (Use parentheses or a minus sign for an operating loss.) Tuffet Seating Company Contribution Margin Income Statement Sales revenue Variable expenses: Cost of goods sold Operating expenses Contribution margin Fixed expenses Operating income (loss) by Operating income from implementing these changes would from Requirement 1. b. Alternative 2: The company believes that spending an additional $2,000 on advertising would increase sales volume by 15%. (Use parentheses or a minus sign for an operating loss.) Tuffet Seating Company Contribution Margin Income Statement Sales revenue Variable expenses: Cost of goods sold Operating expenses Contribution margin Fixed expenses Operating income (loss) Operating income from implementing these changes would by from Requirement 1 c. Alternative 3: The company is considering raising the selling price to $90, but believes volume would drop by 20% as a result. (Use parentheses or a minus sign for an operating loss.) Tuffet Seating Company Contribution Margin Income Statement Sales revenue Variable expenses: Cost of goods sold Operating expenses Contribution margin Fixed expenses Operating income (loss) Operating income from implementing these changes would by from Requirement 1. d. Alternative 4: The company would like to source the provu Management believes that the "Made in the USA"label would increase sales volume by 16% and would allow the company to increase the sales price by $9 per unit. In addition, the company would have to spend an additional $5,500 in marketing costs to get the word out to potential customers of this change. (Use parentheses or a minus sign for an operating loss.) Tuffet Seating Company Contribution Margin Income Statement Sales revenue Variable expenses: Cost of goods sold Operating expenses Contribution margin Fixed expenses Operating income (loss) by from Requirement 1. Operating income from implementing these changes would Tuffet Seating Company is currently selling 2,500 oversized bean bag chairs a month at a price of $75 per chair. The variable cost of each chair sold includes $50 to purchase the bean bag chairs from suppliers and a $3 sales commission. Fixed costs are $11,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income. Read the requires Requirements X Operating incor lent 1. d. Alternative 4 Management be increase the sal to get the word for each unit. the company to marketing costs bss.) Con Sales revenue Variable expert Cost of god 1. Prepare the company's current contribution margin income statement. 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 16% if salespeople are paid a commission of 6% of the sales price rather than the current $3 per unit b. Alternative 2: The company believes that spending an additional $2,000 on advertising would increase sales volume by 15%. c. Alternative 3: The company is considering raising the selling price to $90, but believes volume would drop by 20% as a result d. Alternative 4: The company would like to source the product from domestic suppliers who charge $10 more for each unit. Management believes that the "Made in the USA" label would increase sales volume by 16% and would allow the company to increase the sales price by $9 per unit. In addition, the company would have to spend an additional $5,500 in marketing costs to get the word out to potential customers of this change. Operating Contribution m Fixed expense Operating inco Operating incor Print Done Choose from ar Save for Later