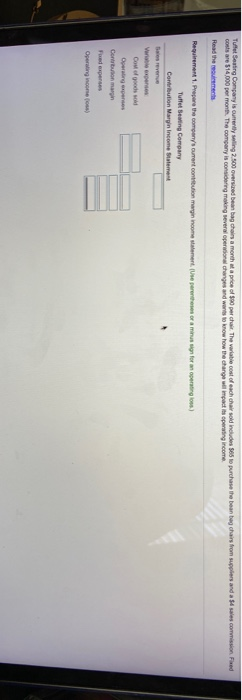

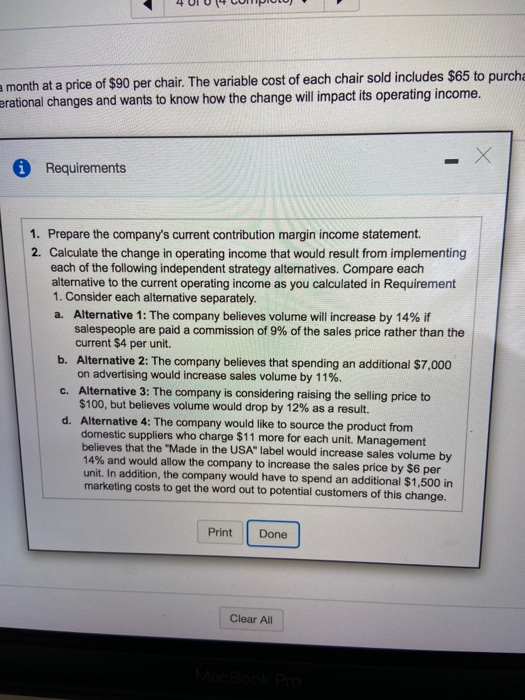

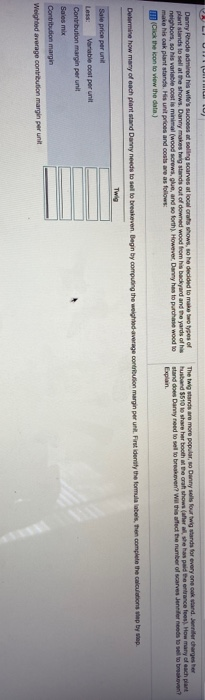

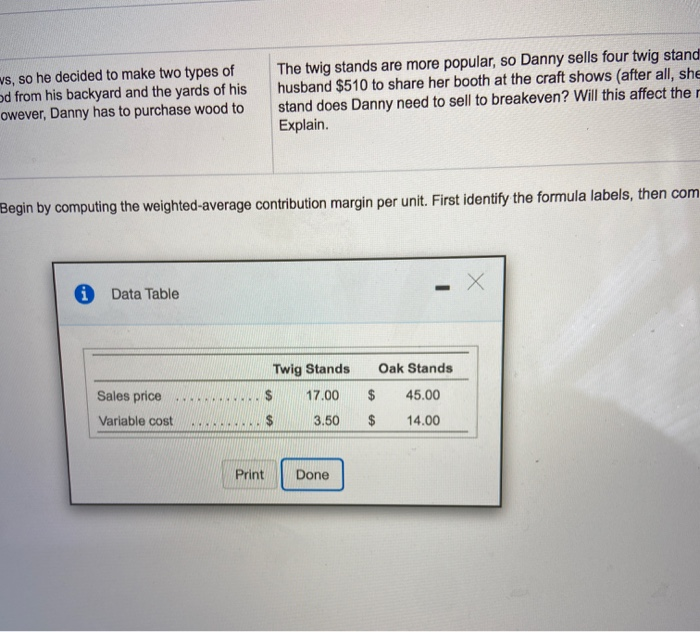

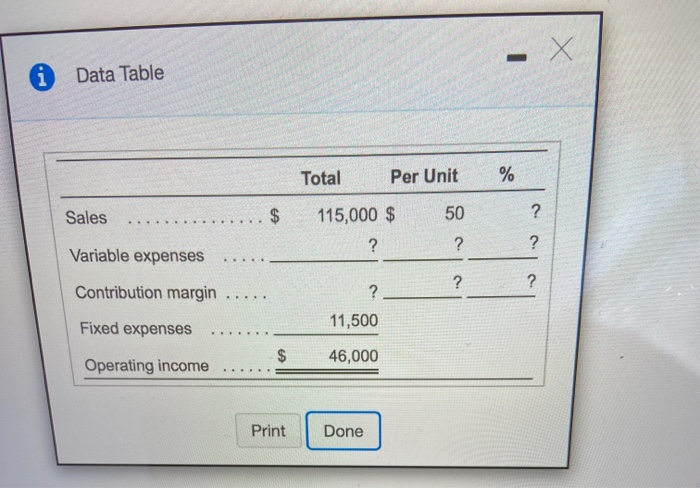

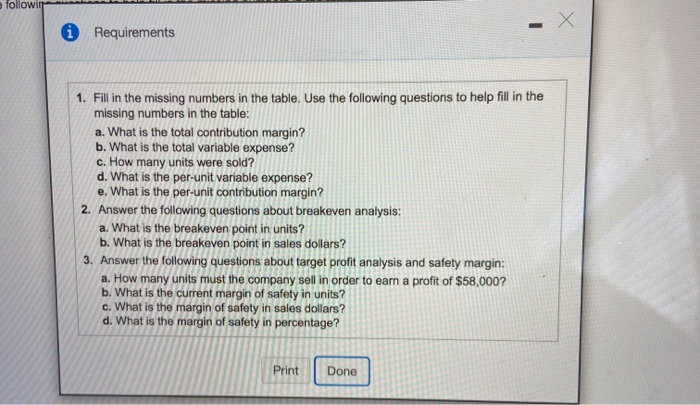

Tuffet Seating Company is currently wling 2.500 oversized bean bag chairs a month at a price of purchair. The variable cost of each chair sold includes ses to purchase the bean bag chairs from suppliers and a $4 sales commission Feed costs are $14.000 per month. The company is considering making several operational changes and wait to know how the change will impact its operating income Read the rements Requirement 1. Prepare the company's current contribution margin income woment (e peretheses or a minus sign for cering) Tuttu Seting Company Contribution Margin Income Same Cost of goods so Con margin Operating conte (0) a month at a price of $90 per chair. The variable cost of each chair sold includes $65 to purcha erational changes and wants to know how the change will impact its operating income. Requirements 1. Prepare the company's current contribution margin income statement. 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 14% if salespeople are paid a commission of 9% of the sales price rather than the current $4 per unit. b. Alternative 2: The company believes that spending an additional $7,000 on advertising would increase sales volume by 11%. c. Alternative 3: The company is considering raising the selling price to $100, but believes volume would drop by 12% as a result d. Alternative 4: The company would like to source the product from domestic suppliers who charge $11 more for each unit. Management believes that the "Made in the USA"label would increase sales volume by 14% and would allow the company to increase the sales price by $6 per unit. In addition, the company would have to spend an additional $1,500 in marketing costs to get the word out to potential customers of this change. Print Done Clear All Danny Rhode admired his wife's success at soling scarves at local gratis shows, so he decided to make two types of The twig wands are more popular, so Danny sells fourtwig wards for everyone cok vand. Jennifer charges her plant stands to sell at the shows. Danny makes twig stands out of downed wood from his backyard and the yards of the husband 5510 to share her booth tecraft shows her she has alde entrance fees. How many of each part neighbors, so his variable cost is minimal (wood screws, glue, and so forth). However, Darwny has to purchase wood to stand des Danny need to sell to breakeven? Wil this afect the number of scarves Jennifer needs to beven? make his oak plant standsHis unit prices and costs are as follows: Explain (Click the icon to view the data) Determine how many of each plant and Danny needs to sell to breakeven. Begin by computing the weighted average contribution margin per unit. First identity the formula bers, the complete the calculations whep by step Twig Sale price per unit Less: Variable cost per unit Contribution margin per unit Sales mix Contribution margin Weighted average contribution margin per unit ws, so he decided to make two types of od from his backyard and the yards of his owever, Danny has to purchase wood to The twig stands are more popular, so Danny sells four twig stand husband $510 to share her booth at the craft shows (after all, she stand does Danny need to sell to breakeven? Will this affect the Explain. Begin by computing the weighted-average contribution margin per unit. First identify the formula labels, then com Data Table Twig Stands Oak Stands $ 17.00 $ 45.00 + Sales price Variable cost 3.50 $ NA 14.00 Print Done Auston Company manufactures and sols a single product. The company's sales and expenses for last year follow (Click the loon to view the information.) Read the requirements Requirement 1. Fa in the missing numbers in the table. Use the following questions to help fil in the missing numbers in the table: a. What is the total contribution margin? The total contribution margin is $ X Data Table Total Per Unit % Sales $ 115,000 $ 50 ? ..... ? ? ? Variable expenses ? ? Contribution margin ..... ? Fixed expenses 11,500 $ 46,000 Operating income Print Done followin Requirements 1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: a. What is the total contribution margin? b. What is the total variable expense? c. How many units were sold? d. What is the per-unit variable expense? e. What is the per-unit contribution margin? 2. Answer the following questions about breakeven analysis: a. What is the breakeven point in units? b. What is the breakeven point in sales dollars? 3. Answer the following questions about target profit analysis and safety margin: a. How many units must the company sell in order to earn a profit of $58,000? b. What is the current margin of safety in units? c. What is the margin of safety in sales dollars? d. What is the margin of safety in percentage? Print Done