Answered step by step

Verified Expert Solution

Question

1 Approved Answer

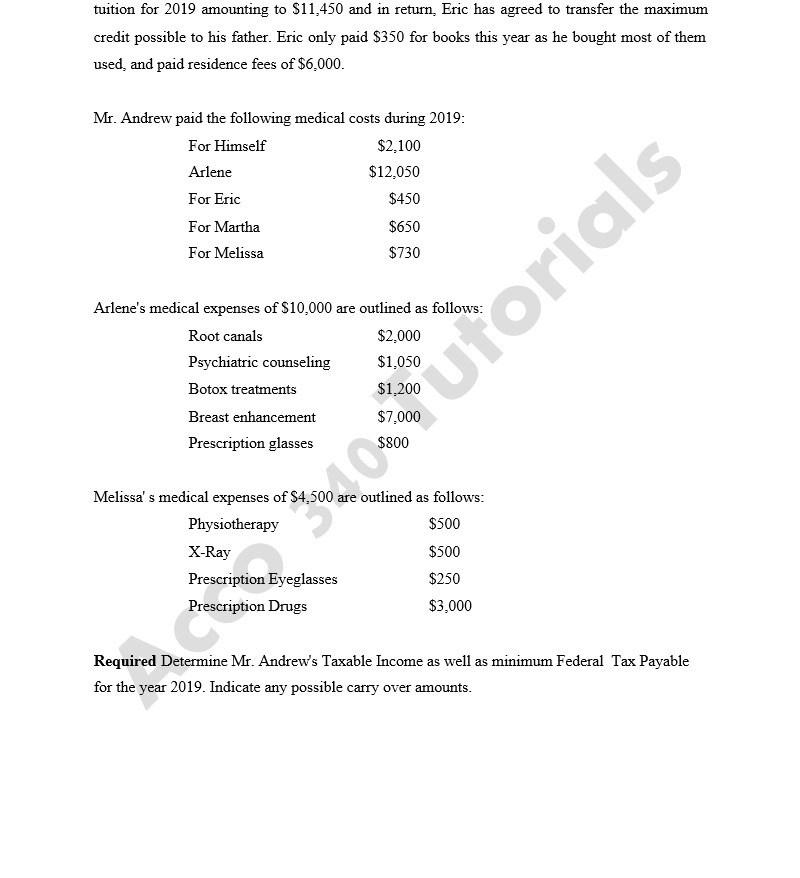

tuition for 2019 amounting to $11,450 and in return, Eric has agreed to transfer the maximum credit possible to his father. Eric only paid

tuition for 2019 amounting to $11,450 and in return, Eric has agreed to transfer the maximum credit possible to his father. Eric only paid $350 for books this year as he bought most of them used, and paid residence fees of $6,000. Mr. Andrew paid the following medical costs during 2019: For Himself $2,100 Arlene $12,050 For Eric $450 For Martha $650 For Melissa $730 Arlene's medical expenses of $10,000 are outlined as follows: Root canals $2,000 Psychiatric counseling Botox treatments Breast enhancement Prescription glasses Melissa's medical expenses of $4,500 are outlined as follows: Physiotherapy $500 $500 $250 $3,000 X-Ray Prescription Eyeglasses Prescription Drugs 40 utorials Required Determine Mr. Andrew's Taxable Income as well as minimum Federal Tax Payable for the year 2019. Indicate any possible carry over amounts.

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To determine Mr Andrews taxable income and minimum federal tax payable for the year 2019 we need to calculate his total income deductions and credits Lets break down the information provided Income Mr ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started