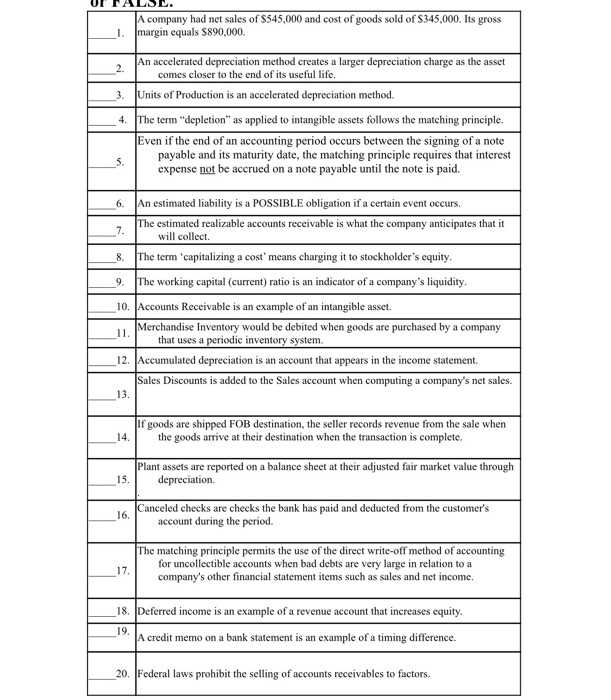

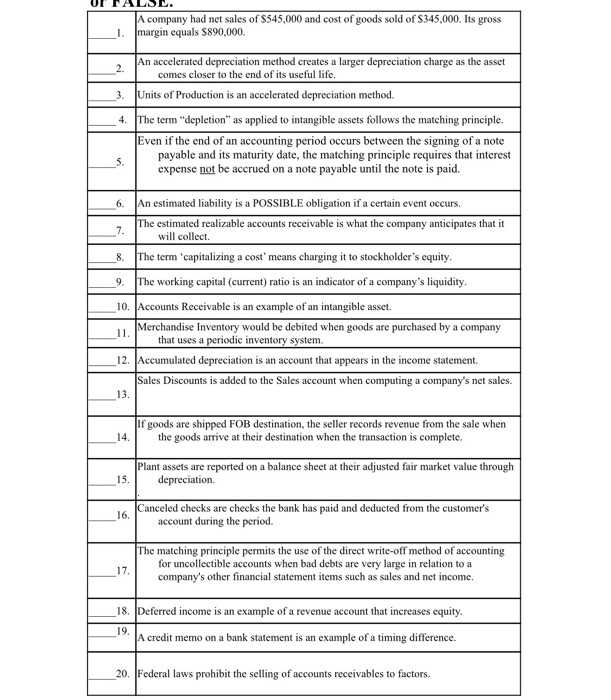

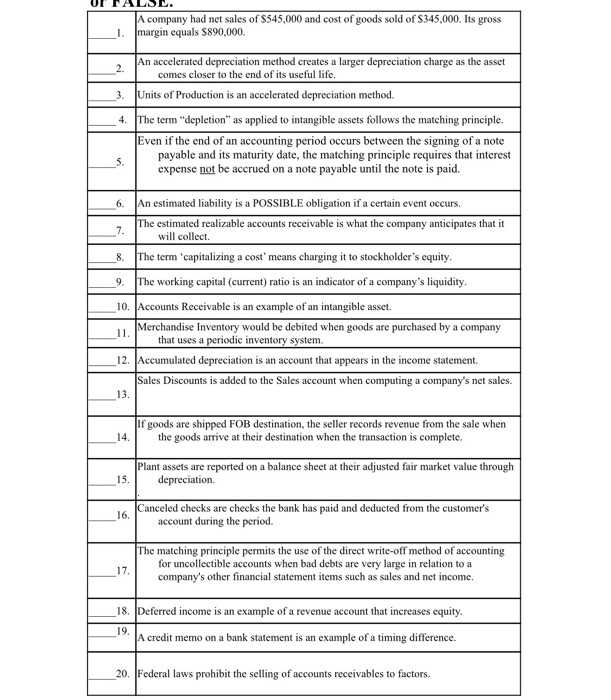

Ture or fause question

UI TALSE. A company had net sales of $545,000 and cost of goods sold of S345,000. Its gross 1. margin equals $890,000 An accelerated depreciation method creates a larger depreciation charge as the asset comes closer to the end of its useful life. 3. JUnits of Production is an accelerated depreciation method. __4. The term "depletion" as applied to intangible assets follows the matching principle. Even if the end of an accounting period occurs between the signing of a note payable and its maturity date, the matching principle requires that interest expense not be accrued on a note payable until the note is paid. 6. An estimated liability is a POSSIBLE obligation if a certain event occurs. The estimated realizable accounts receivable is what the company anticipates that it will collect. _8. The term 'capitalizing a cost' means charging it to stockholder's equity. 9. The working capital (current) ratio is an indicator of a company's liquidity. _10. Accounts Receivable is an example of an intangible asset. Merchandise Inventory would be debited when goods are purchased by a company that uses a periodic inventory system. 12. Accumulated depreciation is an account that appears in the income statement Sales Discounts is added to the Sales account when computing a company's net sales. 13. Jif goods are shipped FOB destination, the seller records revenue from the sale when the goods arrive at their destination when the transaction is complete. Plant assets are reported on a balance sheet at their adjusted fair market value through depreciation. 15. 16. Canceled checks are checks the bank has paid and deducted from the customer's account during the period. The matching principle permits the use of the direct write-off method of accounting for uncollectible accounts when bad debts are very large in relation to a company's other financial statement items such as sales and net income. _18. Deferred income is an example of a revenue account that increases equity. - A credit memo on a bank statement is an example of a timing difference. __20. Federal laws prohibit the selling of accounts receivables to factors