Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Turn back to Figure 2.3 and look at the Treasury bond maturing in August 2048. a. How much would you have to pay to purchase

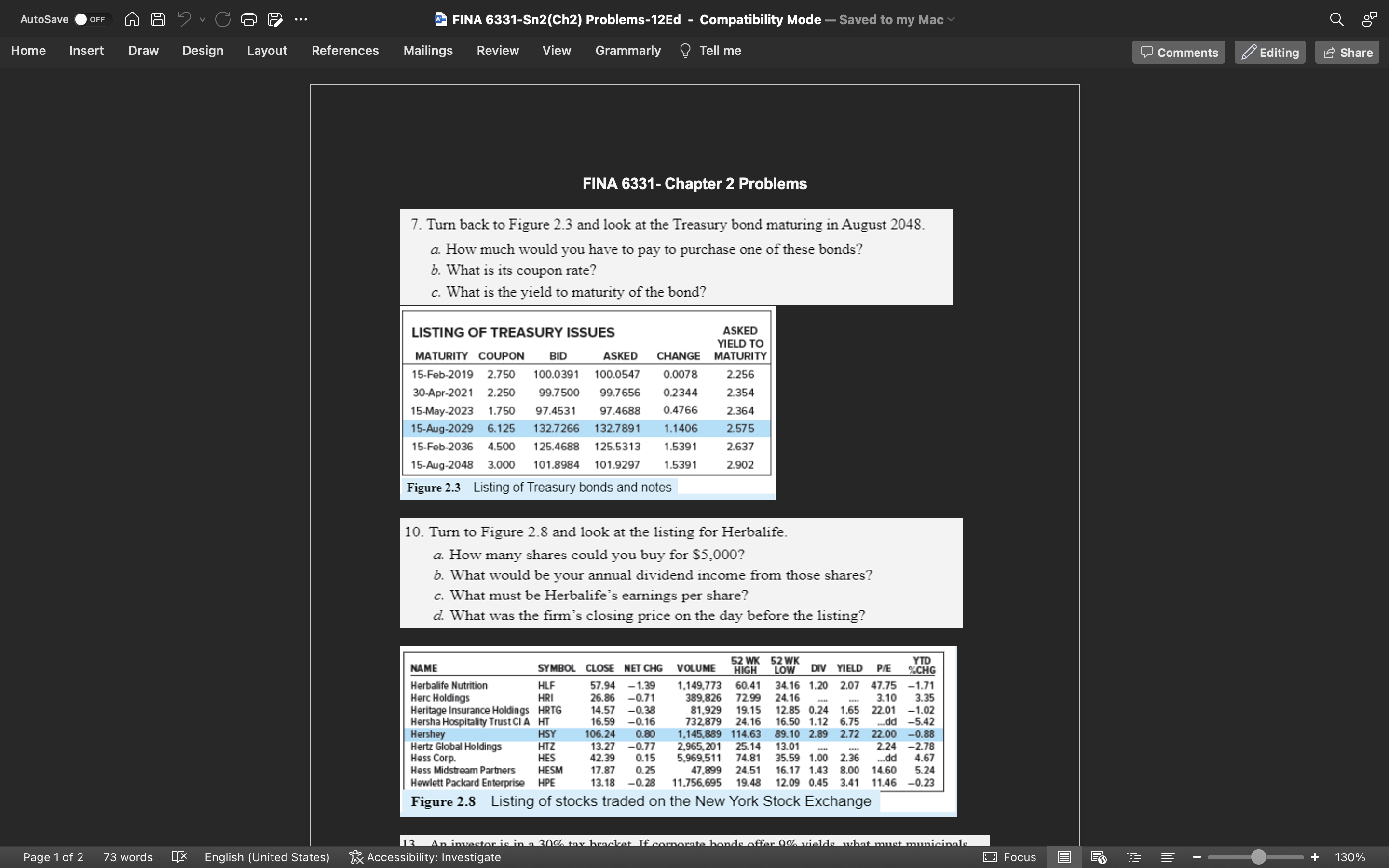

Turn back to Figure 2.3 and look at the Treasury bond maturing in August 2048. a. How much would you have to pay to purchase one of these bonds? b. What is its coupon rate? c. What is the yield to maturity of the bond? Figure 2.3 Listing of Treasury bonds and notes

The first Table

7. Turn back to Figure 2.3 and look at the Treasury bond maturing in August 2048. a. How much would you have to pay to purchase one of these bonds? b. What is its coupon rate? c. What is the yield to maturity of the bond? 10. Turn to Figure 2.8 and look at the listing for Herbalife. a. How many shares could you buy for $5,000 ? b. What would be your annual dividend income from those shares? c. What must be Herbalife's earnings per share? d. What was the firm's closing price on the day before the listing

7. Turn back to Figure 2.3 and look at the Treasury bond maturing in August 2048. a. How much would you have to pay to purchase one of these bonds? b. What is its coupon rate? c. What is the yield to maturity of the bond? 10. Turn to Figure 2.8 and look at the listing for Herbalife. a. How many shares could you buy for $5,000 ? b. What would be your annual dividend income from those shares? c. What must be Herbalife's earnings per share? d. What was the firm's closing price on the day before the listing Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started