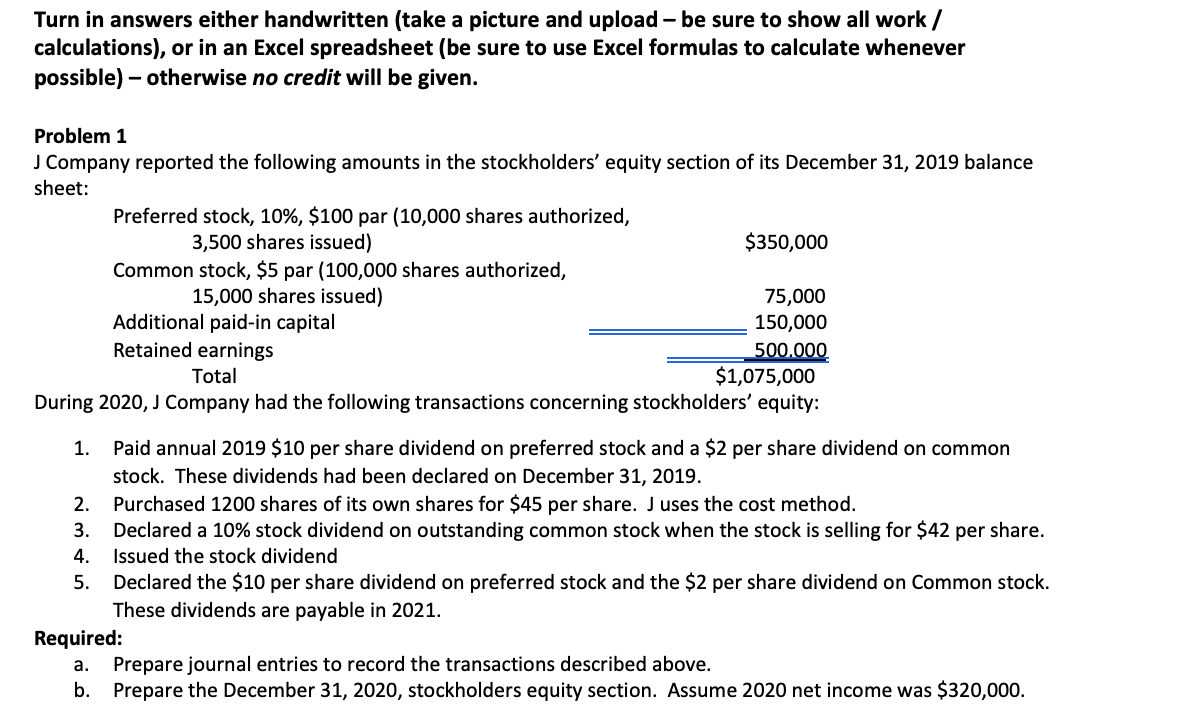

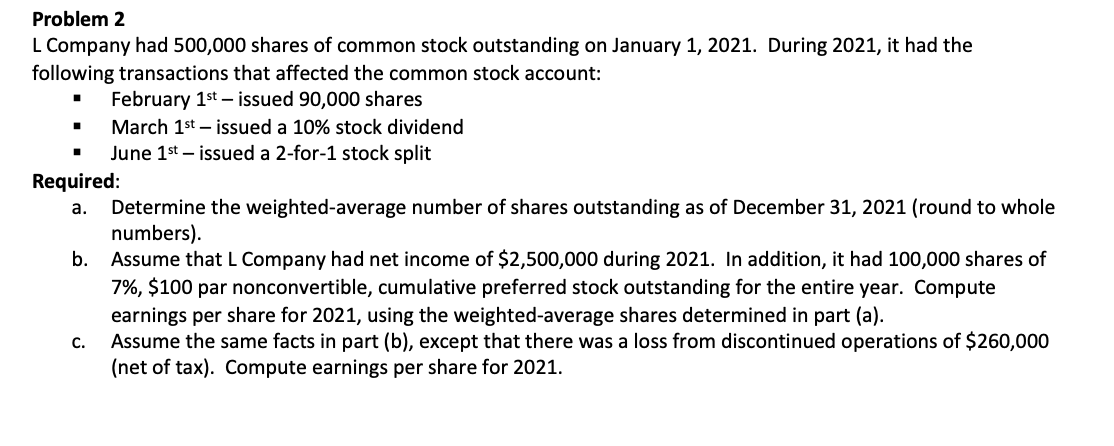

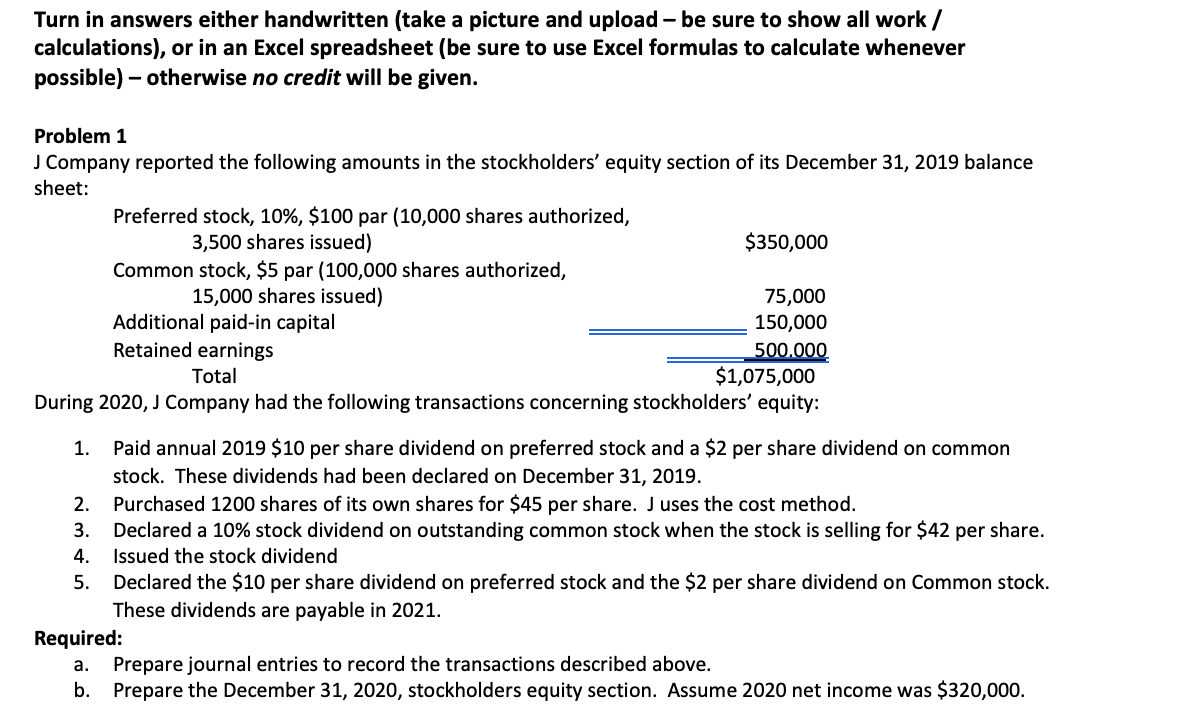

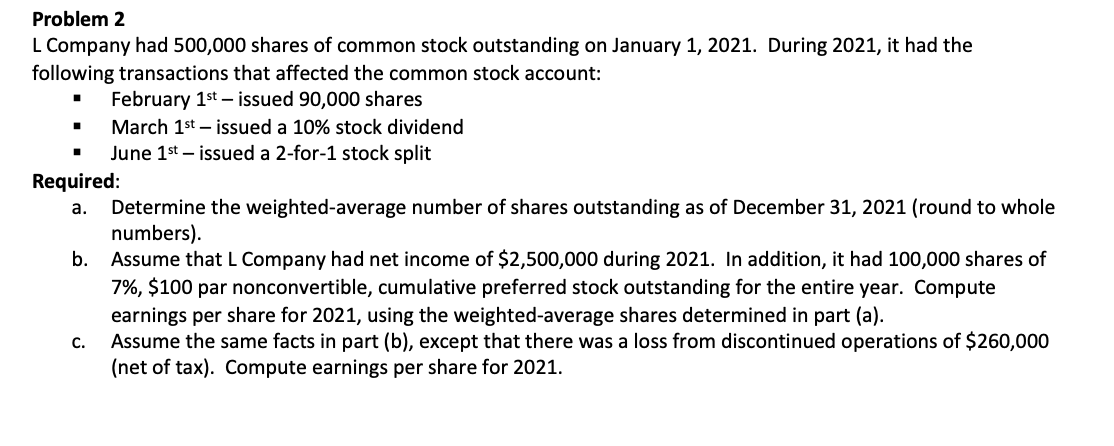

Turn in answers either handwritten (take a picture and upload - be sure to show all work / calculations), or in an Excel spreadsheet (be sure to use Excel formulas to calculate whenever possible) - otherwise no credit will be given. Problem 1 J Company reported the following amounts in the stockholders' equity section of its December 31, 2019 balance sheet: Preferred stock, 10%, $100 par (10,000 shares authorized, 3,500 shares issued) $350,000 Common stock, $5 par (100,000 shares authorized, 15,000 shares issued) 75,000 Additional paid-in capital 150,000 Retained earnings 500.000 Total $1,075,000 During 2020, J Company had the following transactions concerning stockholders' equity: nim 1. Paid annual 2019 $10 per share dividend on preferred stock and a $2 per share dividend on common stock. These dividends had been declared on December 31, 2019. Purchased 1200 shares of its own shares for $45 per share. J uses the cost method. Declared a 10% stock dividend on outstanding common stock when the stock is selling for $42 per share. 4. Issued the stock dividend 5. Declared the $10 per share dividend on preferred stock and the $2 per share dividend on Common stock. These dividends are payable in 2021. Required: a. Prepare journal entries to record the transactions described above. b. Prepare the December 31, 2020, stockholders equity section. Assume 2020 net income was $320,000. Problem 2 L Company had 500,000 shares of common stock outstanding on January 1, 2021. During 2021, it had the following transactions that affected the common stock account: February 1st - issued 90,000 shares March 1st - issued a 10% stock dividend . June 1st - issued a 2-for-1 stock split Required: a. Determine the weighted average number of shares outstanding as of December 31, 2021 (round to whole numbers). b. Assume that L Company had net income of $2,500,000 during 2021. In addition, it had 100,000 shares of 7%, $100 par nonconvertible, cumulative preferred stock outstanding for the entire year. Compute earnings per share for 2021, using the weighted average shares determined in part (a). C. Assume the same facts in part (b), except that there was a loss from discontinued operations of $260,000 (net of tax). Compute earnings per share for 2021