Turn in with an Excel file with your calculations and a report

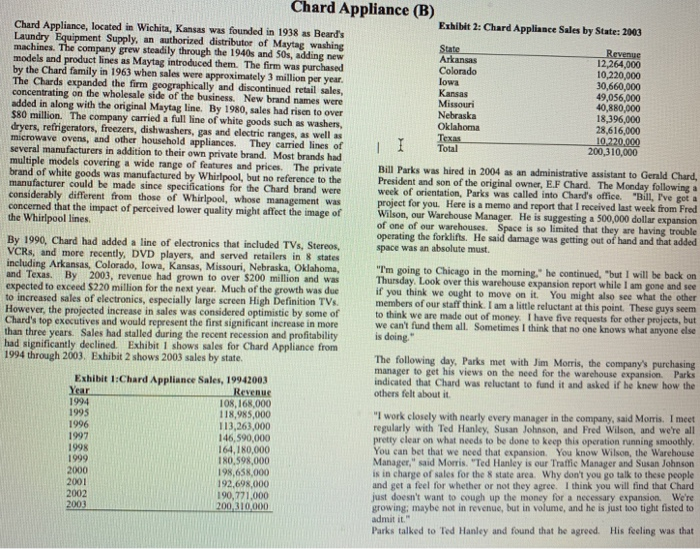

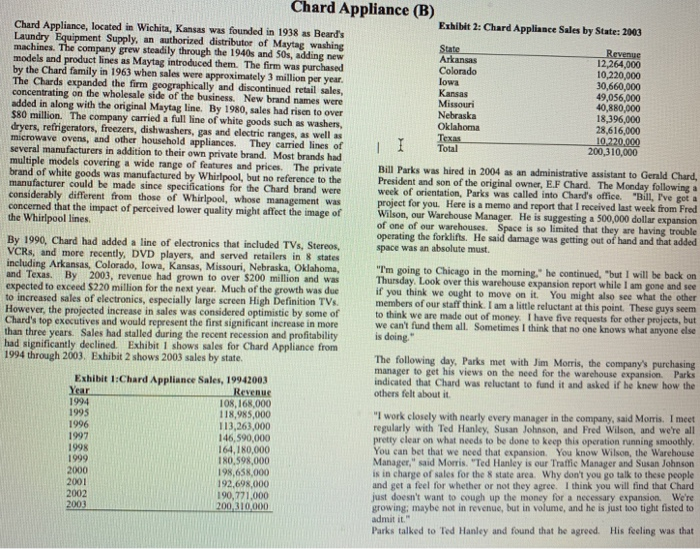

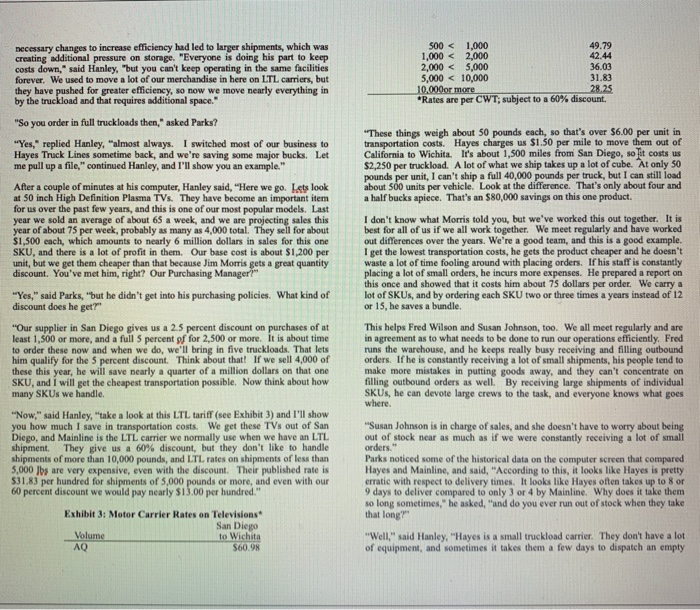

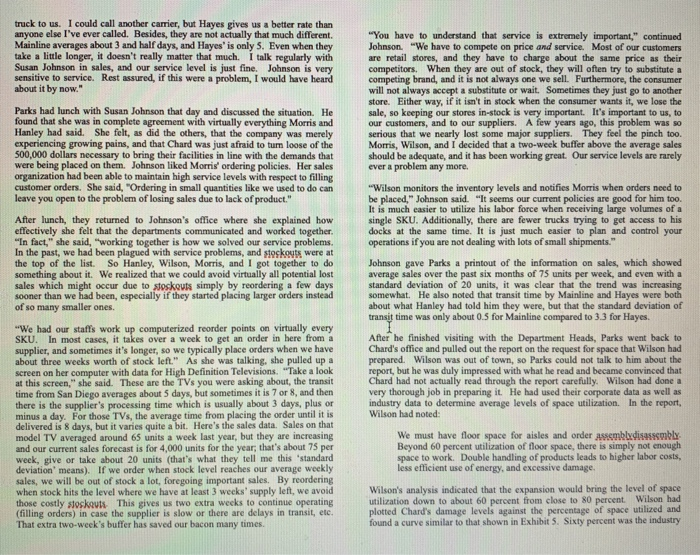

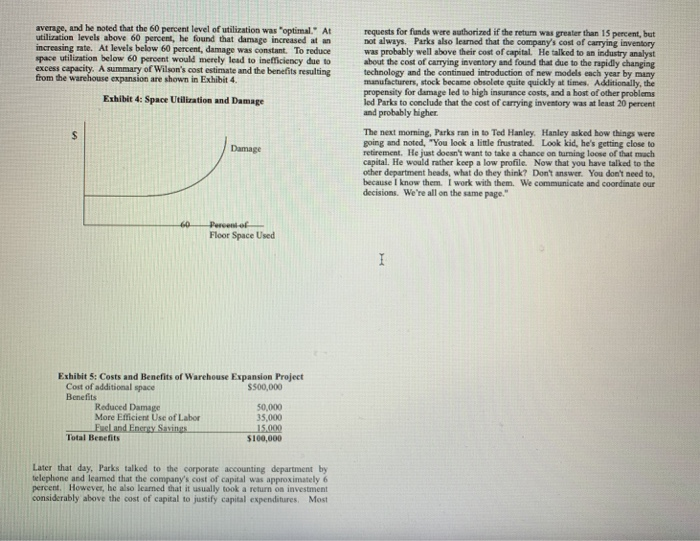

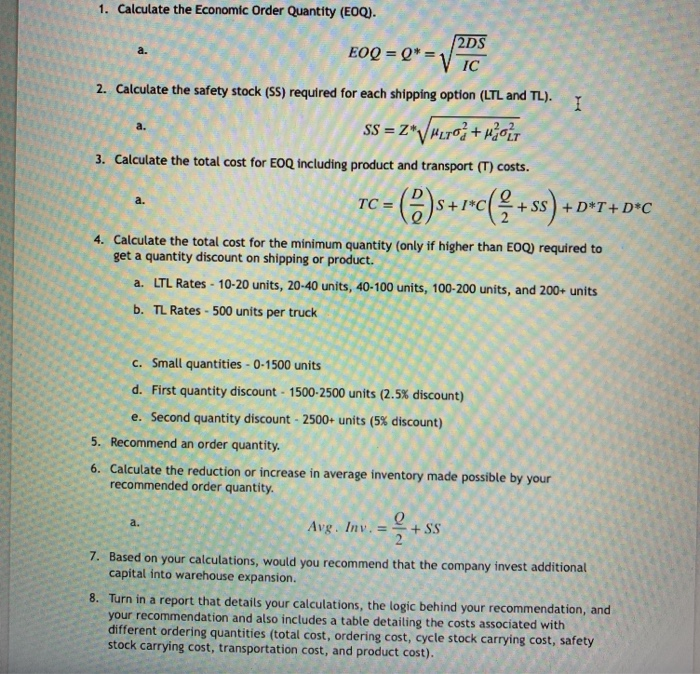

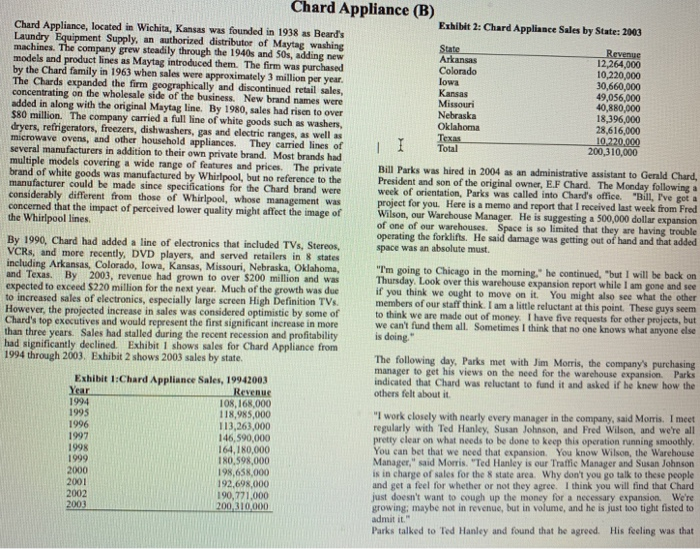

Chard Appliance (B) Exhibit 2: Chard Appliance Sales by State: 2003 Chard Appliance, located in Wichita, Kansas was founded in 1938 as Beard's Laundry Equipment Supply, an authorized distributor of Maytag washing machines. The company grew steadily through the 1940s and S0s, adding new models and product lines as Maytag introduced them. The firm was purchased by the Chard family in 1963 when sales were approximately 3 million per year The Chards expanded the firm geographically concentrating on the wholesale side of the business. New brand names were added in along with the original Maytag line. By 1980, sales had risen to over $80 million. The company carried a full line of white goods such as washers dryers, refrigerators, freezers, dishwashers, gas and electric ranges, as well as microwave ovens several manufacturers in addition to their own private brand. Most brands had multiple models covering a wide range of features and prices. The private brand of white goods was manufactured by Whirlpool, but no reference to the manufacturer could be made since specifications for the Chard brand were considerably differ Arkansas Colorado lowa Kansas Missouri Nebraska Oklahoma 12,264,00 10,220,000 30,660,000 49,056,000 40,880,000 18,396,000 28,616,000 and discontinued retail sales, household appliances Total 200,310,000 Bill Parks was hired in 2004 as an administrative assistant to Gerald President and son of the original owner, E.F Chard. The Monday follo Chard, concerned that the impact of perceived lower quality might affect the image of ond rgport that I received last week from Fred He is suggesting a 500,000 dollar expansion Wilson, our Warchouse Manager. of one of our warehouses. Space is so limited that they are having trouble operating the forklifts. He said damage was getting o space was an absolute must. the Whirlpool lines. out of hand and that added By 1990, Chard had added a line of electronics that included TVs, Stereos, VCRs, and more recently, DVD players, and served retailers in 8 states including Arkansas, Colorado, lowa, Kansas, Missouri, Nebraska, Oklahoma, and Texas. By 2003, revenue had grown to over $200 million and was "I'm going to Chicago in the moming Thursday. Look over this warehouse expansion report while I am gone and if you think we ought to move on it. You might also see what the members of our staff think. I am a little reluctant at this point. These guys seem he continued, "but I will be b increased sales of However, the projected increase in sales was considered optimistic by some ofto think we are Chard's top executives and would represent the first significant increase in more than three years. Sales had stalled during the recent recession and profitability had significantly declined. Exhibit I shows sales for Chard Appliance from electronics, especially large screen High Definition TVs made out of money. I have five requests for other projects, but s what anyone else The following day, Parks met with Jim Morris, the company's purchasing manager to get his views on the need for the warehouse expansion. Parks indicated that Chard was reluctant to fund it and asked if he knew how the others felt about it 1994 through 2003. Exhibit 2 shows 2003 sales by state Exhibit 1:Chard Appliance Sales, 19942003 Revenus 108,168,000 118,985,000 113,263,000 146,590,000 164.180,000 180,598,000 198,638,000 192,698,000 190,771,000 "I work closely with nearly every manager in the company, said Morris. I meet regularly with Ted Hanley, Susan Johnson, and Fred Wilson, and we're all 997 clear on what needs to be done to keep this operation running smoothly ou can bet that we need that expansion. You know Wilson, the Warehouse Manager," said Morris. "Ted Hanley is our Traffic Manager and Susan Johnson is in charge of sales for the 8 state area. Why don't you go talk to these people and get a feel for whether or not they agree. I think you will find that Chard 2000 just doesn't want to cough up the growing; maybe not in revenue, but in for a necessary expansion We're e, and he is just too tight fisted to Parks talked to Ted Hanley and found that he agreed. His feeling was that necessary changes to increase efficiency had led to larger shipments, which was creating additional pressure on storage "Everyone is doing his part to keep costs down," said Hanley, "but you can't keep operating in the same facilities forever. We used to move a lt of our merchandise in here on LTL carriers, but for greater efficiency, so now we move nearly everything in and that requires additional space. *Rates are per CWT, subject to a 60% discount. "So you order in full truckloads then," asked Parks? These things weigh about 50 pounds each, so that's over $6.00 per unit in transportation costs. Hayes charges us $1.50 per mile to move them out of Hayes Truck Lines sometime back, and we're saving some major bucks. LetCalifornia to Wichita. It's about 1,500 miles from San Diego, so it costs us $2,250 per truckload. A lot of what we ship takes up a lot of cube. At only 50 pounds per unit, I can't ship a full 40,000 pounds per truck, but I can still load about 500 units per vehicle. Look at the difference. That's only about four and Yes," replied Hanley, "almost always. I switched most of our business to me pull up a file," continued Hanley, and I'll show you an example." After a couple of minutes at his computer, Hanley said, "Here we go. Lets look at 50 inch High Definition Plasma TVs. They have become an important item for us over the past few years, and this is one of our most popular models. Last a half bucks apiece. That's an $80,000 savings on this one product I don't know what Morris told you, but we've worked this out together. It is best for all of us if we all work together. We meet regularly and have worked out differences over the years. We're a good team, and this is a good example I get the lowest transportation costs, he gets the product cheaper and he doesn't waste a lot of time fooling around with placing orders. If his staff is constanty placing a lot of small orders, he incurs more expenses. He prepared a report on this once and showed that it costs him about 75 dollars per order. We carry a lot of SKUs, and by ordering each SKU two or three times a years instead of 12 year we sold an average of about 65 a week, and we are year of about 75 per week, probably as many as 4,000 total. They sell for about $1,500 each, which amounts to nearly 6 million dollars in sales for this one SKU, and there is a lot of profit in them. Our base cost is about $1,200 per unit, but we get them cheaper than that because Jim Morris gets a great quantity discount. You've met him, right? Our Purchasing Manager?" "Yes," said Parks, "but he didn't get into his purchasing policies. What kind of discount does he get?" "Our supplier in San Diego gives us a 2.5 percent discount on purchases of at least 1,500 or more, and a full 5 percent of for 2,500 or more. It is about time to order these now and when we do, we'll bring in five truckloads. That lets him qualify for the 5 percent discount. Think about that If we sell 4,000 of these this year, he will save nearly a quarter of a million dollars on that one SKU, and I will get the cheapest transportation possible. Now think about hovw This helps Fred Wilson and Susan Johnson, too. We all meet regularly and are in agreement as to what needs to be done to run our operations efficiently. Fred runs the warchouse, and he keeps really busy receiving and filling outbound orders. If he is constantly receiving a lot of small shipments, his people tend to make more mistakes in putting goods away, and they can't concentrate on filling outbound orders as well. By receiving large shipments of individual SKUs, he can devote large crews to the task, and everyone knows what goes Now," said Hanley, "take a look at this LTL tariff (see Exhibit 3) and I'll show you how much I save in transportation costs. We get these TVs out of San Diego, and Mainline is the LTL carrier we normally use when we have an LTL pment. They give us a 60% discount, but they don't like to handle shipments of more than 10,000 pounds, and LTL rates on shipments of less than 5,000 Jbs are very expensive, even with the discount. Their published rate is "Susan Johnson is in charge of sales, and she doesn't have to worry about being out of stock near as much as if we were constantly receiving a lot of small Parks noticed some of the historical data on the computer screen that compared Hayes and Mainline, and said, "According to this, it looks like Hayes is pretty erratic with respect to delivery times. It looks like Hayes often takes up to 8 or 9 days to deliver compared to only 3 or 4 by Mainline. Why does it take them so long sometimes," he asked, "and do you ever run out of stock when they take 531,83 per hundred for shipments of 5,000 60 percent discount we would pay nearly $13.00 per hundred." Exhibit 3: Motor Carrier Rates on Televisions Well," said Hanley, "Hayes is a small truckload carrier. They don't have a lot of equipment, and sometimes it takes them a few days to dispatch an empty AQ truck to us. I could call another carrier, but Hayes gives us a better rate than anyone else I've ever called. Besides, they are not actually that much different.You have to understand that service is extremely important," continued Mainline averages about 3 and half days, and Hayes' is only 5. Even when they take a little longer, it doesn't really matter that much. I talk regularly with Susan Johnson in sales, and our service level is just fine. Johnson is very competitors, When they are out of stock, they will often try to substitute a sensitive to service. Rest assured, if this were a problem, I would have heard Johnson. "We have to compete on price and service. Most of our customers are retail stores, and they have to charge about the same price as their Parks had lunch with Susan Johnson that day and discussed the situation. He found that she was in complete agreement with virtually everything Morris and Hanley had said. She felt, as did the others, that the company was merely experiencing growing pains, and that Chard was just afraid to turn loose of 500,000 dollars necessary to bring their facilities in line with the demands that were being placed on them. Johnson liked Morris' ordering policies. Her sales organization had been able to maintain high service levels with respect to filling customer orders. She said, "Ordering in small quantities like we used to do can leave you open to the problem of losing sales due to lack of product. competing brand, and it is not always one we sell. Furthermore, the consumer will not always accept a substitute or wait. Sometimes they just go to another store. Either way, if it isn't in stock when the consumer wants it, we lose the sale, so keeping our stores in-stock is very important. It's important to us, to our customers, and to our suppliers. A few years ago, this problem was so serious that we nearly lost some major suppliers. They feel the pinch too. Morris, Wilson, and I decided that a two-week buffer above the average sales should be adequate, and it has been working great. Our service levels are rarely Wilson monitors the inventory levels and notifies Morris when orders need to be placed," Johnson said. "It seems our current policies are good for him too It is much easier to utilize his labor force when receiving large volumes of a After lunch, they returned to Johnson's office where she explained howsingle SKU. Additionally, there are fewer trucks trying to get access to his effectively she felt that the departments communicated and worked together "In fact," she said, "working together is how we solved our service problems. In the past, we had been plagued with service problems, and steskouts were at the top of the list. So Hanley, Wilson, Morris, and I got together to do something about it. We realized that we could avoid virtually all potential lost sales which might occur due to stoskouts simply by reordering a few days docks at the same time. It is just much easier to plan and control your operations if you are not dealing with lots of small shipments Johnson gave Parks a printout of the information on sales, which showed average sales over the past six months of 75 units per week, and even with a standard deviation of 20 units, it was clear that the trend was increasing somewhat. He also noted that transit time by Mainline and Hayes were both ner than we had been, especially if they started placing larger orders instead of so many smaller ones. about what Hanley had told him they were, but that the standard deviation of time was only about 0.5 for Mainline c 3 for Hayes. "We had our staffs work up computerized reorder points on virtually every over a week to get an order in here from a supplier, and sometimes it's longer, so we typically place orders when we have about three weeks worth of stock left." As she was talking, she pulled upa screen on her computer with data for High Definition Televisions. "Take a look at this screen," she said. These are the TVs you were asking about, the transit time from San Diego averages about 5 days, but sometimes it is 7 or 8, and then there is the supplier's processing time which is usually about 3 days, plus or minus a day. For those TVs, the average time from placing the order until it is delivered is 8 days, but it varies quite a bit. Here's the sales data. Sales on that model TV averaged around 65 units a week last year, but they are increasing and our current sales forecast is for 4,000 units for the year; that's about 75 per week, give or take about 20 units (that's what they tell me this 'standard deviation' means). If we order when stock level reaches our average weekly sales, we will be out of stock a lot, foregoing important sales. By reordering when stock hits the level where we have at least 3 weeks' supply left, we avoid stoskouts This gives us two extra weeks to continue operating )in case the supplier is slow or there are delays in transit, etc. After he finished visiting with the Department Heads, Parks went back Chard's office and pulled out the report on the request for space that Wilson had prepared. Wilson was out of town, so Parks could not talk to him about the report, but he was duly impressed with what he read and became convinced that Chard had not actually read through the report carefully. Wilson had done a very thorough job in preparing it. He had used their corporate data as well as industry data to determine average levels of space utilization. In the report, Wilson had noted SKU. In most cases, it takes We must have floor space for aisles and order Beyond 60 percent utilization of floor space, there is simply not enough space to work. Double handling of products leads to higher labor costs, less efficient use of energy, and excessive damage Wilson's analysis indicated that the expansion would bring the level of space utilization down to about 60 percent from close to 80 percent. Wilson had plotted Chards damage levels against the percentage of space utilized and found a curve similar to that shown in Exhibit 5. Sixty percent was the industry That extra two-week's buffer has saved our bacon many times. average, and he noted that the 60 percent level of utilization was "optimal." At utilization levels above 60 percent, he found that damage increased at an increasing rate. At levels below 60 percent, damage was constant. To reduce space utilization below 60 percent would merely lead to inefficiency due to excess capacity. A summary of Wilson's cost estimate and the benefits resulting from the warehouse expansion are shown in Exhibit 4. requests for funds were authorized if the return was greater than 15 percent, but not always. Parks also learned that the company's cost of carrying inventory was probably well above their cost of capital He talked to an industry analyst about the cost of carrying inventory and found that due to the rapidly changing technology and the continued introduction of new models each year by many manufacturers, stock became obsolete quite quickly at times. Additionally, the propensity for damage led to high insurance costs, and a host of other problems led Parks to conclude that the cost of carrying inventory was at least 20 percent and probably higher Exhibit 4: Space Utiliration and Damage The next morning, Parks ran in to Ted Hanley. Hanley asked how things were going and noted, "You look a litle frustrated. Look kid, he's getting close to retirement, He just doesn't want to take a chance on turming loose of that mach capital. He would rather keep a low profile. Now that you have talked to the other department heads, what do they think? Don't answer. You don't need to, because I know them. I work with them. We communicate and coordinate our decisions. We're all on the same page." Damage Floor Space Used Exhibit 5: Costs and Benefits of Warehouse Expansion Project $500,000 Cost of additional space Benefits Reduced Damage More Efficient Use of Labor 0,000 35,000 Total Beeefits $100,000 Later that day, Parks talked to the corporate accounting department by telephone and leamed that the company's cost of capital was approximately 6 percent. However, he also leaned that it usually took a return on investment considerably above the cost of capital to justify capital expenditures Most 1. Calculate the Economic Order Quantity (EOQ) 309-010 2DS IC a. 2. Calculate the safety stock (SS) required for each shipping option (LTL and TL). a. 3. Calculate the total cost for EOQ including product and transport (T) costs a. 0 Calculate the total cost for the minimum quantity (only if higher than EOQ) required to get a quantity discount on shipping or product. 4. a. LTL Rates-10-20 units, 20-40 units, 40-100 units, 100-200 units, and 200+ units b. TL Rates-500 units per truck c. Small quantities-0-1500 units d. First quantity discount-1500-2500 units (2.5% discount) e. Second quantity discount-2500+ units (5% discount) 5. Recommend an order quantity 6. Calculate the reduction or increase in average inventory made possible by your recommended order quantity a. Avg . Inv.=-+SS 7. Based on your calculations, would you recommend that the company invest additional capital into warehouse expansion. 8. Turn in a report that details your calculations, the logic behind your recommendation, and your recommendation and also includes a table detaiting the costs associated with different ordering quantities (total cost, ordering cost, cycle stock carrying cost, safety stock carrying cost, transportation cost, and product cost). Chard Appliance (B) Exhibit 2: Chard Appliance Sales by State: 2003 Chard Appliance, located in Wichita, Kansas was founded in 1938 as Beard's Laundry Equipment Supply, an authorized distributor of Maytag washing machines. The company grew steadily through the 1940s and S0s, adding new models and product lines as Maytag introduced them. The firm was purchased by the Chard family in 1963 when sales were approximately 3 million per year The Chards expanded the firm geographically concentrating on the wholesale side of the business. New brand names were added in along with the original Maytag line. By 1980, sales had risen to over $80 million. The company carried a full line of white goods such as washers dryers, refrigerators, freezers, dishwashers, gas and electric ranges, as well as microwave ovens several manufacturers in addition to their own private brand. Most brands had multiple models covering a wide range of features and prices. The private brand of white goods was manufactured by Whirlpool, but no reference to the manufacturer could be made since specifications for the Chard brand were considerably differ Arkansas Colorado lowa Kansas Missouri Nebraska Oklahoma 12,264,00 10,220,000 30,660,000 49,056,000 40,880,000 18,396,000 28,616,000 and discontinued retail sales, household appliances Total 200,310,000 Bill Parks was hired in 2004 as an administrative assistant to Gerald President and son of the original owner, E.F Chard. The Monday follo Chard, concerned that the impact of perceived lower quality might affect the image of ond rgport that I received last week from Fred He is suggesting a 500,000 dollar expansion Wilson, our Warchouse Manager. of one of our warehouses. Space is so limited that they are having trouble operating the forklifts. He said damage was getting o space was an absolute must. the Whirlpool lines. out of hand and that added By 1990, Chard had added a line of electronics that included TVs, Stereos, VCRs, and more recently, DVD players, and served retailers in 8 states including Arkansas, Colorado, lowa, Kansas, Missouri, Nebraska, Oklahoma, and Texas. By 2003, revenue had grown to over $200 million and was "I'm going to Chicago in the moming Thursday. Look over this warehouse expansion report while I am gone and if you think we ought to move on it. You might also see what the members of our staff think. I am a little reluctant at this point. These guys seem he continued, "but I will be b increased sales of However, the projected increase in sales was considered optimistic by some ofto think we are Chard's top executives and would represent the first significant increase in more than three years. Sales had stalled during the recent recession and profitability had significantly declined. Exhibit I shows sales for Chard Appliance from electronics, especially large screen High Definition TVs made out of money. I have five requests for other projects, but s what anyone else The following day, Parks met with Jim Morris, the company's purchasing manager to get his views on the need for the warehouse expansion. Parks indicated that Chard was reluctant to fund it and asked if he knew how the others felt about it 1994 through 2003. Exhibit 2 shows 2003 sales by state Exhibit 1:Chard Appliance Sales, 19942003 Revenus 108,168,000 118,985,000 113,263,000 146,590,000 164.180,000 180,598,000 198,638,000 192,698,000 190,771,000 "I work closely with nearly every manager in the company, said Morris. I meet regularly with Ted Hanley, Susan Johnson, and Fred Wilson, and we're all 997 clear on what needs to be done to keep this operation running smoothly ou can bet that we need that expansion. You know Wilson, the Warehouse Manager," said Morris. "Ted Hanley is our Traffic Manager and Susan Johnson is in charge of sales for the 8 state area. Why don't you go talk to these people and get a feel for whether or not they agree. I think you will find that Chard 2000 just doesn't want to cough up the growing; maybe not in revenue, but in for a necessary expansion We're e, and he is just too tight fisted to Parks talked to Ted Hanley and found that he agreed. His feeling was that necessary changes to increase efficiency had led to larger shipments, which was creating additional pressure on storage "Everyone is doing his part to keep costs down," said Hanley, "but you can't keep operating in the same facilities forever. We used to move a lt of our merchandise in here on LTL carriers, but for greater efficiency, so now we move nearly everything in and that requires additional space. *Rates are per CWT, subject to a 60% discount. "So you order in full truckloads then," asked Parks? These things weigh about 50 pounds each, so that's over $6.00 per unit in transportation costs. Hayes charges us $1.50 per mile to move them out of Hayes Truck Lines sometime back, and we're saving some major bucks. LetCalifornia to Wichita. It's about 1,500 miles from San Diego, so it costs us $2,250 per truckload. A lot of what we ship takes up a lot of cube. At only 50 pounds per unit, I can't ship a full 40,000 pounds per truck, but I can still load about 500 units per vehicle. Look at the difference. That's only about four and Yes," replied Hanley, "almost always. I switched most of our business to me pull up a file," continued Hanley, and I'll show you an example." After a couple of minutes at his computer, Hanley said, "Here we go. Lets look at 50 inch High Definition Plasma TVs. They have become an important item for us over the past few years, and this is one of our most popular models. Last a half bucks apiece. That's an $80,000 savings on this one product I don't know what Morris told you, but we've worked this out together. It is best for all of us if we all work together. We meet regularly and have worked out differences over the years. We're a good team, and this is a good example I get the lowest transportation costs, he gets the product cheaper and he doesn't waste a lot of time fooling around with placing orders. If his staff is constanty placing a lot of small orders, he incurs more expenses. He prepared a report on this once and showed that it costs him about 75 dollars per order. We carry a lot of SKUs, and by ordering each SKU two or three times a years instead of 12 year we sold an average of about 65 a week, and we are year of about 75 per week, probably as many as 4,000 total. They sell for about $1,500 each, which amounts to nearly 6 million dollars in sales for this one SKU, and there is a lot of profit in them. Our base cost is about $1,200 per unit, but we get them cheaper than that because Jim Morris gets a great quantity discount. You've met him, right? Our Purchasing Manager?" "Yes," said Parks, "but he didn't get into his purchasing policies. What kind of discount does he get?" "Our supplier in San Diego gives us a 2.5 percent discount on purchases of at least 1,500 or more, and a full 5 percent of for 2,500 or more. It is about time to order these now and when we do, we'll bring in five truckloads. That lets him qualify for the 5 percent discount. Think about that If we sell 4,000 of these this year, he will save nearly a quarter of a million dollars on that one SKU, and I will get the cheapest transportation possible. Now think about hovw This helps Fred Wilson and Susan Johnson, too. We all meet regularly and are in agreement as to what needs to be done to run our operations efficiently. Fred runs the warchouse, and he keeps really busy receiving and filling outbound orders. If he is constantly receiving a lot of small shipments, his people tend to make more mistakes in putting goods away, and they can't concentrate on filling outbound orders as well. By receiving large shipments of individual SKUs, he can devote large crews to the task, and everyone knows what goes Now," said Hanley, "take a look at this LTL tariff (see Exhibit 3) and I'll show you how much I save in transportation costs. We get these TVs out of San Diego, and Mainline is the LTL carrier we normally use when we have an LTL pment. They give us a 60% discount, but they don't like to handle shipments of more than 10,000 pounds, and LTL rates on shipments of less than 5,000 Jbs are very expensive, even with the discount. Their published rate is "Susan Johnson is in charge of sales, and she doesn't have to worry about being out of stock near as much as if we were constantly receiving a lot of small Parks noticed some of the historical data on the computer screen that compared Hayes and Mainline, and said, "According to this, it looks like Hayes is pretty erratic with respect to delivery times. It looks like Hayes often takes up to 8 or 9 days to deliver compared to only 3 or 4 by Mainline. Why does it take them so long sometimes," he asked, "and do you ever run out of stock when they take 531,83 per hundred for shipments of 5,000 60 percent discount we would pay nearly $13.00 per hundred." Exhibit 3: Motor Carrier Rates on Televisions Well," said Hanley, "Hayes is a small truckload carrier. They don't have a lot of equipment, and sometimes it takes them a few days to dispatch an empty AQ truck to us. I could call another carrier, but Hayes gives us a better rate than anyone else I've ever called. Besides, they are not actually that much different.You have to understand that service is extremely important," continued Mainline averages about 3 and half days, and Hayes' is only 5. Even when they take a little longer, it doesn't really matter that much. I talk regularly with Susan Johnson in sales, and our service level is just fine. Johnson is very competitors, When they are out of stock, they will often try to substitute a sensitive to service. Rest assured, if this were a problem, I would have heard Johnson. "We have to compete on price and service. Most of our customers are retail stores, and they have to charge about the same price as their Parks had lunch with Susan Johnson that day and discussed the situation. He found that she was in complete agreement with virtually everything Morris and Hanley had said. She felt, as did the others, that the company was merely experiencing growing pains, and that Chard was just afraid to turn loose of 500,000 dollars necessary to bring their facilities in line with the demands that were being placed on them. Johnson liked Morris' ordering policies. Her sales organization had been able to maintain high service levels with respect to filling customer orders. She said, "Ordering in small quantities like we used to do can leave you open to the problem of losing sales due to lack of product. competing brand, and it is not always one we sell. Furthermore, the consumer will not always accept a substitute or wait. Sometimes they just go to another store. Either way, if it isn't in stock when the consumer wants it, we lose the sale, so keeping our stores in-stock is very important. It's important to us, to our customers, and to our suppliers. A few years ago, this problem was so serious that we nearly lost some major suppliers. They feel the pinch too. Morris, Wilson, and I decided that a two-week buffer above the average sales should be adequate, and it has been working great. Our service levels are rarely Wilson monitors the inventory levels and notifies Morris when orders need to be placed," Johnson said. "It seems our current policies are good for him too It is much easier to utilize his labor force when receiving large volumes of a After lunch, they returned to Johnson's office where she explained howsingle SKU. Additionally, there are fewer trucks trying to get access to his effectively she felt that the departments communicated and worked together "In fact," she said, "working together is how we solved our service problems. In the past, we had been plagued with service problems, and steskouts were at the top of the list. So Hanley, Wilson, Morris, and I got together to do something about it. We realized that we could avoid virtually all potential lost sales which might occur due to stoskouts simply by reordering a few days docks at the same time. It is just much easier to plan and control your operations if you are not dealing with lots of small shipments Johnson gave Parks a printout of the information on sales, which showed average sales over the past six months of 75 units per week, and even with a standard deviation of 20 units, it was clear that the trend was increasing somewhat. He also noted that transit time by Mainline and Hayes were both ner than we had been, especially if they started placing larger orders instead of so many smaller ones. about what Hanley had told him they were, but that the standard deviation of time was only about 0.5 for Mainline c 3 for Hayes. "We had our staffs work up computerized reorder points on virtually every over a week to get an order in here from a supplier, and sometimes it's longer, so we typically place orders when we have about three weeks worth of stock left." As she was talking, she pulled upa screen on her computer with data for High Definition Televisions. "Take a look at this screen," she said. These are the TVs you were asking about, the transit time from San Diego averages about 5 days, but sometimes it is 7 or 8, and then there is the supplier's processing time which is usually about 3 days, plus or minus a day. For those TVs, the average time from placing the order until it is delivered is 8 days, but it varies quite a bit. Here's the sales data. Sales on that model TV averaged around 65 units a week last year, but they are increasing and our current sales forecast is for 4,000 units for the year; that's about 75 per week, give or take about 20 units (that's what they tell me this 'standard deviation' means). If we order when stock level reaches our average weekly sales, we will be out of stock a lot, foregoing important sales. By reordering when stock hits the level where we have at least 3 weeks' supply left, we avoid stoskouts This gives us two extra weeks to continue operating )in case the supplier is slow or there are delays in transit, etc. After he finished visiting with the Department Heads, Parks went back Chard's office and pulled out the report on the request for space that Wilson had prepared. Wilson was out of town, so Parks could not talk to him about the report, but he was duly impressed with what he read and became convinced that Chard had not actually read through the report carefully. Wilson had done a very thorough job in preparing it. He had used their corporate data as well as industry data to determine average levels of space utilization. In the report, Wilson had noted SKU. In most cases, it takes We must have floor space for aisles and order Beyond 60 percent utilization of floor space, there is simply not enough space to work. Double handling of products leads to higher labor costs, less efficient use of energy, and excessive damage Wilson's analysis indicated that the expansion would bring the level of space utilization down to about 60 percent from close to 80 percent. Wilson had plotted Chards damage levels against the percentage of space utilized and found a curve similar to that shown in Exhibit 5. Sixty percent was the industry That extra two-week's buffer has saved our bacon many times. average, and he noted that the 60 percent level of utilization was "optimal." At utilization levels above 60 percent, he found that damage increased at an increasing rate. At levels below 60 percent, damage was constant. To reduce space utilization below 60 percent would merely lead to inefficiency due to excess capacity. A summary of Wilson's cost estimate and the benefits resulting from the warehouse expansion are shown in Exhibit 4. requests for funds were authorized if the return was greater than 15 percent, but not always. Parks also learned that the company's cost of carrying inventory was probably well above their cost of capital He talked to an industry analyst about the cost of carrying inventory and found that due to the rapidly changing technology and the continued introduction of new models each year by many manufacturers, stock became obsolete quite quickly at times. Additionally, the propensity for damage led to high insurance costs, and a host of other problems led Parks to conclude that the cost of carrying inventory was at least 20 percent and probably higher Exhibit 4: Space Utiliration and Damage The next morning, Parks ran in to Ted Hanley. Hanley asked how things were going and noted, "You look a litle frustrated. Look kid, he's getting close to retirement, He just doesn't want to take a chance on turming loose of that mach capital. He would rather keep a low profile. Now that you have talked to the other department heads, what do they think? Don't answer. You don't need to, because I know them. I work with them. We communicate and coordinate our decisions. We're all on the same page." Damage Floor Space Used Exhibit 5: Costs and Benefits of Warehouse Expansion Project $500,000 Cost of additional space Benefits Reduced Damage More Efficient Use of Labor 0,000 35,000 Total Beeefits $100,000 Later that day, Parks talked to the corporate accounting department by telephone and leamed that the company's cost of capital was approximately 6 percent. However, he also leaned that it usually took a return on investment considerably above the cost of capital to justify capital expenditures Most 1. Calculate the Economic Order Quantity (EOQ) 309-010 2DS IC a. 2. Calculate the safety stock (SS) required for each shipping option (LTL and TL). a. 3. Calculate the total cost for EOQ including product and transport (T) costs a. 0 Calculate the total cost for the minimum quantity (only if higher than EOQ) required to get a quantity discount on shipping or product. 4. a. LTL Rates-10-20 units, 20-40 units, 40-100 units, 100-200 units, and 200+ units b. TL Rates-500 units per truck c. Small quantities-0-1500 units d. First quantity discount-1500-2500 units (2.5% discount) e. Second quantity discount-2500+ units (5% discount) 5. Recommend an order quantity 6. Calculate the reduction or increase in average inventory made possible by your recommended order quantity a. Avg . Inv.=-+SS 7. Based on your calculations, would you recommend that the company invest additional capital into warehouse expansion. 8. Turn in a report that details your calculations, the logic behind your recommendation, and your recommendation and also includes a table detaiting the costs associated with different ordering quantities (total cost, ordering cost, cycle stock carrying cost, safety stock carrying cost, transportation cost, and product cost)