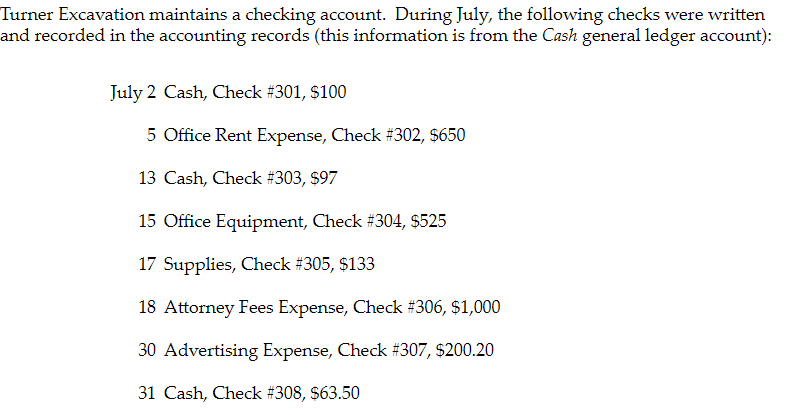

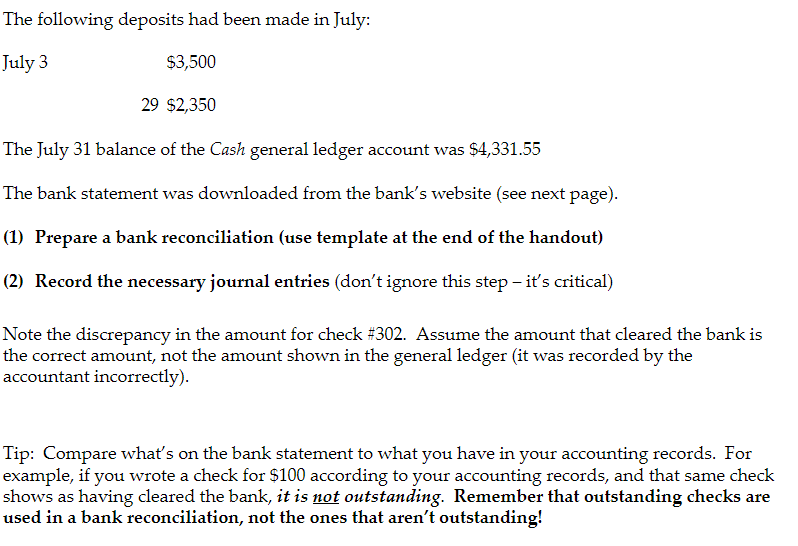

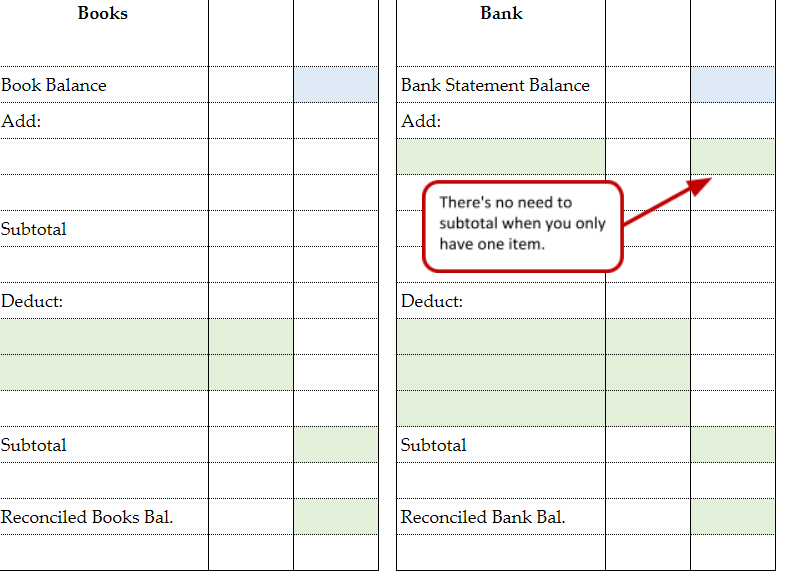

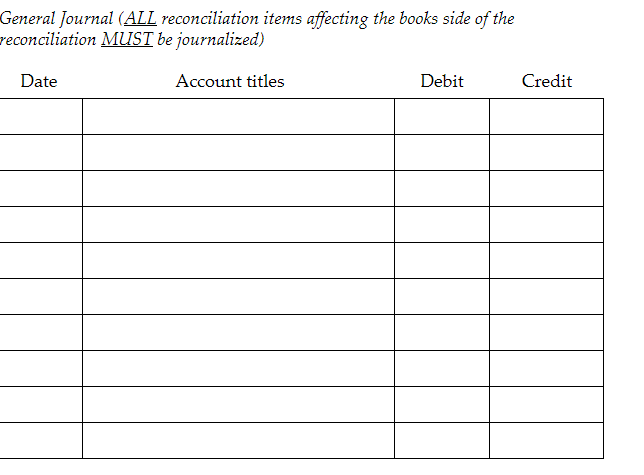

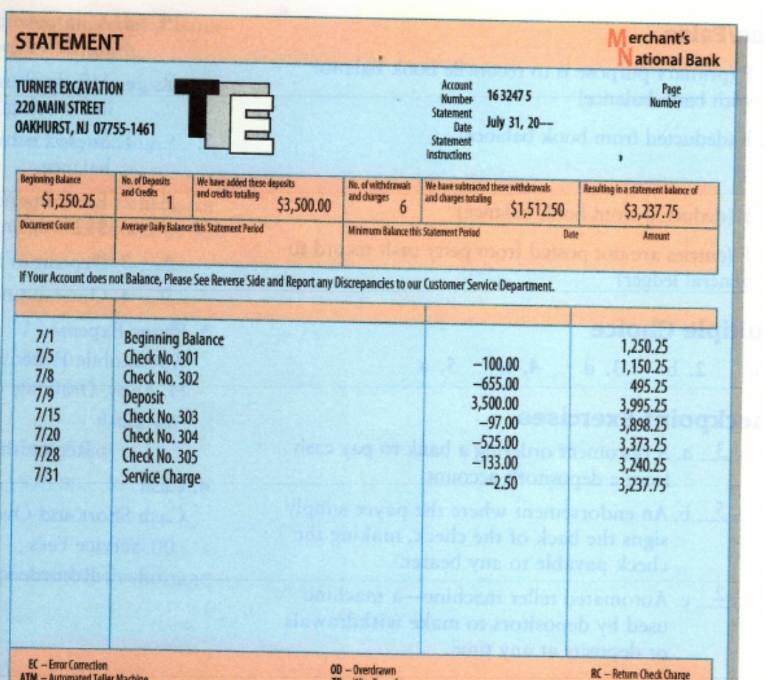

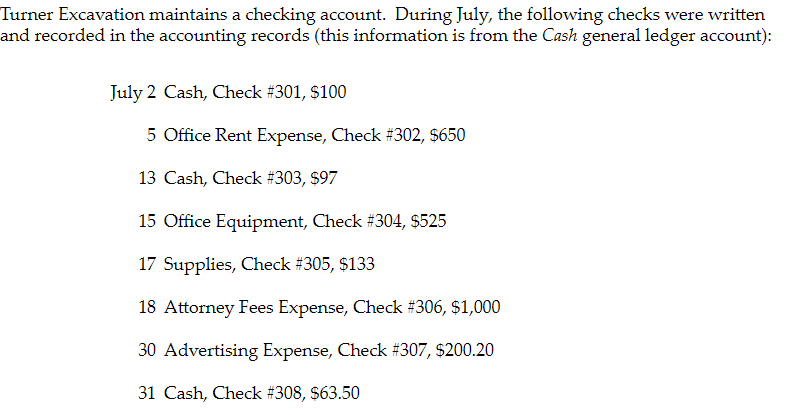

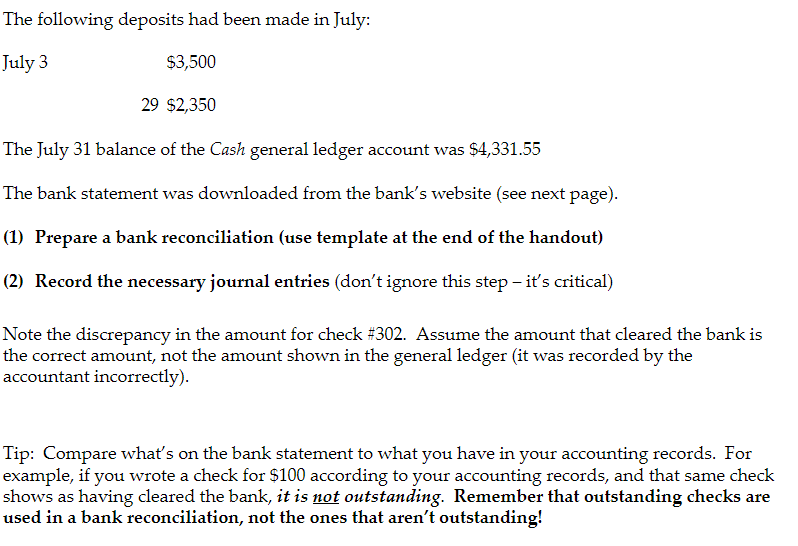

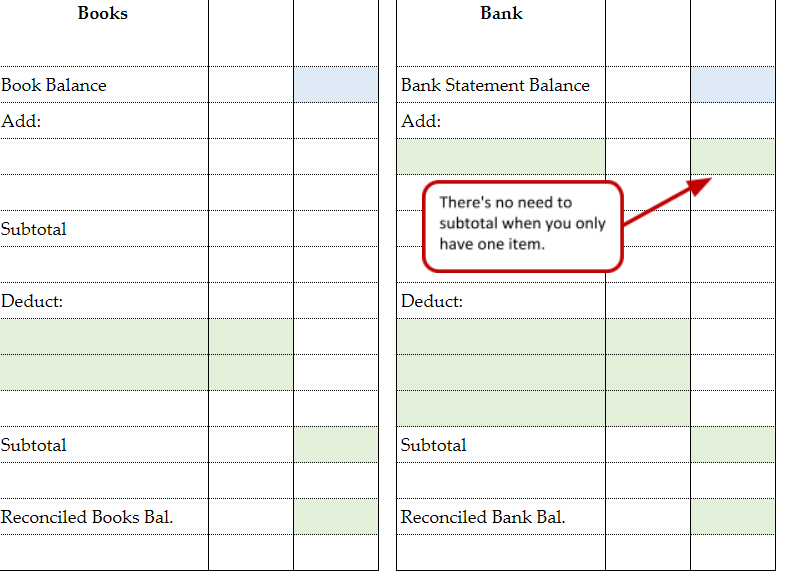

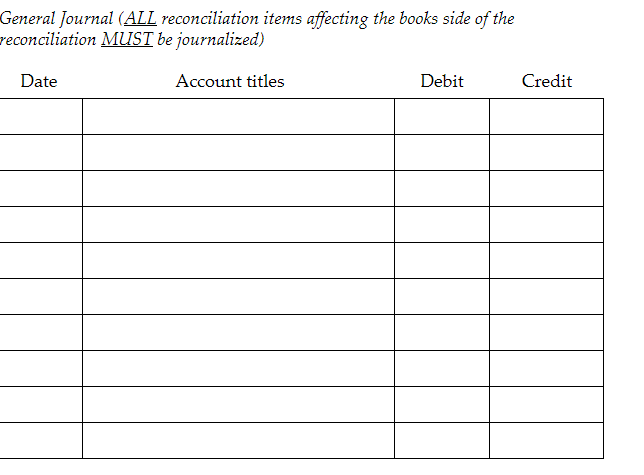

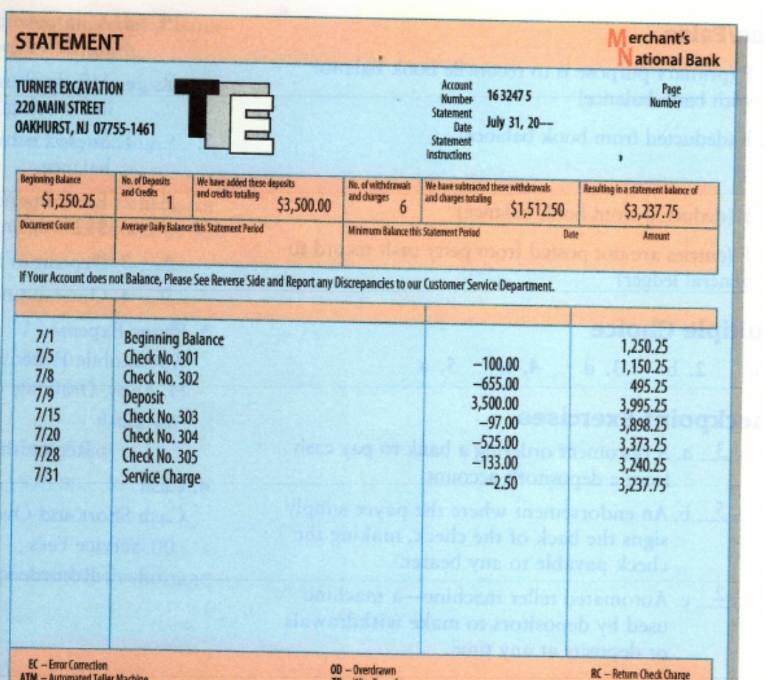

Turner Excavation maintains a checking account. During July, the following checks were written and recorded in the accounting records (this information is from the Cash general ledger account): July 2 Cash, Check #301, $100 5 Office Rent Expense, Check #302, $650 13 Cash, Check #303, 997 15 Office Equipment, Check #304, $525 17 Supplies, Check #305, $133 18 Attorney Fees Expense, Check #306, $1,000 30 Advertising Expense, Check #307, $200.20 31 Cash, Check #308, $63.50 The following deposits had been made in July: July 3 $3,500 29 $2,350 The July 31 balance of the Cash general ledger account was $4,331.55 The bank statement was downloaded from the bank's website (see next page). (1) Prepare a bank reconciliation (use template at the end of the handout) (2) Record the necessary journal entries (don't ignore this step - it's critical) Note the discrepancy in the amount for check #302. Assume the amount that cleared the bank is the correct amount, not the amount shown in the general ledger (it was recorded by the accountant incorrectly). Tip: Compare what's on the bank statement to what you have in your accounting records. For example, if you wrote a check for $100 according to your accounting records, and that same check shows as having cleared the bank, it is not outstanding. Remember that outstanding checks are used in a bank reconciliation, not the ones that aren't outstanding! Books Bank Book Balance Bank Statement Balance Add: Add: Subtotal There's no need to subtotal when you only have one item. Deduct: Deduct: Subtotal Subtotal Reconciled Books Bal. Reconciled Bank Bal. General Journal (ALL reconciliation items affecting the books side of the reconciliation MUST be journalized) Date Account titles Debit Credit STATEMENT Merchant's National Bank Page TURNER EXCAVATION 220 MAIN STREET OAKHURST, NJ 07755-1461 Number TE Account Number 1632475 Statement Date July 31, 20- Statement Instructions Beyining Balance $1,250.25 Document Count No. of Deposits We are added these deposits and Geos and credits totaling $3,500.00 Average Baby Balance this statement Period 1 No. of withdrawals We have subtracted these withdrawals and durges and changes totaling $1,512.50 Minimum Balance this Statement Period Resulting ina statement balance of $3,237.75 Amount If Your Account does not Balance, Please See Reverse Side and Report any Discrepancies to our Customer Service Department. 7/1 7/5 7/8 7/9 7/15 7/20 7/28 7/31 Beginning Balance Check No. 301 Check No. 302 Deposit Check No. 303 Check No. 304 Check No. 305 Service Charge -100.00 -655.00 3,500.00 -97.00 -525.00 -133.00 -2.50 1,250.25 1,150.25 495.25 3,995.25 3,898.25 3,373.25 3,240.25 3,237.75 EC-Error Correction ATN - Automated Taller Machine OD - Overdrawn RC -Return Check Charge