Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Turnover Specialists, Ltd. (TSL), Specializes in taking underperforming companies to a higher level of performance. TSL's capital structure at December 31, 2015, including 10,000 shares

Turnover Specialists, Ltd. (TSL), Specializes in taking underperforming companies to a higher level of performance. TSL's capital structure at December 31, 2015, including 10,000 shares of $2.25 preferred stock and 120,000 shares of common stock. During 2016 TSL issued common stock and ended the year with 126,000 shares of common stock outstanding. average common shares outstanding during 2016 were 122,000. Income from continuing operations during 2016 was $219,000. The company does continue to segment of the business at a loss of $65,000. All amounts for after income tax. Assume the number of preferred shares outstanding did not change in 2016.

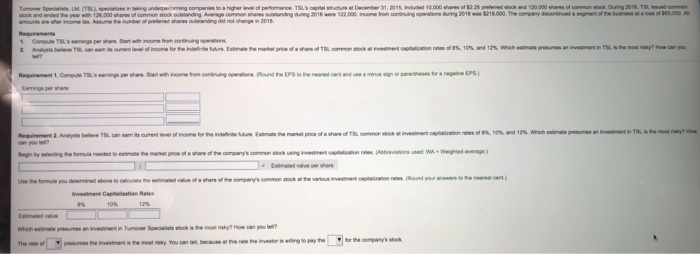

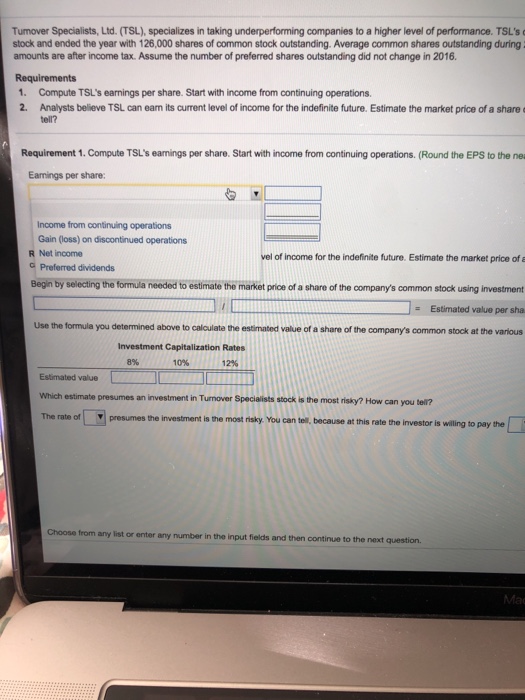

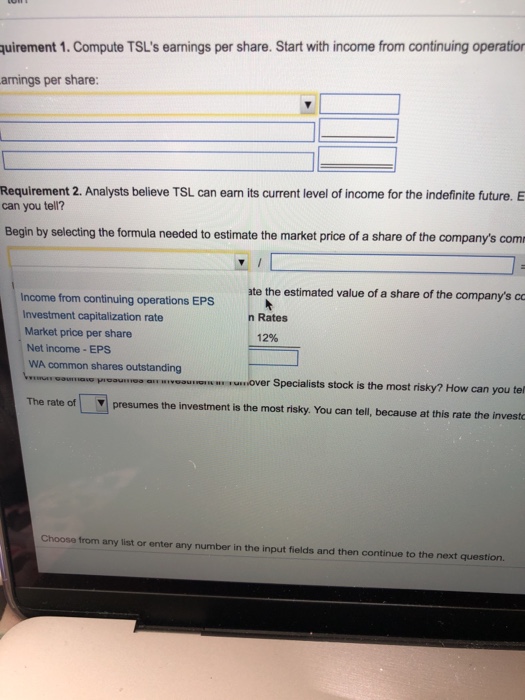

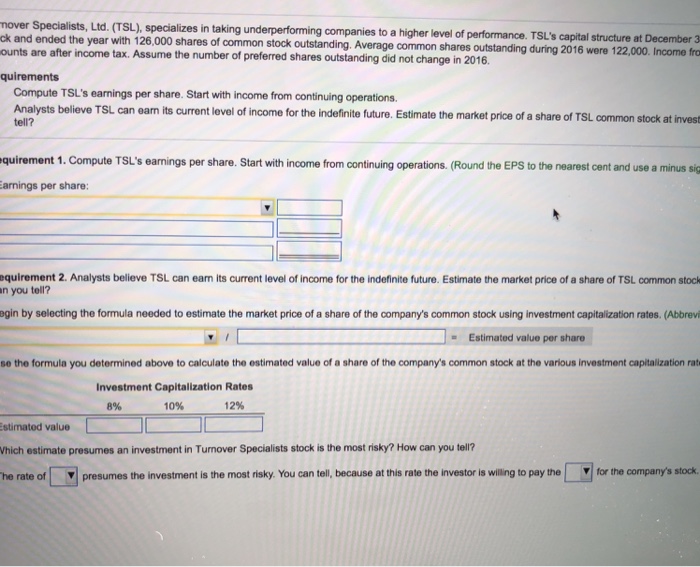

Requirement 1. compute TSL's earnings per share. Start with income from continuing operations.

Requirement 2. Analysts believe TSL can earn its current level of income for the indefinite future. Estimate the market price of a share of TSL common stock at investment investment capitalization rate of 8%, 10%, and 12%. Which estimate presumes an investment in TSL is the most risky? how can you tell?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started