Answered step by step

Verified Expert Solution

Question

1 Approved Answer

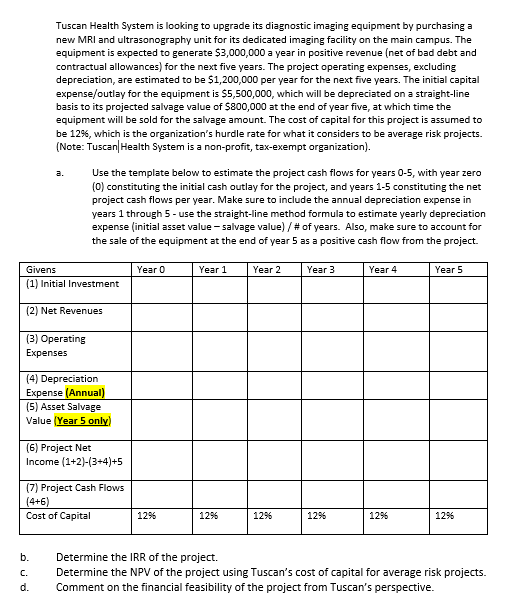

Tuscan Health System is looking to upgrade its diagnostic imaging equipment by purchasing a new MRI and ultrasonography unit for its dedicated imaging facility on

Tuscan Health System is looking to upgrade its diagnostic imaging equipment by purchasing a

new MRI and ultrasonography unit for its dedicated imaging facility on the main campus. The

equipment is expected to generate $ a year in positive revenue net of bad debt and

contractual allowances for the next five years. The project operating expenses, excluding

depreciation, are estimated to be $ per year for the next five years. The initial capital

expenseoutlay for the equipment is $ which will be depreciated on a straightline

basis to its projected salvage value of $ at the end year five, at which time the

equipment will be sold for the salvage amount. The cost of capital for this project is assumed to

be which is the organization's hurdle rate for what it considers to be average risk projects.

Note: TuscanHealth System is a nonprofit, taxexempt organization

a Use the template below to estimate the project cash flows for years with year zero

constituting the initial cash outlay for the project, and years constituting the net

project cash flows per year. Make sure to include the annual depreciation expense in

years through use the straightline method formula to estimate yearly depreciation

expense initial asset value salvage value # of years. Also, make sure to account for

the sale of the equipment at the end of year as a positive cash flow from the project.

b Determine the IRR of the project.

c Determine the NPV of the project using Tuscan's cost of capital for average risk projects.

d Comment on the financial feasibility of the project from Tuscan's perspective.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started