Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tuto cut.c.za/webapps/assessment/take/kesicoutse assessment ide_15370 1course_id=66001&content id=4630 1 question_num lor * Questions 5 points EvoGreen (Pty) Ltd invested R3 500 000 in a production plant to

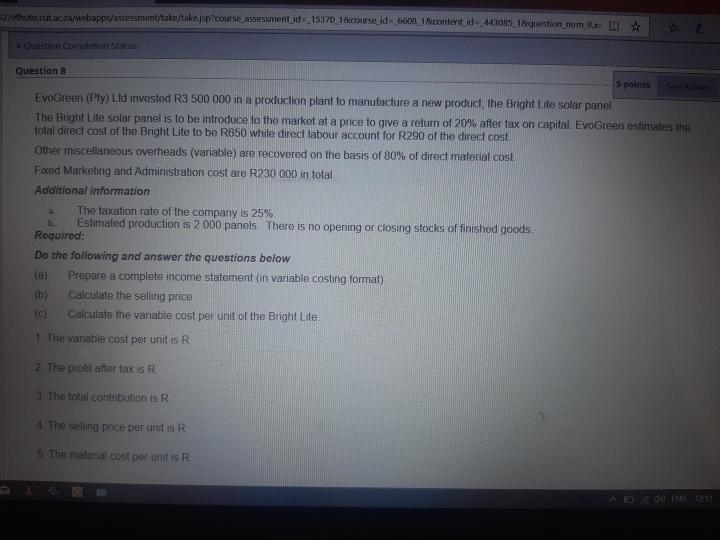

tuto cut.c.za/webapps/assessment/take/kesicoutse assessment ide_15370 1course_id=66001&content id=4630 1 question_num lor * Questions 5 points EvoGreen (Pty) Ltd invested R3 500 000 in a production plant to manufacture a new produd, the Bright Life solar panel The Bright Lite solar panel is to be introduce to the market at a price to give a return of 20% after tax on capital. EvoGreen estimates the total direct cost of the Bright Lite to be R650 while direct labour account for R290 of the direct cost Other miscellaneous overheads (variable) are recovered on the basis of 80% of direct material cost Food Marketing and Administration cost are R230 000 in total Additional information The taxation rate of the company is 25% Estimated production is 2000 panels. There is no opening or closing stocks of finished goods Required: Do the following and answer the questions below (8) Prepare a complete income statement in variable costing format) (6 Calculate the selling price Calculate the vanable cost per unit of the Bright Lite ha 1 The variable cost per unit is R 2. The proht after tax is R 3. The total contribution is R 4 The selling price per unit is R 5 The material Cost per unit is R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started