Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tutorial 3 - Adjusting Entries, Closing Entries, Statement of Changes in Equity On January 1st,2023 Stanford Pines incorporated Mystery Shack Inc. A merchandiser selling odd

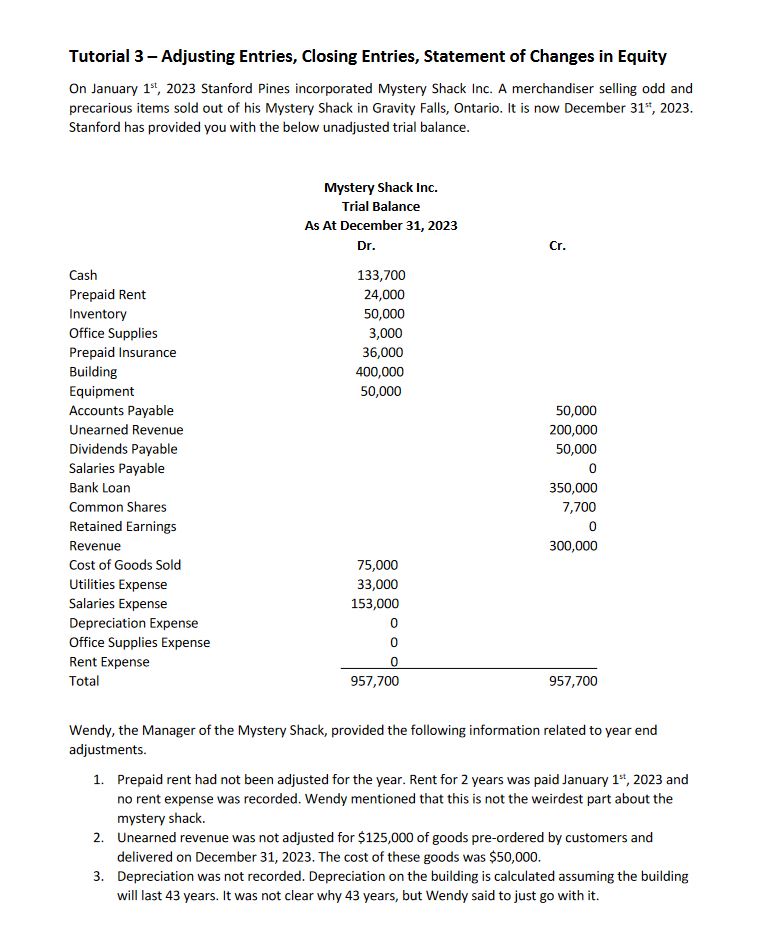

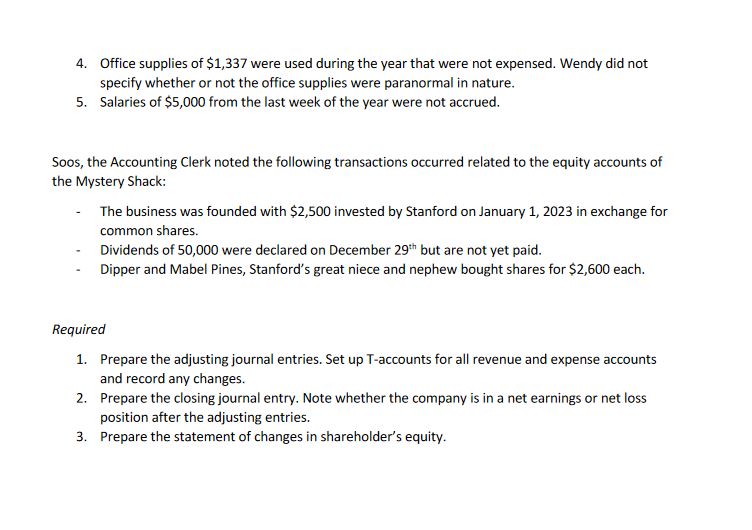

Tutorial 3 - Adjusting Entries, Closing Entries, Statement of Changes in Equity On January 1st,2023 Stanford Pines incorporated Mystery Shack Inc. A merchandiser selling odd and precarious items sold out of his Mystery Shack in Gravity Falls, Ontario. It is now December 31 2023. Stanford has provided you with the below unadjusted trial balance. Wendy, the Manager of the Mystery Shack, provided the following information related to year end adjustments. 1. Prepaid rent had not been adjusted for the year. Rent for 2 years was paid January 1st,2023 and no rent expense was recorded. Wendy mentioned that this is not the weirdest part about the mystery shack. 2. Unearned revenue was not adjusted for $125,000 of goods pre-ordered by customers and delivered on December 31,2023 . The cost of these goods was $50,000. 3. Depreciation was not recorded. Depreciation on the building is calculated assuming the building will last 43 years. It was not clear why 43 years, but Wendy said to just go with it. 4. Office supplies of $1,337 were used during the year that were not expensed. Wendy did not specify whether or not the office supplies were paranormal in nature. 5. Salaries of $5,000 from the last week of the year were not accrued. Soos, the Accounting Clerk noted the following transactions occurred related to the equity accounts of the Mystery Shack: - The business was founded with $2,500 invested by Stanford on January 1, 2023 in exchange for common shares. - Dividends of 50,000 were declared on December 29th but are not yet paid. - Dipper and Mabel Pines, Stanford's great niece and nephew bought shares for $2,600 each. Required 1. Prepare the adjusting journal entries. Set up T-accounts for all revenue and expense accounts and record any changes. 2. Prepare the closing journal entry. Note whether the company is in a net earnings or net loss position after the adjusting entries. 3. Prepare the statement of changes in shareholder's equity

Tutorial 3 - Adjusting Entries, Closing Entries, Statement of Changes in Equity On January 1st,2023 Stanford Pines incorporated Mystery Shack Inc. A merchandiser selling odd and precarious items sold out of his Mystery Shack in Gravity Falls, Ontario. It is now December 31 2023. Stanford has provided you with the below unadjusted trial balance. Wendy, the Manager of the Mystery Shack, provided the following information related to year end adjustments. 1. Prepaid rent had not been adjusted for the year. Rent for 2 years was paid January 1st,2023 and no rent expense was recorded. Wendy mentioned that this is not the weirdest part about the mystery shack. 2. Unearned revenue was not adjusted for $125,000 of goods pre-ordered by customers and delivered on December 31,2023 . The cost of these goods was $50,000. 3. Depreciation was not recorded. Depreciation on the building is calculated assuming the building will last 43 years. It was not clear why 43 years, but Wendy said to just go with it. 4. Office supplies of $1,337 were used during the year that were not expensed. Wendy did not specify whether or not the office supplies were paranormal in nature. 5. Salaries of $5,000 from the last week of the year were not accrued. Soos, the Accounting Clerk noted the following transactions occurred related to the equity accounts of the Mystery Shack: - The business was founded with $2,500 invested by Stanford on January 1, 2023 in exchange for common shares. - Dividends of 50,000 were declared on December 29th but are not yet paid. - Dipper and Mabel Pines, Stanford's great niece and nephew bought shares for $2,600 each. Required 1. Prepare the adjusting journal entries. Set up T-accounts for all revenue and expense accounts and record any changes. 2. Prepare the closing journal entry. Note whether the company is in a net earnings or net loss position after the adjusting entries. 3. Prepare the statement of changes in shareholder's equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started