Answered step by step

Verified Expert Solution

Question

1 Approved Answer

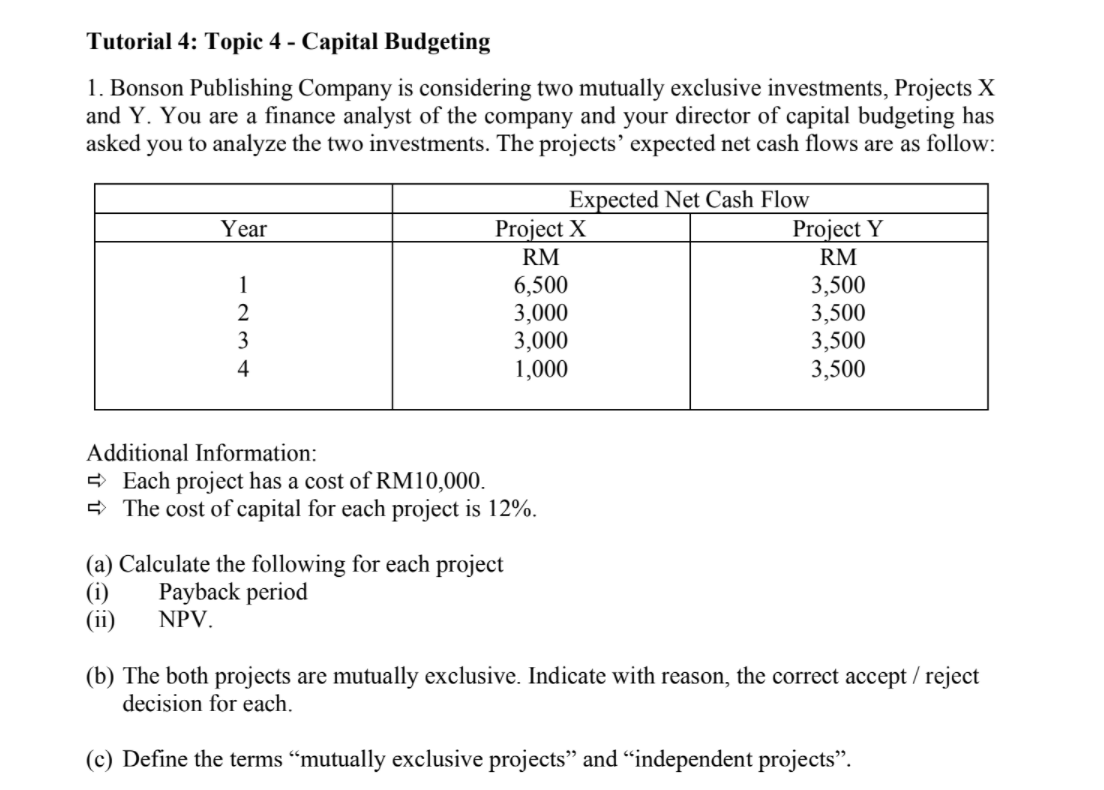

Tutorial 4: Topic 4 - Capital Budgeting 1. Bonson Publishing Company is considering two mutually exclusive investments, Projects X and Y. You are a

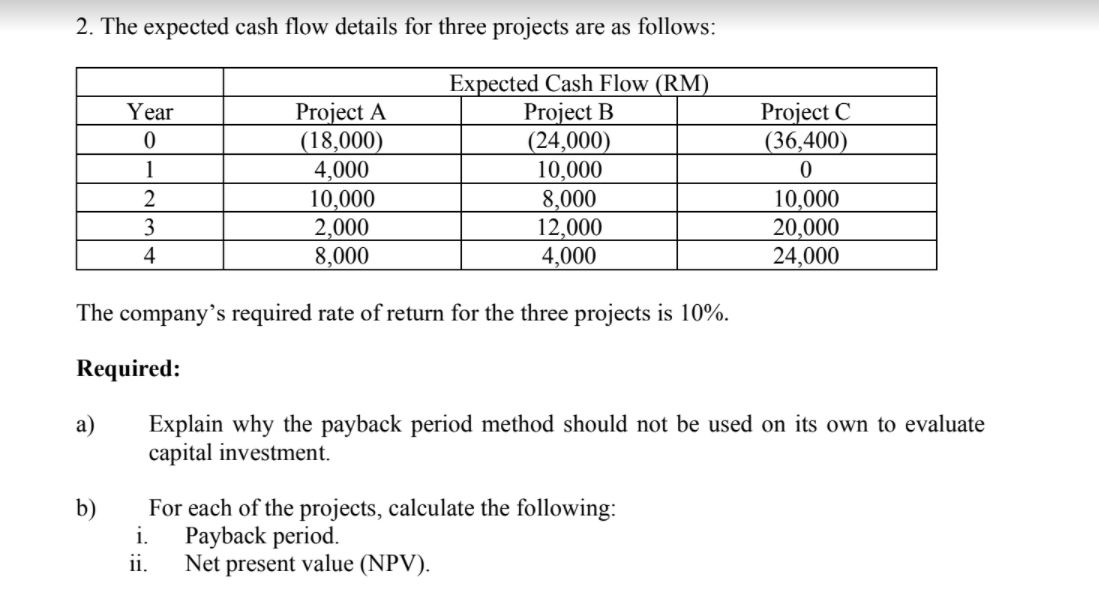

Tutorial 4: Topic 4 - Capital Budgeting 1. Bonson Publishing Company is considering two mutually exclusive investments, Projects X and Y. You are a finance analyst of the company and your director of capital budgeting has asked you to analyze the two investments. The projects' expected net cash flows are as follow: Expected Net Cash Flow Year Project X Project Y RM RM 1 6,500 3,500 1234 2 3,000 3,500 3,000 3,500 4 1,000 3,500 Additional Information: Each project has a cost of RM10,000. The cost of capital for each project is 12%. (a) Calculate the following for each project (ii) Payback period NPV. (b) The both projects are mutually exclusive. Indicate with reason, the correct accept / reject decision for each. (c) Define the terms mutually exclusive projects and independent projects". 2. The expected cash flow details for three projects are as follows: Expected Cash Flow (RM) Year Project A Project B 0 (18,000) (24,000) 1 4,000 10,000 2 10,000 8,000 3 2,000 12,000 4 8,000 4,000 Project C (36,400) 0 10,000 20,000 24,000 The company's required rate of return for the three projects is 10%. Required: a) Explain why the payback period method should not be used on its own to evaluate capital investment. For each of the projects, calculate the following: b) i. Payback period. ii. Net present value (NPV). c) Based on the result above, which project(s) (under mutually exclusive) would you recommend?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started