Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tutorial 6 - NPV II Question 1 Salazar plc has developed a new product for which a rowing demand is anticipated. During the first year,

Tutorial NPV II

Question

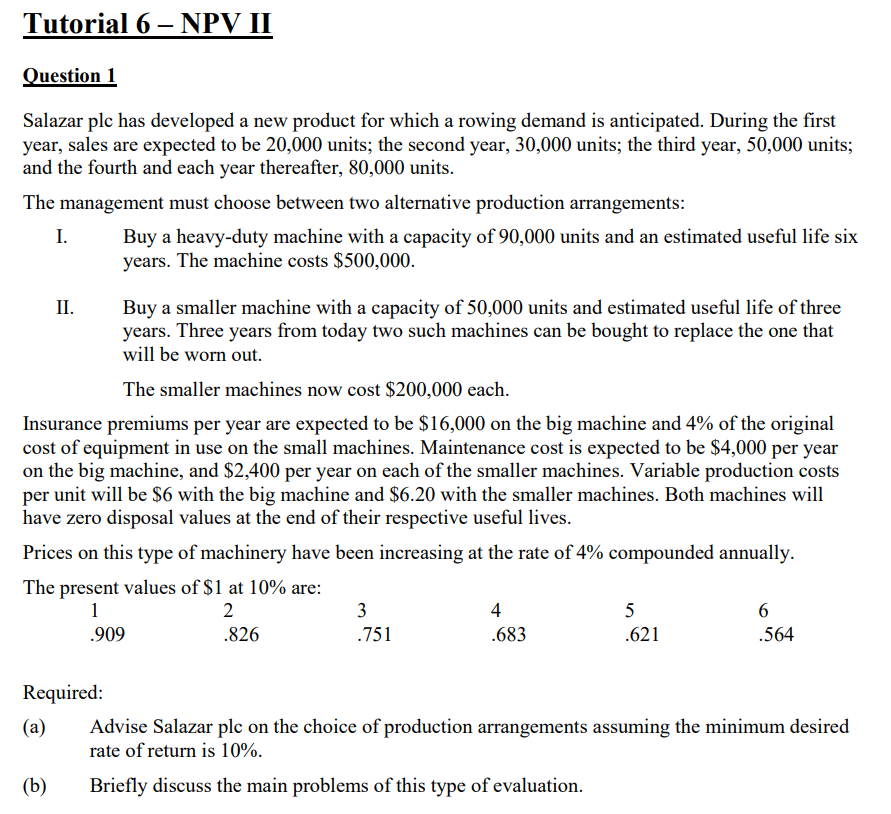

Salazar plc has developed a new product for which a rowing demand is anticipated. During the first

year, sales are expected to be units; the second year, units; the third year, units;

and the fourth and each year thereafter, units.

The management must choose between two alternative production arrangements:

I. Buy a heavyduty machine with a capacity of units and an estimated useful life six

years. The machine costs $

II Buy a smaller machine with a capacity of units and estimated useful life of three

years. Three years from today two such machines can be bought to replace the one that

will be worn out.

The smaller machines now cost $ each.

Insurance premiums per year are expected to be $ on the big machine and of the original

cost of equipment in use on the small machines. Maintenance cost is expected to be $ per year

on the big machine, and $ per year on each of the smaller machines. Variable production costs

per unit will be $ with the big machine and $ with the smaller machines. Both machines will

have zero disposal values at the end of their respective useful lives.

Prices on this type of machinery have been increasing at the rate of compounded annually.

The present values of $ at are:

Required:

a Advise Salazar plc on the choice of production arrangements assuming the minimum desired

rate of return is

b Briefly discuss the main problems of this type of evaluation.

References:

Drury, C Management and cost accounting, th edn, Cengage Learning

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started