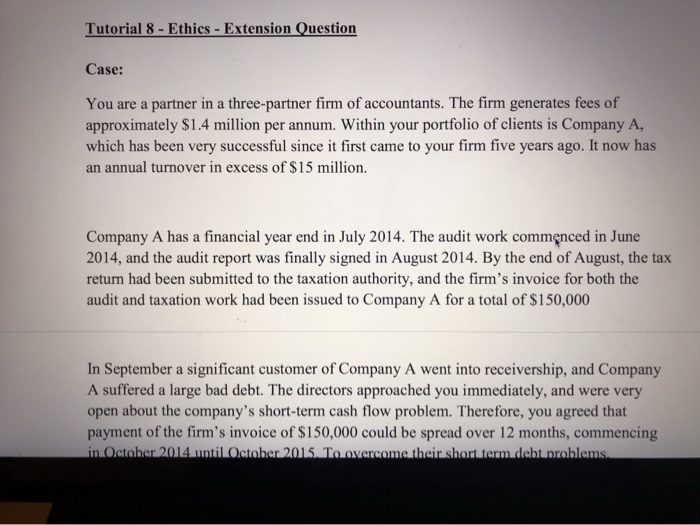

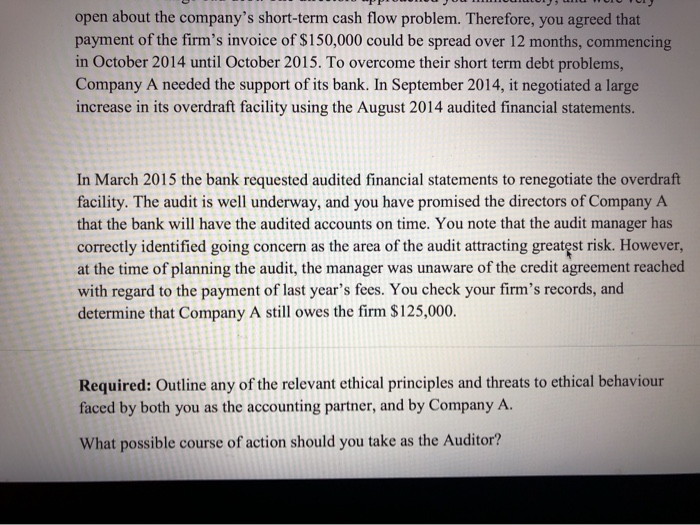

Tutorial 8- Ethics- Extension Question Case: You are a partner in a three-partner firm of accountants. The firm generates fees of approximately $1.4 million per annum. Within your portfolio of clients is Company A, an annual turnover in excess of $15 million. Company A has a financial year end in July 2014. The audit work commenced in June 2014, and the audit report was finally signed in August 2014. By the end of August, the tax return had been submitted to the taxation authority, and the firm's invoice for both the audit and taxation work had been issued to Company A for a total of $150,000 In September a significant customer of Company A went into receivership, and Company A suffered a large bad debt. The directors approached you immediately, and were very open about the company's short-term cash flow problem. Therefore, you agreed that payment of the firm's invoice of $150,000 could be spread over 12 months, commencing tober 2015 open about the company's short-term cash flow problem. Therefore, you agreed that payment of the firm's invoice of $150,000 could be spread over 12 months, commencing in October 2014 until October 2015. To overcome their short term debt problems, Company A needed the support of its bank. In September 2014, it negotiated a large increase in its overdraft facility using the August 2014 audited financial statements. In March 2015 the bank requested audited financial statements to renegotiate the overdraft facility. The audit is well underway, and you have promised the directors of Company A that the bank will have the audited accounts on time. You note that the audit manager has correctly identified going concern as the area of the audit attracting greatst risk. However, at the time of planning the audit, the manager was unaware of the credit agreement reached with regard to the payment of last year's fees. You check your firm's records, and determine that Company A still owes the firm S125,000. Required: Outline any of the relevant ethical principles and threats to ethical behaviour faced by both you as the accounting partner, and by Company A. What possible course of action should you take as the Auditor