Answered step by step

Verified Expert Solution

Question

1 Approved Answer

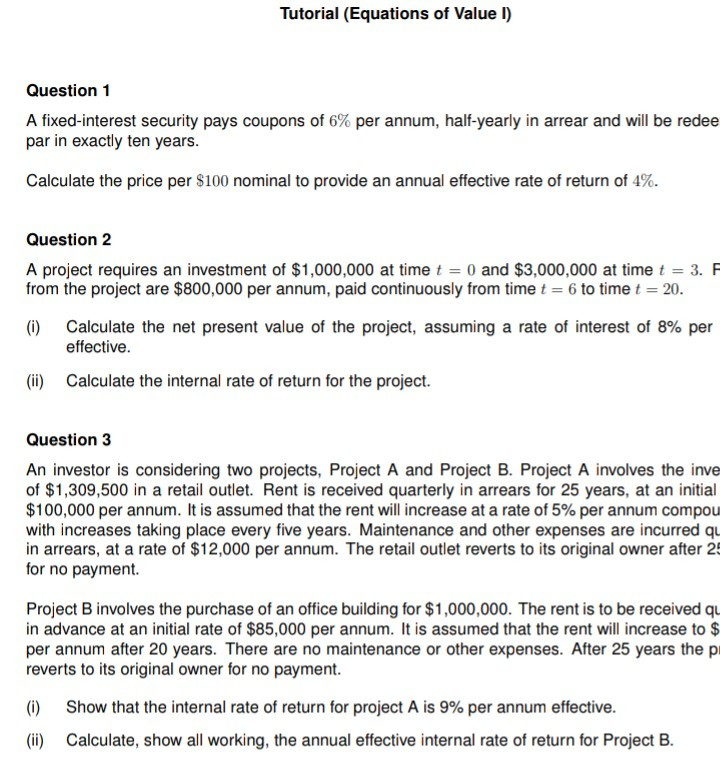

Tutorial (Equations of Value 1) Question 1 A fixed-interest security pays coupons of 6% per annum, half-yearly in arrear and will be redee par in

Tutorial (Equations of Value 1) Question 1 A fixed-interest security pays coupons of 6% per annum, half-yearly in arrear and will be redee par in exactly ten years. Calculate the price per $100 nominal to provide an annual effective rate of return of 4%. Question 2 A project requires an investment of $1,000,000 at time t = 0 and $3,000,000 at time t = 3. F from the project are $800,000 per annum, paid continuously from time t = 6 to time t = 20. (i) Calculate the net present value of the project, assuming a rate of interest of 8% per effective. (ii) Calculate the internal rate of return for the project. Question 3 An investor is considering two projects, Project A and Project B. Project A involves the inve of $1,309,500 in a retail outlet. Rent is received quarterly in arrears for 25 years, at an initial $100,000 per annum. It is assumed that the rent will increase at a rate of 5% per annum compou with increases taking place every five years. Maintenance and other expenses are incurred qu in arrears, at a rate of $12,000 per annum. The retail outlet reverts to its original owner after 2 for no payment. Project B involves the purchase of an office building for $1,000,000. The rent is to be received qu in advance at an initial rate of $85,000 per annum. It is assumed that the rent will increase to $ per annum after 20 years. There are no maintenance or other expenses. After 25 years the p reverts to its original owner for no payment. (1) Show that the internal rate of return for project A is 9% per annum effective. (ii) Calculate, show all working, the annual effective internal rate of return for Project B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started