Answered step by step

Verified Expert Solution

Question

1 Approved Answer

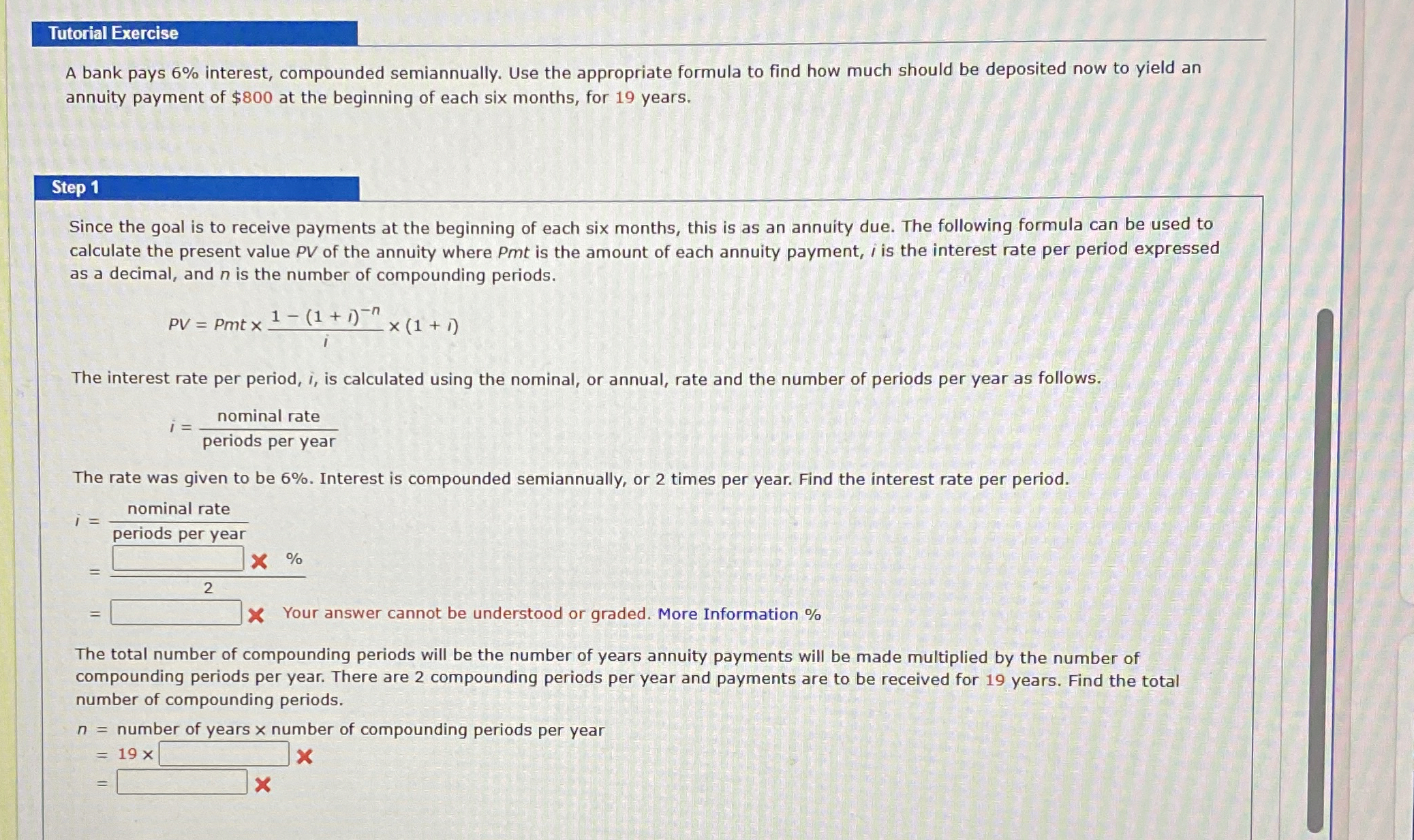

Tutorial Exercise A bank pays 6 % interest, compounded semiannually. Use the appropriate formula to find how much should be deposited now to yield an

Tutorial Exercise

A bank pays interest, compounded semiannually. Use the appropriate formula to find how much should be deposited now to yield an annuity payment of $ at the beginning of each six months, for years.

Step

Since the goal is to receive payments at the beginning of each six months, this is as an annuity due. The following formula can be used to calculate the present value of the annuity where is the amount of each annuity payment, is the interest rate per period expressed as a decimal, and is the number of compounding periods.

The interest rate per period, is calculated using the nominal, or annual, rate and the number of periods per year as follows.

The rate was given to be Interest is compounded semiannually, or times per year. Find the interest rate per period.

Your answer cannot understood graded. More Information

The total number of compounding periods will be the number of years annuity payments will be made multiplied by the number of compounding periods per year. There are compounding periods per year and payments are to be received for years. Find the total number of compounding periods.

number years number compounding periods per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started