Answered step by step

Verified Expert Solution

Question

1 Approved Answer

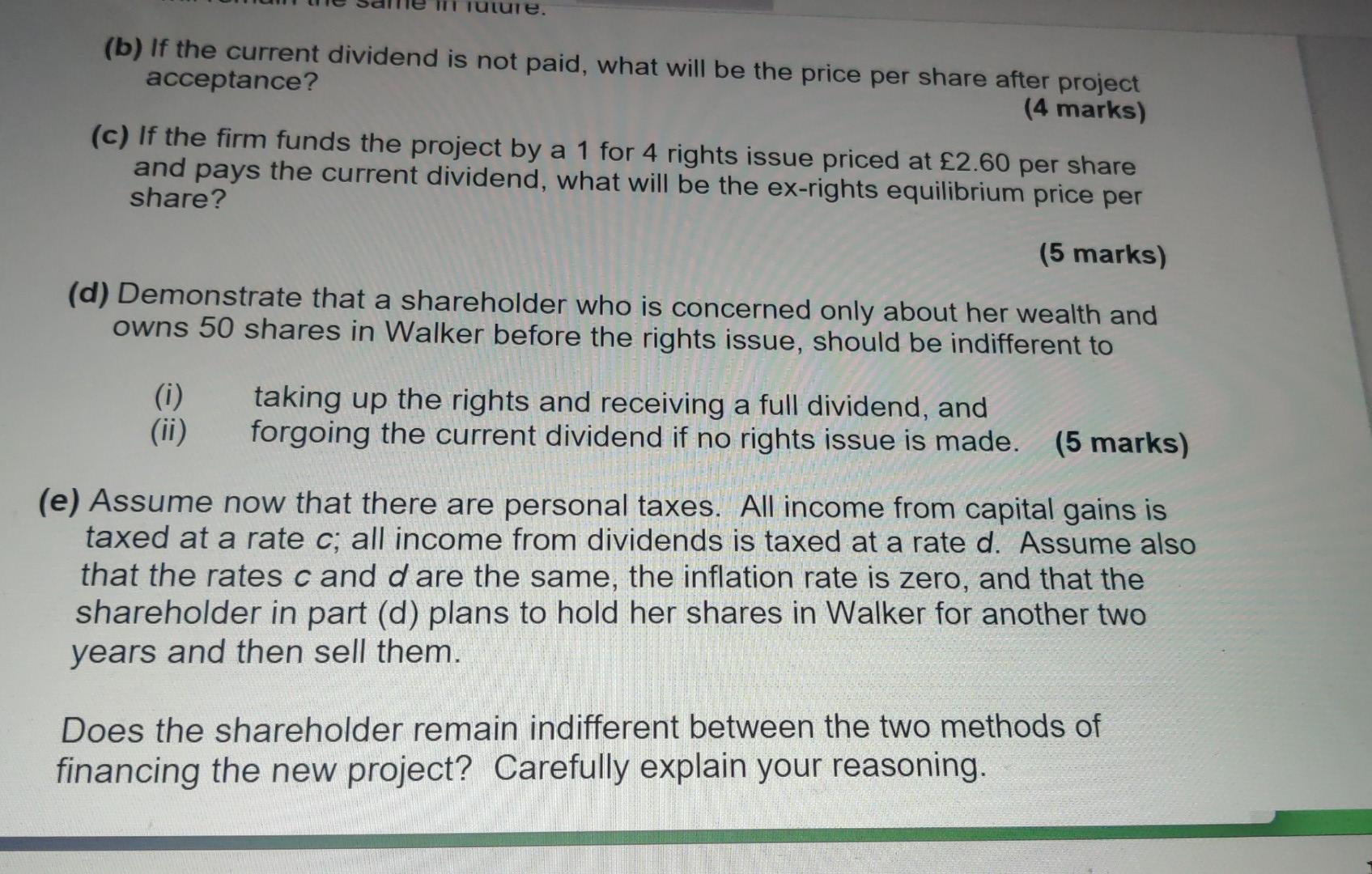

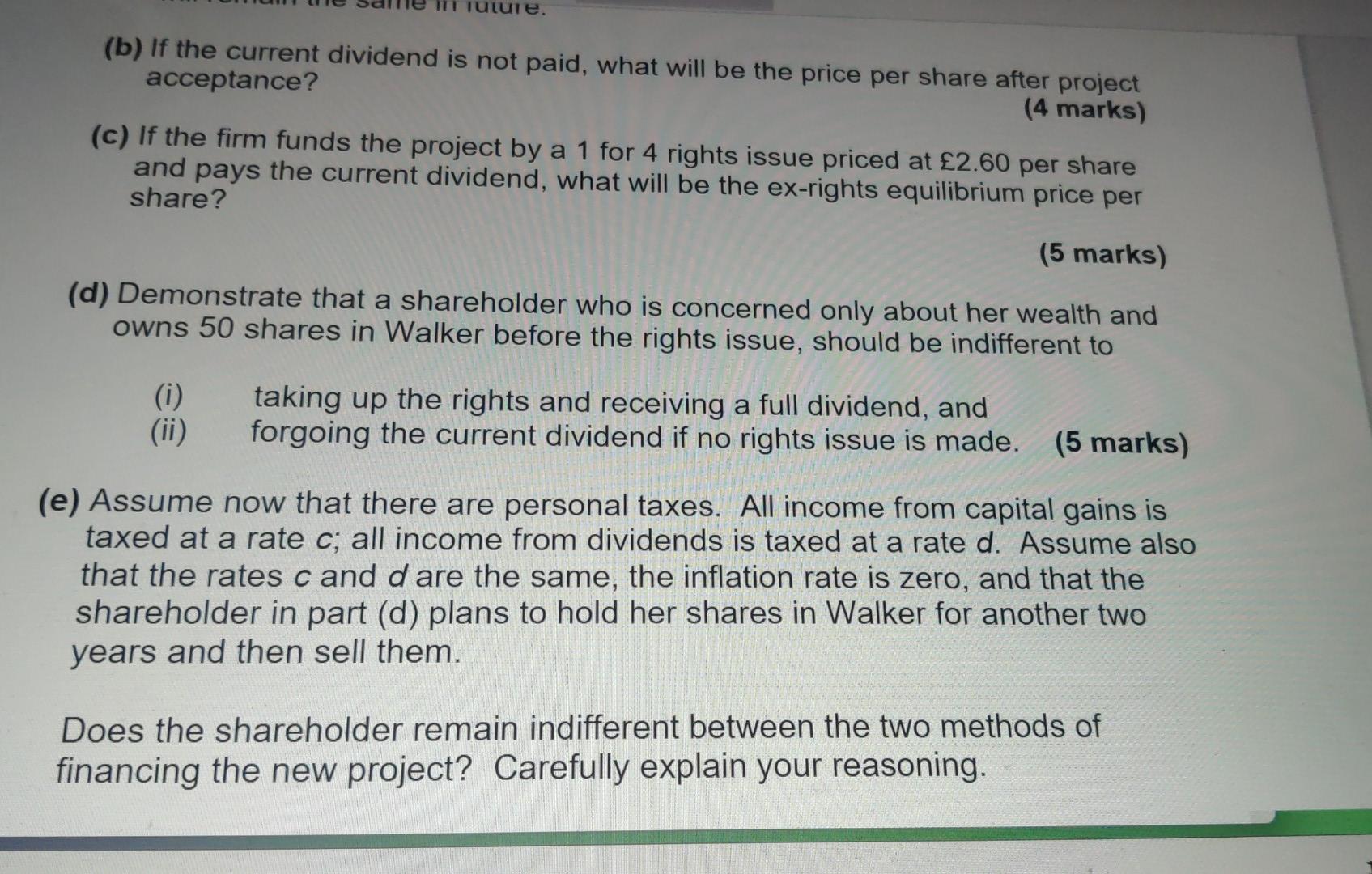

Tuture. (b) If the current dividend is not paid, what will be the price per share after project acceptance? (4 marks) (c) If the firm

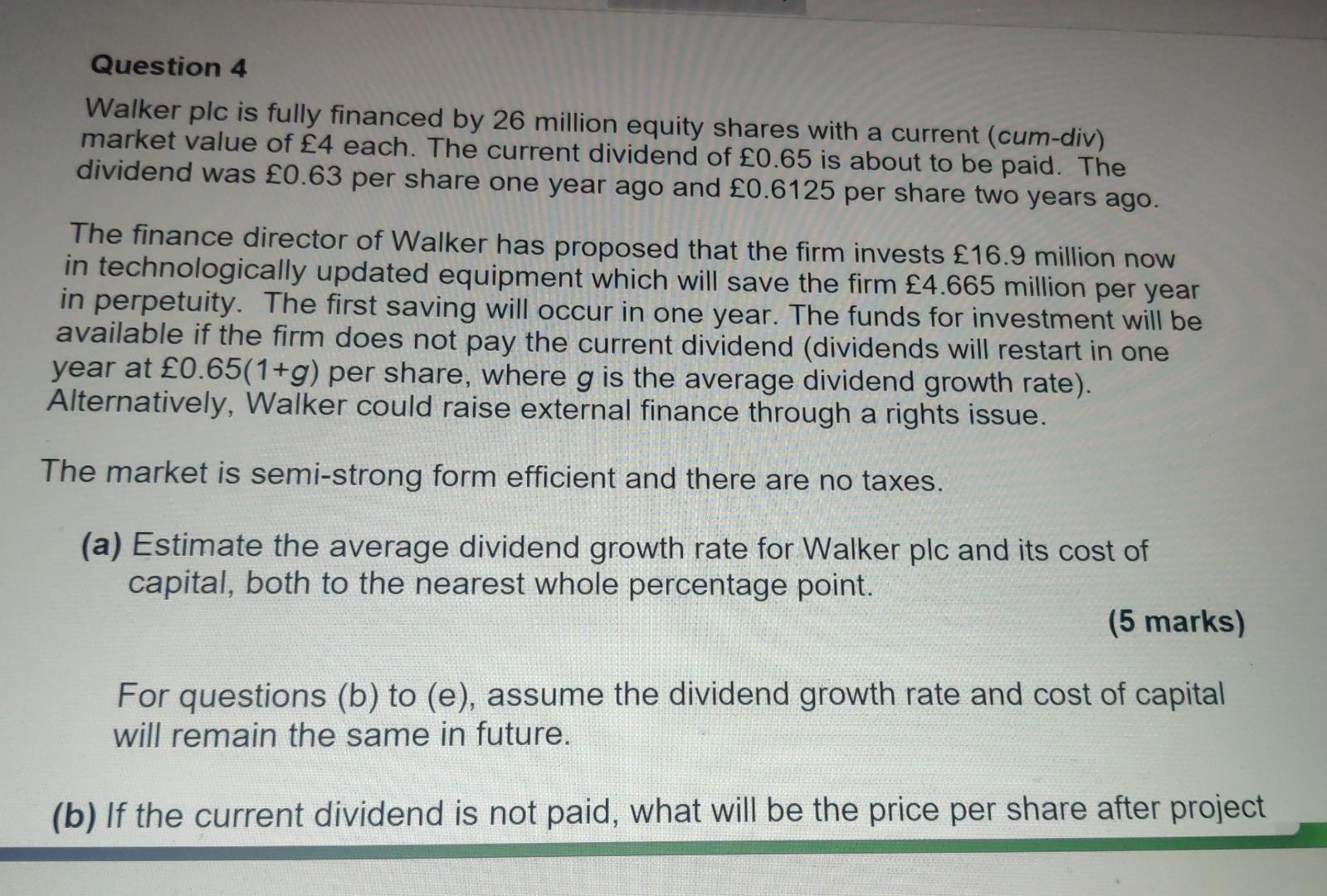

Tuture. (b) If the current dividend is not paid, what will be the price per share after project acceptance? (4 marks) (c) If the firm funds the project by a 1 for 4 rights issue priced at 2.60 per share and pays the current dividend, what will be the ex-rights equilibrium price per share? (5 marks) (d) Demonstrate that a shareholder who is concerned only about her wealth and owns 50 shares in Walker before the rights issue, should be indifferent to (i) (ii) taking up the rights and receiving a full dividend, and forgoing the current dividend if no rights issue is made. (5 marks) (e) Assume now that there are personal taxes. All income from capital gains is taxed at a rate c; all income from dividends is taxed at a rate d. Assume also that the rates c and d are the same, the inflation rate is zero, and that the shareholder in part (d) plans to hold her shares in Walker for another two years and then sell them. Does the shareholder remain indifferent between the two methods of financing the new project? Carefully explain your reasoning. Tuture. (b) If the current dividend is not paid, what will be the price per share after project acceptance? (4 marks) (c) If the firm funds the project by a 1 for 4 rights issue priced at 2.60 per share and pays the current dividend, what will be the ex-rights equilibrium price per share? (5 marks) (d) Demonstrate that a shareholder who is concerned only about her wealth and owns 50 shares in Walker before the rights issue, should be indifferent to (i) (ii) taking up the rights and receiving a full dividend, and forgoing the current dividend if no rights issue is made. (5 marks) (e) Assume now that there are personal taxes. All income from capital gains is taxed at a rate c; all income from dividends is taxed at a rate d. Assume also that the rates c and d are the same, the inflation rate is zero, and that the shareholder in part (d) plans to hold her shares in Walker for another two years and then sell them. Does the shareholder remain indifferent between the two methods of financing the new project? Carefully explain your reasoning. Question 4 Walker plc is fully financed by 26 million equity shares with a current (cum-div) market value of 4 each. The current dividend of 0.65 is about to be paid. The dividend was 0.63 per share one year ago and 0.6125 per share two years ago. The finance director of Walker has proposed that the firm invests 16.9 million now in technologically updated equipment which will save the firm 4.665 million per year in perpetuity. The first saving will occur in one year. The funds for investment will be available if the firm does not pay the current dividend (dividends will restart in one year at 0.65(1+g) per share, where g is the average dividend growth rate). Alternatively, Walker could raise external finance through a rights issue. The market is semi-strong form efficient and there are no taxes. (a) Estimate the average dividend growth rate for Walker plc and its cost of capital, both to the nearest whole percentage point. (5 marks) For questions (b) to (e), assume the dividend growth rate and cost of capital will remain the same in future. (b) If the current dividend is not paid, what will be the price per share after project Tuture. (b) If the current dividend is not paid, what will be the price per share after project acceptance? (4 marks) (c) If the firm funds the project by a 1 for 4 rights issue priced at 2.60 per share and pays the current dividend, what will be the ex-rights equilibrium price per share? (5 marks) (d) Demonstrate that a shareholder who is concerned only about her wealth and owns 50 shares in Walker before the rights issue, should be indifferent to (i) (ii) taking up the rights and receiving a full dividend, and forgoing the current dividend if no rights issue is made. (5 marks) (e) Assume now that there are personal taxes. All income from capital gains is taxed at a rate c; all income from dividends is taxed at a rate d. Assume also that the rates c and d are the same, the inflation rate is zero, and that the shareholder in part (d) plans to hold her shares in Walker for another two years and then sell them. Does the shareholder remain indifferent between the two methods of financing the new project? Carefully explain your reasoning. Tuture. (b) If the current dividend is not paid, what will be the price per share after project acceptance? (4 marks) (c) If the firm funds the project by a 1 for 4 rights issue priced at 2.60 per share and pays the current dividend, what will be the ex-rights equilibrium price per share? (5 marks) (d) Demonstrate that a shareholder who is concerned only about her wealth and owns 50 shares in Walker before the rights issue, should be indifferent to (i) (ii) taking up the rights and receiving a full dividend, and forgoing the current dividend if no rights issue is made. (5 marks) (e) Assume now that there are personal taxes. All income from capital gains is taxed at a rate c; all income from dividends is taxed at a rate d. Assume also that the rates c and d are the same, the inflation rate is zero, and that the shareholder in part (d) plans to hold her shares in Walker for another two years and then sell them. Does the shareholder remain indifferent between the two methods of financing the new project? Carefully explain your reasoning. Question 4 Walker plc is fully financed by 26 million equity shares with a current (cum-div) market value of 4 each. The current dividend of 0.65 is about to be paid. The dividend was 0.63 per share one year ago and 0.6125 per share two years ago. The finance director of Walker has proposed that the firm invests 16.9 million now in technologically updated equipment which will save the firm 4.665 million per year in perpetuity. The first saving will occur in one year. The funds for investment will be available if the firm does not pay the current dividend (dividends will restart in one year at 0.65(1+g) per share, where g is the average dividend growth rate). Alternatively, Walker could raise external finance through a rights issue. The market is semi-strong form efficient and there are no taxes. (a) Estimate the average dividend growth rate for Walker plc and its cost of capital, both to the nearest whole percentage point. (5 marks) For questions (b) to (e), assume the dividend growth rate and cost of capital will remain the same in future. (b) If the current dividend is not paid, what will be the price per share after project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started