Answered step by step

Verified Expert Solution

Question

1 Approved Answer

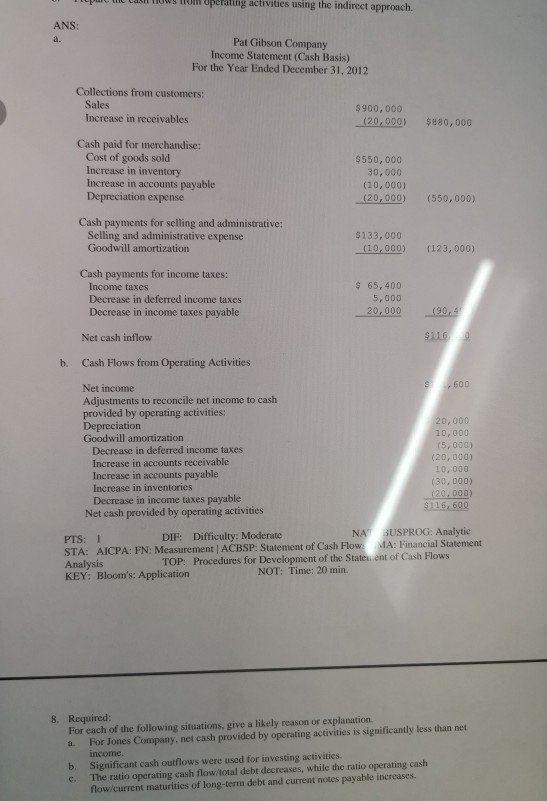

Tuulil TWS In operating activities using the indirect approach. ANS: Pat Gibson Company Income Statement (Cash Basis) For the Year Ended December 31, 2012 Collections

Tuulil TWS In operating activities using the indirect approach. ANS: Pat Gibson Company Income Statement (Cash Basis) For the Year Ended December 31, 2012 Collections from customers: Sales Increase in receivables $900,000 120,000) $880,000 Cash paid for merchandise: Cost of goods sold Increase in inventory Increase in accounts payable Depreciation expense $550,000 30,000 (10,000) (20,000) (550,000) Cash payments for selling and administrative: Selling and administrative expense Goodwill amortization $133,000 (10,000) 123,000) Cash payments for income taxes: Income taxes Decrease in deferred income taxes Decrease in income taxes payable $ 65, 400 5,000 20,000 (90,4 Net cash inflow $116 b. Cash Flows from Operating Activities Net income $ 600 Adjustments to reconcile net income to cash provided by operating activities: Depreciation 20,000 Goodwill amortization 10,000 Decrease in deferred income taxes (5,000) Increase in accounts receivable (20,000) 10,000 Increase in accounts payable (30,000) Increase in inventories Decrease in income taxes payable 120.000) $115,600 Net cash provided by operating activities PTS: 1 DIF: Difficulty: Moderate NA BUSPROG: Analytic STA: AICPA FN: Measurement ACBSP: Statement of Cash Flow MA: Financial Statement Analysis TOP: Procedures for Development of the Statement of Cash Flows KEY: Bloom's: Application NOT: Time: 20 min. 8. Required: For each of the following situations, give a likely reason or explanation a. For Jones Company, net cash provided by operating activities is significantly less than net income. b. Significant cash outflows were used for investing activities. c. The ratio operating cash flow/total debt decreases, while the ratio operating cash flow/current maturities of long-term debt and current notes payable increases. Tuulil TWS In operating activities using the indirect approach. ANS: Pat Gibson Company Income Statement (Cash Basis) For the Year Ended December 31, 2012 Collections from customers: Sales Increase in receivables $900,000 120,000) $880,000 Cash paid for merchandise: Cost of goods sold Increase in inventory Increase in accounts payable Depreciation expense $550,000 30,000 (10,000) (20,000) (550,000) Cash payments for selling and administrative: Selling and administrative expense Goodwill amortization $133,000 (10,000) 123,000) Cash payments for income taxes: Income taxes Decrease in deferred income taxes Decrease in income taxes payable $ 65, 400 5,000 20,000 (90,4 Net cash inflow $116 b. Cash Flows from Operating Activities Net income $ 600 Adjustments to reconcile net income to cash provided by operating activities: Depreciation 20,000 Goodwill amortization 10,000 Decrease in deferred income taxes (5,000) Increase in accounts receivable (20,000) 10,000 Increase in accounts payable (30,000) Increase in inventories Decrease in income taxes payable 120.000) $115,600 Net cash provided by operating activities PTS: 1 DIF: Difficulty: Moderate NA BUSPROG: Analytic STA: AICPA FN: Measurement ACBSP: Statement of Cash Flow MA: Financial Statement Analysis TOP: Procedures for Development of the Statement of Cash Flows KEY: Bloom's: Application NOT: Time: 20 min. 8. Required: For each of the following situations, give a likely reason or explanation a. For Jones Company, net cash provided by operating activities is significantly less than net income. b. Significant cash outflows were used for investing activities. c. The ratio operating cash flow/total debt decreases, while the ratio operating cash flow/current maturities of long-term debt and current notes payable increases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started