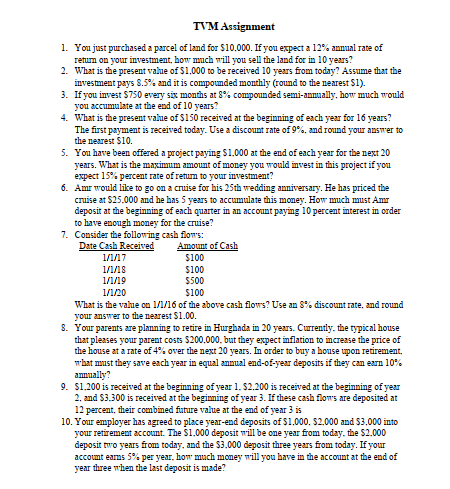

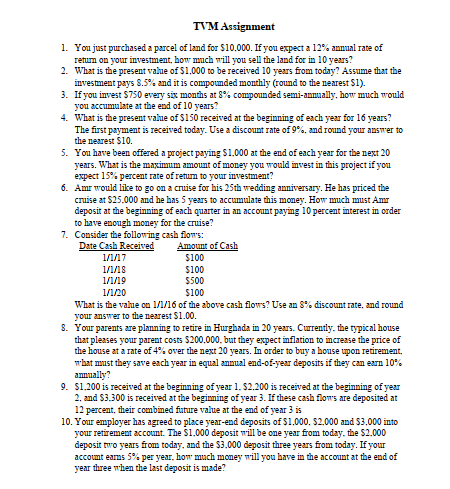

TVM Assignment 1. You just purchased a parcel of land for $10.000. If you expect a 12% annual rate of return on your investment, how much will you sell the land for in 10 years? 2. What is the present value of $1,000 to be received 10 years from today? Assume that the investment pays 3.5% and it is compounded monthly (round to the nearest S1). 3. If you invest $750 every six months at 8% compounded semi-annually, how much would you accumulate at the end of 10 years? 4. What is the present value of $150 received at the beginning of each year for 16 years? The first payment is received today. Use a discount rate of 9% and round your answer to the nearest 510. 5. You have been offered a project paying $1.000 at the end of each year for the next 20 years. What is the maximum amount of money you would invest in this project if you expect 15% percent rate of return to your investment? 6. Amr would like to go on a cruise for his 25th wedding anniversary. He has priced the cruise at $25.000 and he has 5 years to accumulate this money. How much must Am deposit at the beginning of each quarter in an account paying 10 percent interest in order to have enough money for the cruise? 7. Consider the following cash flows: Date Cash Received Amount of Cash 1/1/17 $100 1/1/18 $100 1/1/19 $500 1/1/20 $100 What is the value on 1/1/16 of the above cash flows? Use an 8% discount rate, and round your answer to the nearest $1.00. 8. Your parents are planning to retire in Hurghada in 20 years. Currently, the typical house that pleases your parent costs $200.000, but they expect inflation to increase the price of the house at a rate of 4% over the next 20 years. In order to buy a house upon retirement, What must they save each year in equal annual end-of-year deposits if they can earn 10% amually? 9. $1.200 is received at the beginning of year 1. $2,200 is received at the beginning of year 2. and $3.300 is received at the beginning of year 3. If these cash flors are deposited at 12 percent, their combined future value at the end of year 3 is 10. Your employer has agreed to place year-end deposits of $1.000. 52,000 and $3.000 into your retirement account. The $1.000 deposit will be one year from today, the $2.000 deposit two years from today, and the $3.000 deposit three years from today. If your account eams 5% per year, how much money will you have in the account at the end of year three when the last deposit is made