Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TVM Assignment 5 points each Use your financial calculator to answer the following questions and make sure to show your work. Watch the TVM video

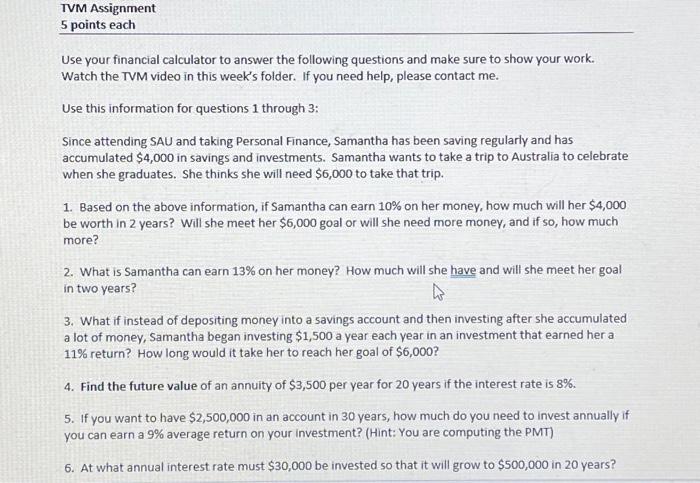

TVM Assignment 5 points each Use your financial calculator to answer the following questions and make sure to show your work. Watch the TVM video in this week's folder. If you need help, please contact me. Use this information for questions 1 through 3: Since attending SAU and taking Personal Finance, Samantha has been saving regularly and has accumulated $4,000 in savings and investments. Samantha wants to take a trip to Australia to celebrate when she graduates. She thinks she will need $6,000 to take that trip. 1. Based on the above information, if Samantha can earn 10% on her money, how much will her $4,000 be worth in 2 years? Will she meet her $6,000 goal or will she need more money, and if so, how much more? 2. What is Samantha can earn 13% on her money? How much will she have and will she meet her goal in two years? 3. What if instead of depositing money into a savings account and then investing after she accumulated a lot of money, Samantha began investing $1,500 a year each year in an investment that earned her a 11% return? How long would it take her to reach her goal of $6,000? 4. Find the future value of an annuity of $3,500 per year for 20 years if the interest rate is 8%. 5. If you want to have $2,500,000 in an account in 30 years, how much do you need to invest annually if you can earn a 9% average return on your investment? (Hint: You are computing the PMT) 6. At what annual interest rate must $30,000 be invested so that it will grow to $500,000 in 20 years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started