Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Twelve months ago, David opened a coffee shop, The Daily Grind, in Mercy Hospital's former gift shop. David was confident that he had the knowledge

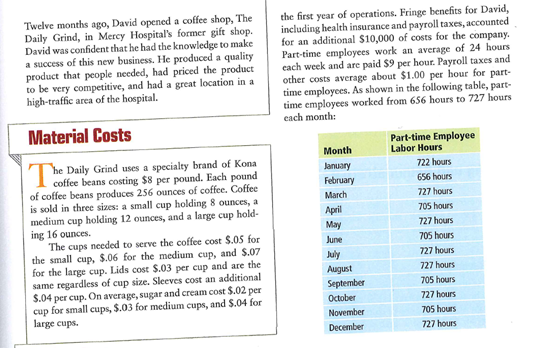

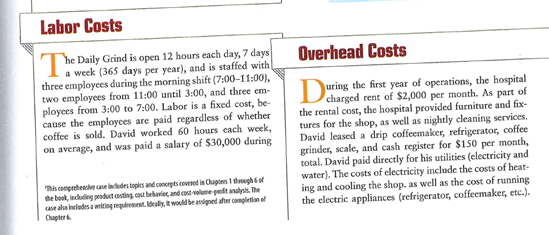

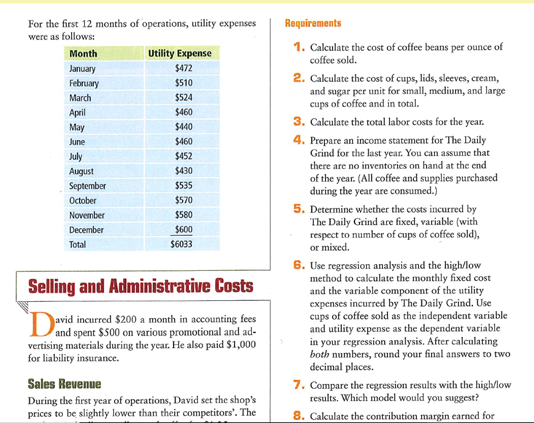

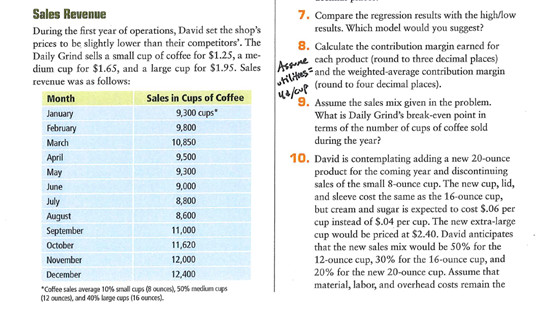

Twelve months ago, David opened a coffee shop, The Daily Grind, in Mercy Hospital's former gift shop. David was confident that he had the knowledge to make a success of this new business. He produced a quality product that people needed, had priced the product to be very competitive, and had a great location in a high-traffic area of the hospital. Material Costs he Daily Grind uses a specialty brand of Kona coffee beans costing $8 per pound. Each pound of coffee beans produces 256 ounces of coffec. Coffee is sold in three sizes: a small cup holding 8 ounces, a medium cup holding 12 ounces, and a large cup holding 16 ounces. The cups needed to serve the colfee cost $.05 for the small cup, $.06 for the medium cup, and $.07 for the large cup. Lids cost $.03 per cup and are the same regardless of cup size. Sleeves cost an additional $.04 per cup. On average, sugar and cream cost $.02 per cup for small cups, $.03 for medium cups, and $.04 for large cups. the first year of operations. Fringe benefits for David, including health insurance and payroll taxes, accounted for an additional $10,000 of costs for the company. Part-time employees work an average of 24 hours each week and are paid $9 per hour. Payroll taxes and other costs average about $1.00 per hour for parttime employees. As shown in the following table, parttime employees worked from 656 hours to 727 hours each month: he Daily Grind is open 12 hours each day, 7 days I a week ( 365 days per year), and is staffed with three employees during the morning shift (7:00-11:00), two employees from 11:00 until 3:00, and three employces from 3:00 to 7:00. Labor is a fixed cost, because the employces are paid regardless of whether coffee is sold. David worked 60 hours each week, on average, and was paid a salary of $30,000 during Chaplet 6. Overhead Costs uring the first year of operations, the hospital charged rent of $2,000 per month. As part of the rental cost, the hospital provided furniture and fixtures for the shop, as well as nightly cleaning services. David leased a drip coffeemaker, refrigerator, coffee grinder, scale, and cash register for $150 per month, total. David paid directly for his utilities (electricity and water). The costs of electricity include the costs of heating and cooling the shop. as well as the cost of running the electric appliances (refrigerator, coffeemaker, etc.). same in the upcoming year. How would this change in sales mix affect the company's breakeven point? 11. David would like to increase sales in the second year of operations so that he may raise his salary to $50,000 (not including $15,000 of fringe benefits) while reducing his workload to 40 hours per weck with two paid weeks of vacation during the year. Reducing his workload will require inereasing the number of hours worked by parttime employees by 1,080 hours per year. Assume the introduction of the extra-large cup and the new sales mix as discussed in requirement 10 . What level of annual sales would be required in order for David to reach his goal? 12. Write a short memo to David and discuss whether you think he will be able to reach his goal during the second year of operations. For the first 12 months of operations, utility expenses were as follows: Requirements 1. Calculate the cost of coffee beans per ounce of colfee sold. 2. Calculate the cost of cups, lids, sleeves, cream, and sugar per unit for small, medium, and large cups of coffee and in total. 3. Calculate the total labor costs for the year. 4. Prepare an income statement for The Daily Grind for the last year. You can assume that there are no inventories on hand at the end of the year. (All coffee and supplies purchased during the year are consumed.) 5. Determine whether the costs incurred by The Daily Grind are fixed, variable (with respect to number of cups of coffec sold), or mixed. 6. Use regression analysis and the high/low method to calculate the monthly fixed cost and the variable component of the utility expenses incurred by The Daily Grind. Use cups of coffee sold as the independent variable and utility expense as the dependent variable in your regression analysis. After calculating both numbers, round your final answers to two decimal places. 7. Compare the regression results with the high/low results. Which model would you suggest? 8. Calculate the contribution margin earned for Sales Reurenue During the first year of operations, David set the shop's prices to be slightly lower than their competitors'. The Daily Grind sells a small cup of coffee for $1.25, a medium cup for $1.65, and a large cup for $1.95. Sales revenue was as follows: 7. Compare the regression results with the high/low results. Which model would you suggest? 8. Calculate the contribution margin earned for Aspre each product (round to three decimal places) filtus" and the weighted-average contribution margin 4 / /0 ? (round to four decimal places). 9. Assume the sales mix given in the problem. What is Daily Grind's break-even point in terms of the number of cups of coffee sold during the year? 10. David is contemplating adding a new 20 -ounce product for the coming year and discontinuing sales of the small 8-ounce cup. The new cup, lid, and sleeve cost the same as the 16-ounce cup, but cream and sugar is expected to cost $.06 per cup instead of \$.04 per cup. The new extra-large cup would be priced at \$2.40. David anticipates that the new sales mix would be 50% for the 12-ounce cup, 30% for the 16-ounce cup, and 20% for the new 20 -ounce cup. Assume that material, labor, and overhead costs remain the +Coffee sales average 10% small cups (8 ounced. 50% mediun oyps (12 ounced, and 40% bege cups 16 euncest

Twelve months ago, David opened a coffee shop, The Daily Grind, in Mercy Hospital's former gift shop. David was confident that he had the knowledge to make a success of this new business. He produced a quality product that people needed, had priced the product to be very competitive, and had a great location in a high-traffic area of the hospital. Material Costs he Daily Grind uses a specialty brand of Kona coffee beans costing $8 per pound. Each pound of coffee beans produces 256 ounces of coffec. Coffee is sold in three sizes: a small cup holding 8 ounces, a medium cup holding 12 ounces, and a large cup holding 16 ounces. The cups needed to serve the colfee cost $.05 for the small cup, $.06 for the medium cup, and $.07 for the large cup. Lids cost $.03 per cup and are the same regardless of cup size. Sleeves cost an additional $.04 per cup. On average, sugar and cream cost $.02 per cup for small cups, $.03 for medium cups, and $.04 for large cups. the first year of operations. Fringe benefits for David, including health insurance and payroll taxes, accounted for an additional $10,000 of costs for the company. Part-time employees work an average of 24 hours each week and are paid $9 per hour. Payroll taxes and other costs average about $1.00 per hour for parttime employees. As shown in the following table, parttime employees worked from 656 hours to 727 hours each month: he Daily Grind is open 12 hours each day, 7 days I a week ( 365 days per year), and is staffed with three employees during the morning shift (7:00-11:00), two employees from 11:00 until 3:00, and three employces from 3:00 to 7:00. Labor is a fixed cost, because the employces are paid regardless of whether coffee is sold. David worked 60 hours each week, on average, and was paid a salary of $30,000 during Chaplet 6. Overhead Costs uring the first year of operations, the hospital charged rent of $2,000 per month. As part of the rental cost, the hospital provided furniture and fixtures for the shop, as well as nightly cleaning services. David leased a drip coffeemaker, refrigerator, coffee grinder, scale, and cash register for $150 per month, total. David paid directly for his utilities (electricity and water). The costs of electricity include the costs of heating and cooling the shop. as well as the cost of running the electric appliances (refrigerator, coffeemaker, etc.). same in the upcoming year. How would this change in sales mix affect the company's breakeven point? 11. David would like to increase sales in the second year of operations so that he may raise his salary to $50,000 (not including $15,000 of fringe benefits) while reducing his workload to 40 hours per weck with two paid weeks of vacation during the year. Reducing his workload will require inereasing the number of hours worked by parttime employees by 1,080 hours per year. Assume the introduction of the extra-large cup and the new sales mix as discussed in requirement 10 . What level of annual sales would be required in order for David to reach his goal? 12. Write a short memo to David and discuss whether you think he will be able to reach his goal during the second year of operations. For the first 12 months of operations, utility expenses were as follows: Requirements 1. Calculate the cost of coffee beans per ounce of colfee sold. 2. Calculate the cost of cups, lids, sleeves, cream, and sugar per unit for small, medium, and large cups of coffee and in total. 3. Calculate the total labor costs for the year. 4. Prepare an income statement for The Daily Grind for the last year. You can assume that there are no inventories on hand at the end of the year. (All coffee and supplies purchased during the year are consumed.) 5. Determine whether the costs incurred by The Daily Grind are fixed, variable (with respect to number of cups of coffec sold), or mixed. 6. Use regression analysis and the high/low method to calculate the monthly fixed cost and the variable component of the utility expenses incurred by The Daily Grind. Use cups of coffee sold as the independent variable and utility expense as the dependent variable in your regression analysis. After calculating both numbers, round your final answers to two decimal places. 7. Compare the regression results with the high/low results. Which model would you suggest? 8. Calculate the contribution margin earned for Sales Reurenue During the first year of operations, David set the shop's prices to be slightly lower than their competitors'. The Daily Grind sells a small cup of coffee for $1.25, a medium cup for $1.65, and a large cup for $1.95. Sales revenue was as follows: 7. Compare the regression results with the high/low results. Which model would you suggest? 8. Calculate the contribution margin earned for Aspre each product (round to three decimal places) filtus" and the weighted-average contribution margin 4 / /0 ? (round to four decimal places). 9. Assume the sales mix given in the problem. What is Daily Grind's break-even point in terms of the number of cups of coffee sold during the year? 10. David is contemplating adding a new 20 -ounce product for the coming year and discontinuing sales of the small 8-ounce cup. The new cup, lid, and sleeve cost the same as the 16-ounce cup, but cream and sugar is expected to cost $.06 per cup instead of \$.04 per cup. The new extra-large cup would be priced at \$2.40. David anticipates that the new sales mix would be 50% for the 12-ounce cup, 30% for the 16-ounce cup, and 20% for the new 20 -ounce cup. Assume that material, labor, and overhead costs remain the +Coffee sales average 10% small cups (8 ounced. 50% mediun oyps (12 ounced, and 40% bege cups 16 euncest Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started