Answered step by step

Verified Expert Solution

Question

1 Approved Answer

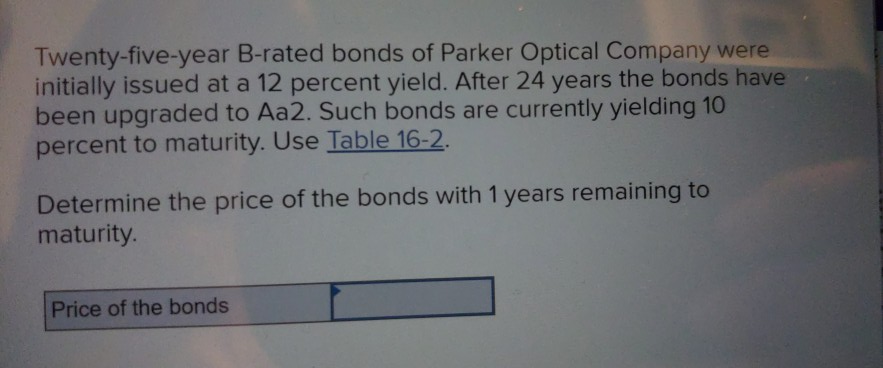

Twenty-five-year B-rated bonds of Parker Optical Company were initially issued at a 12 percent yield. After 24 years the bonds have been upgraded to Aa2.

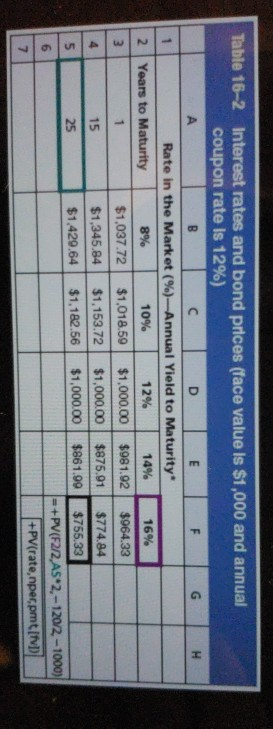

Twenty-five-year B-rated bonds of Parker Optical Company were initially issued at a 12 percent yield. After 24 years the bonds have been upgraded to Aa2. Such bonds are currently yielding 10 percent to maturity. Use Table 16-2. Determine the price of the bonds with 1 years remaining to maturity. Price of the bonds Table 16-2 Interest rates and bond prices (face value is $1,000 and annual coupon rate is 12%) A B D E F G H Rate in the Market (%)- Annual Yield to Maturity* 2 Years to Maturity 8% 10% 12% 14% 16% 3 $1.037.72 $1,018.50 $1,000.00 $981.92 $964.33 4 15 $1,345.84 $1,153.72 $1,000.00 $875.91 $774.84 25 $1,429.64 $1,182.56 $1,000.00 $861.99 $755.33 6 =+PV(F2/2 AS 2, -120/2-1000) 7 +PV(rate, nper,pmt 1 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started