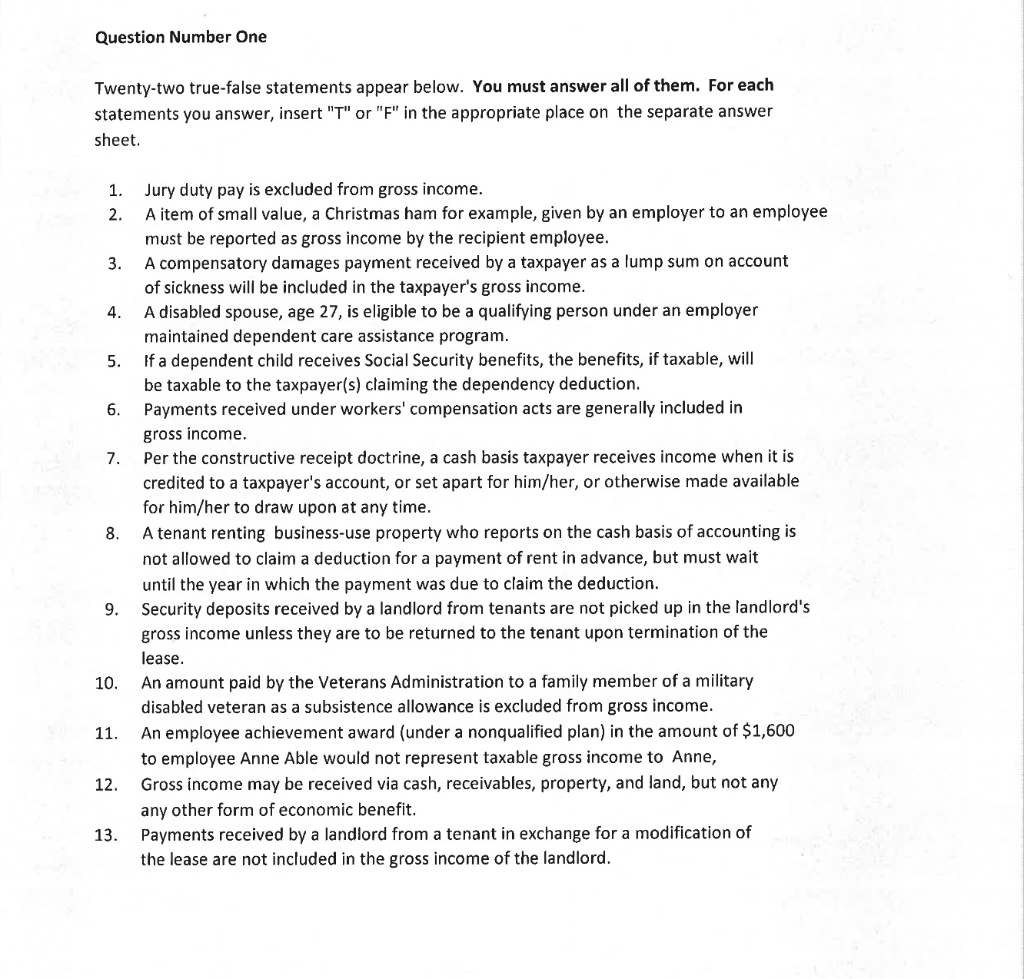

Twenty-two true-false statements appear below. You must answer all of them. For each statements you answer, insert "T" or "F" in the appropriate place on the separate answer sheet. 1. Jury duty pay is excluded from gross income. 2. A item of small value, a Christmas ham for example, given by an employer to an employee must be reported as gross income by the recipient employee. 3. A compensatory damages payment received by a taxpayer as a lump sum on account of sickness will be included in the taxpayer's gross income. 4. A disabled spouse, age 27 , is eligible to be a qualifying person under an employer maintained dependent care assistance program. 5. If a dependent child receives Social Security benefits, the benefits, if taxable, will be taxable to the taxpayer(s) claiming the dependency deduction. 6. Payments received under workers' compensation acts are generally included in gross income. 7. Per the constructive receipt doctrine, a cash basis taxpayer receives income when it is credited to a taxpayer's account, or set apart for him/her, or otherwise made available for him/her to draw upon at any time. 8. A tenant renting business-use property who reports on the cash basis of accounting is not allowed to claim a deduction for a payment of rent in advance, but must wait until the year in which the payment was due to claim the deduction. 9. Security deposits received by a landlord from tenants are not picked up in the landlord's gross income unless they are to be returned to the tenant upon termination of the lease. 10. An amount paid by the Veterans Administration to a family member of a military disabled veteran as a subsistence allowance is excluded from gross income. 11. An employee achievement award (under a nonqualified plan) in the amount of $1,600 to employee Anne Able would not represent taxable gross income to Anne, 12. Gross income may be received via cash, receivables, property, and land, but not any any other form of economic benefit. 13. Payments received by a landlord from a tenant in exchange for a modification of the lease are not included in the gross income of the landlord