Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Twinkle Sdn Bhd is a taxable person for GST, involves in hardware business. The company recorded the following sales and deliveries for November 2016:

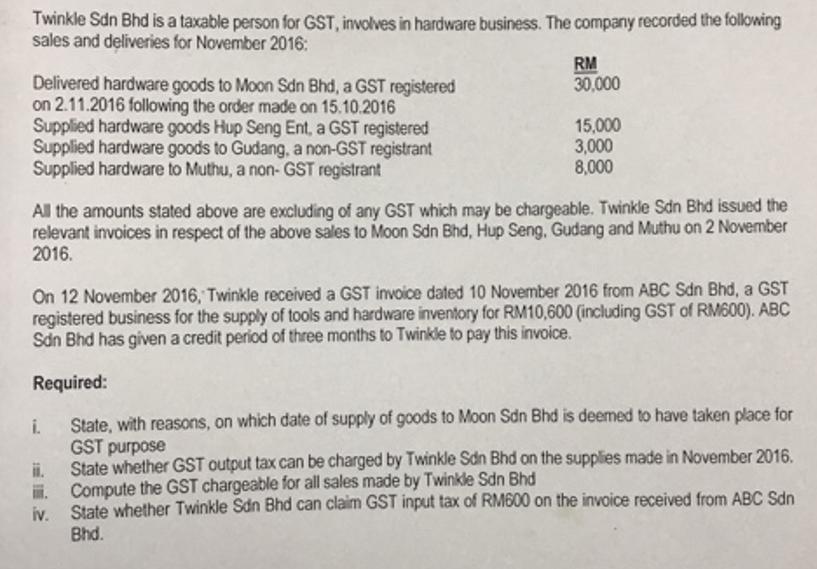

Twinkle Sdn Bhd is a taxable person for GST, involves in hardware business. The company recorded the following sales and deliveries for November 2016: RM 30,000 Delivered hardware goods to Moon Sdn Bhd, a GST registered on 2.11.2016 following the order made on 15.10.2016 Supplied hardware goods Hup Seng Ent, a GST registered Supplied hardware goods to Gudang, a non-GST registrant Supplied hardware to Muthu, a non-GST registrant 15,000 3,000 8,000 All the amounts stated above are excluding of any GST which may be chargeable. Twinkle Sdn Bhd issued the relevant invoices in respect of the above sales to Moon Sdn Bhd, Hup Seng, Gudang and Muthu on 2 November 2016. On 12 November 2016, Twinkle received a GST invoice dated 10 November 2016 from ABC Sdn Bhd, a GST registered business for the supply of tools and hardware inventory for RM10,600 (including GST of RM600). ABC Sdn Bhd has given a credit period of three months to Twinkle to pay this invoice. Required: i. State, with reasons, on which date of supply of goods to Moon Sdn Bhd is deemed to have taken place for GST purpose ii. State whether GST output tax can be charged by Twinkle Sdn Bhd on the supplies made in November 2016. . Compute the GST chargeable for all sales made by Twinkle Sdn Bhd iv. State whether Twinkle Sdn Bhd can claim GST input tax of RM600 on the invoice received from ABC Sdn Bhd.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

i The date of supply of goods to Moon Sdn Bhd is deemed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started