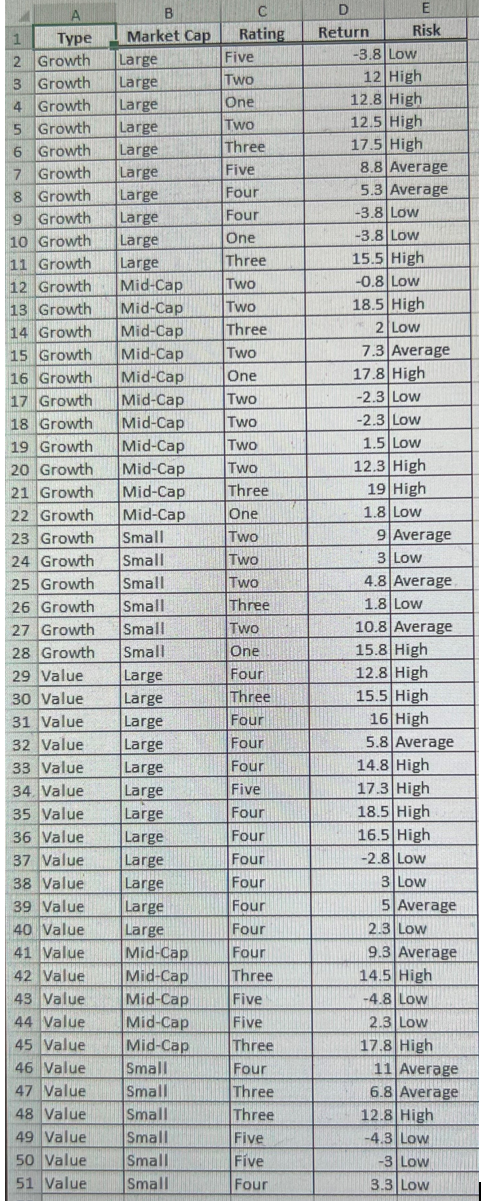

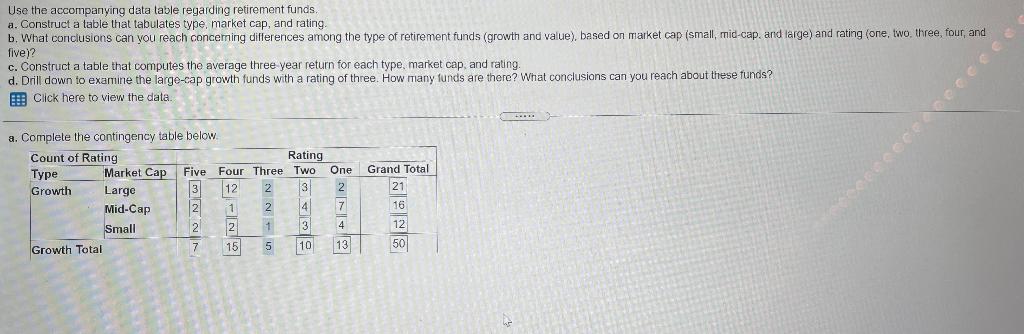

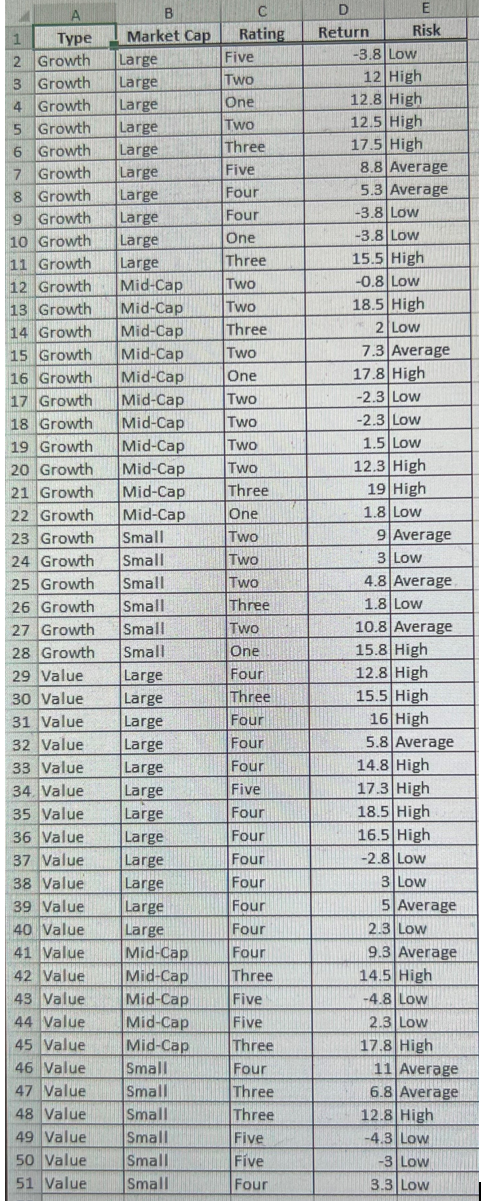

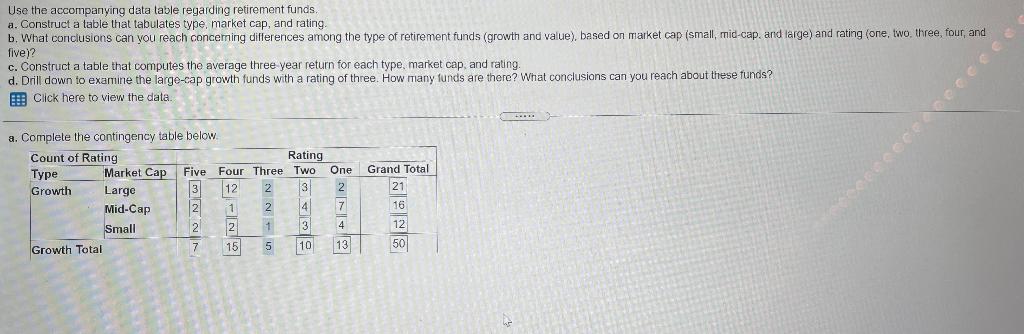

Two A 1 Type 2 Growth 3 Growth 4 Growth 5 Growth 6 Growth 7 Growth 8 Growth 9 Growth 10 Growth 11 Growth 12 Growth 13 Growth 14 Growth 15 Growth 16 Growth 17 Growth 18 Growth 19 Growth 20 Growth 21 Growth 22 Growth 23 Growth 24 Growth 25 Growth 26 Growth 27 Growth 28 Growth 29 Value 30 Value 31 Value 32 Value 33 Value 34. Value 35 Value 36 Value 37 Value 38 Value 39 Value 40 Value 41 Value 42 Value 43 Value 44 Value 45 Value 46 Value 47 Value 48 Value 49 Value 50 Value 51 Value Market Cap Rating Large Five Large TWO Large One Large Two Large Three Large Five Large Four Large Four Large One Large Three Mid-Cap Two Mid-Cap Two Mid-Cap Three Mid-Cap Two Mid-Cap One Mid-Cap Two Mid-Cap Two Mid-Cap Two Mid-Cap Mid-Cap Three Mid-Cap One Small Two Small Two Small Two Small Three Small Two Small One Large Four Large Three Large Four Large Four Large Four Large Five Large Four Large Four Large Four Large Four Large Four Large Four Mid-Cap Four Mid-Cap Mid-Cap Five Mid-Cap Five Mid-Cap Three Small Four Small Three Three Small Five Small Five Small Four E Return Risk -3.8 Low 12 High 12.8 High 12.5 High 17.5 High 8.8 Average 5.3 Average -3.8 Low -3.8 Low 15.5 High -0.8 Low 18.5 High 2 Low 7.3 Average 17.8 High -2.3 Low -2.3 Low 1.5 Low 12.3 High 19 High 1.8 Low 9 Average 3 Low 4.8 Average 1.8 Low 10.8 Average 15.8 High 12.8 High 15.5 High 16 High 5.8 Average 14.8 High 17.3 High 18.5 High 16.5 High -2.8 Low 3 Low 5 Average 2.3 Low 9.3 Average 14.5 High -4.8 Low 2.3 Low 17.8 High 11 Average 6.8 Average 12.8 High -4.3 Low -3 Low 3.3 Low Three Small Use the accompanying data table regarding retirement funds a. Construct a table that tabulates type, market cap, and rating. b. What conclusions can you reach concerning differences among the type of retirement funds (growth and value), based on market cap (small, mid-cap, and targe) and rating (one, two, three, four, and five)? c. Construct a table that computes the average three year return for each type, market cap, and rating d. Drill down to examine the large-cap growth funds with a rating of three. How many funds are there? What conclusions can you reach about these funds? Click here to view the data One 2 Grand Total 21 a. Complete the contingency table below Count of Rating Rating Type Market Cap Five Four Three Two Growth Large 3 12 Mid-Cap 2 1 2 4 Small 2 2 1 13 Growth Total 7 15 5 10 7 16 4 12 13 50 Two A 1 Type 2 Growth 3 Growth 4 Growth 5 Growth 6 Growth 7 Growth 8 Growth 9 Growth 10 Growth 11 Growth 12 Growth 13 Growth 14 Growth 15 Growth 16 Growth 17 Growth 18 Growth 19 Growth 20 Growth 21 Growth 22 Growth 23 Growth 24 Growth 25 Growth 26 Growth 27 Growth 28 Growth 29 Value 30 Value 31 Value 32 Value 33 Value 34. Value 35 Value 36 Value 37 Value 38 Value 39 Value 40 Value 41 Value 42 Value 43 Value 44 Value 45 Value 46 Value 47 Value 48 Value 49 Value 50 Value 51 Value Market Cap Rating Large Five Large TWO Large One Large Two Large Three Large Five Large Four Large Four Large One Large Three Mid-Cap Two Mid-Cap Two Mid-Cap Three Mid-Cap Two Mid-Cap One Mid-Cap Two Mid-Cap Two Mid-Cap Two Mid-Cap Mid-Cap Three Mid-Cap One Small Two Small Two Small Two Small Three Small Two Small One Large Four Large Three Large Four Large Four Large Four Large Five Large Four Large Four Large Four Large Four Large Four Large Four Mid-Cap Four Mid-Cap Mid-Cap Five Mid-Cap Five Mid-Cap Three Small Four Small Three Three Small Five Small Five Small Four E Return Risk -3.8 Low 12 High 12.8 High 12.5 High 17.5 High 8.8 Average 5.3 Average -3.8 Low -3.8 Low 15.5 High -0.8 Low 18.5 High 2 Low 7.3 Average 17.8 High -2.3 Low -2.3 Low 1.5 Low 12.3 High 19 High 1.8 Low 9 Average 3 Low 4.8 Average 1.8 Low 10.8 Average 15.8 High 12.8 High 15.5 High 16 High 5.8 Average 14.8 High 17.3 High 18.5 High 16.5 High -2.8 Low 3 Low 5 Average 2.3 Low 9.3 Average 14.5 High -4.8 Low 2.3 Low 17.8 High 11 Average 6.8 Average 12.8 High -4.3 Low -3 Low 3.3 Low Three Small Use the accompanying data table regarding retirement funds a. Construct a table that tabulates type, market cap, and rating. b. What conclusions can you reach concerning differences among the type of retirement funds (growth and value), based on market cap (small, mid-cap, and targe) and rating (one, two, three, four, and five)? c. Construct a table that computes the average three year return for each type, market cap, and rating d. Drill down to examine the large-cap growth funds with a rating of three. How many funds are there? What conclusions can you reach about these funds? Click here to view the data One 2 Grand Total 21 a. Complete the contingency table below Count of Rating Rating Type Market Cap Five Four Three Two Growth Large 3 12 Mid-Cap 2 1 2 4 Small 2 2 1 13 Growth Total 7 15 5 10 7 16 4 12 13 50