Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple-step versus a single-step

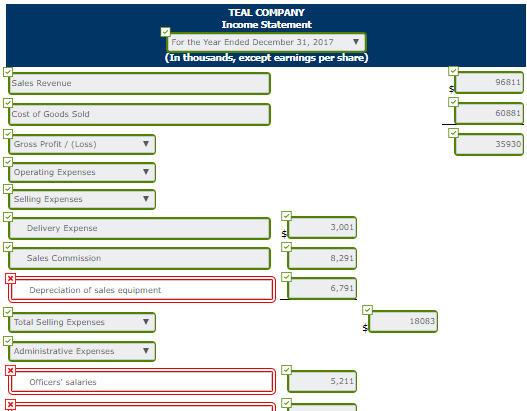

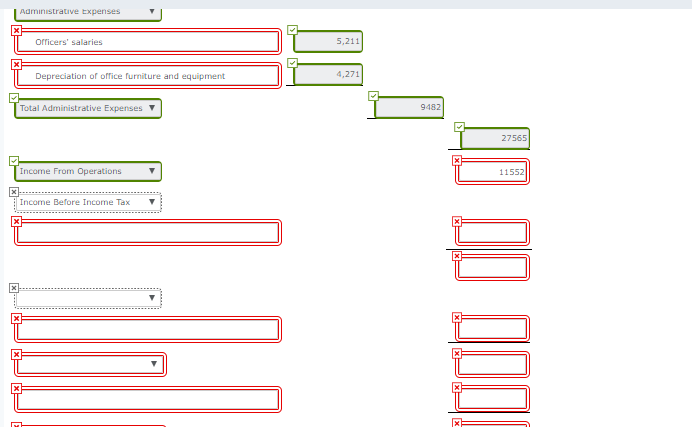

Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple-step versus a single-step format. The discussion involves the following 2017 information related to Teal Company ($000 omitted).

| Administrative expense | ||

| Officers' salaries | $5,211 | |

| Depreciation of office furniture and equipment | 4,271 | |

| Cost of goods sold | 60,881 | |

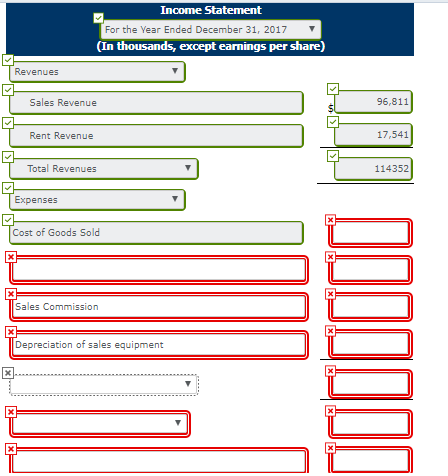

| Rent revenue | 17,541 | |

| Selling expense | ||

| Delivery expense | 3,001 | |

| Sales commissions | 8,291 | |

| Depreciation of sales equipment | 6,791 | |

| Sales revenue | 96,811 | |

| Income tax | 9,381 | |

| Interest expense | 2,17 |

Common shares outstanding for 2017 total 40,550 (000 omitted).

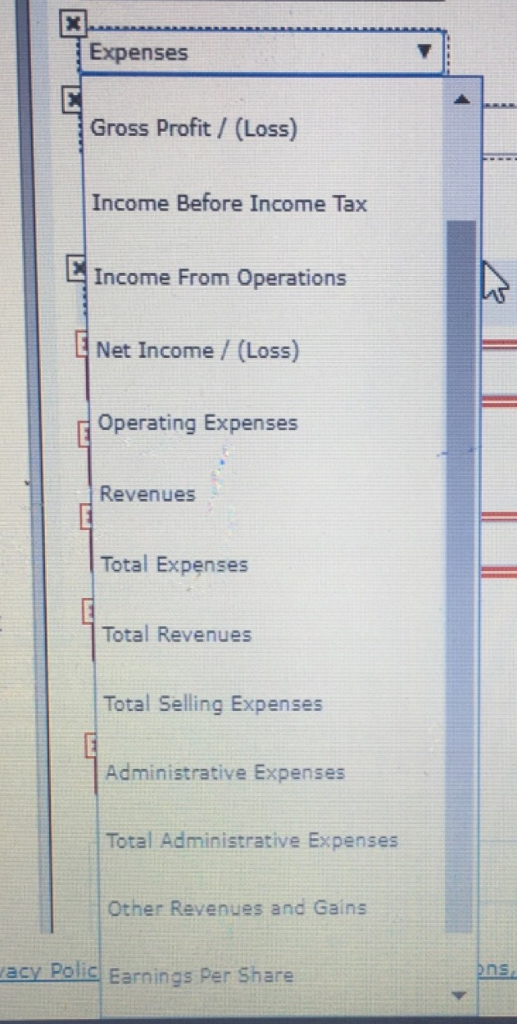

Prepare an income statement for the year 2017 using the multiple-step form.

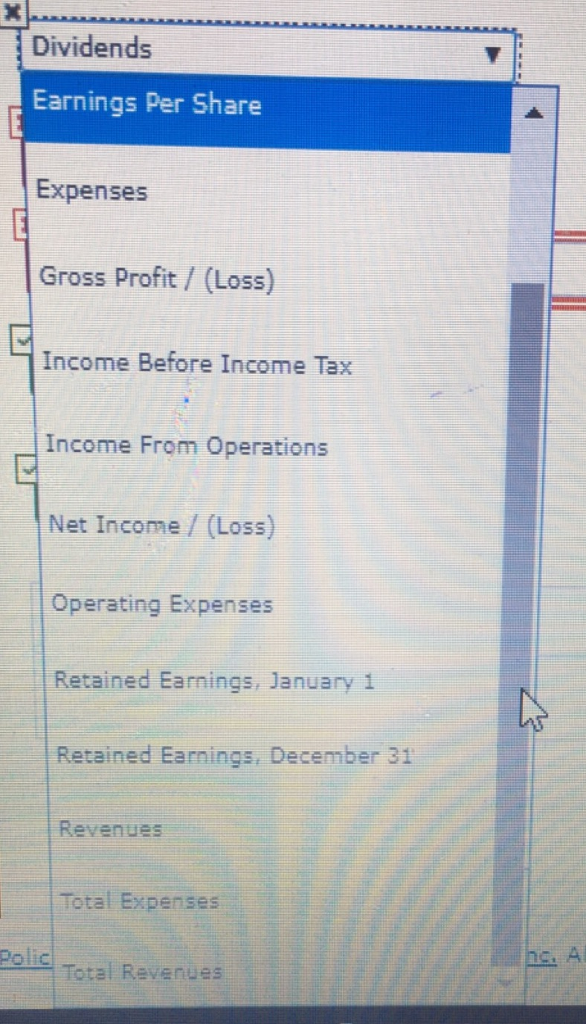

use these options please.

2- Prepare an income statement for the year 2017 using the single-step form

use these options please.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started